Evolving Digital Ecosystem

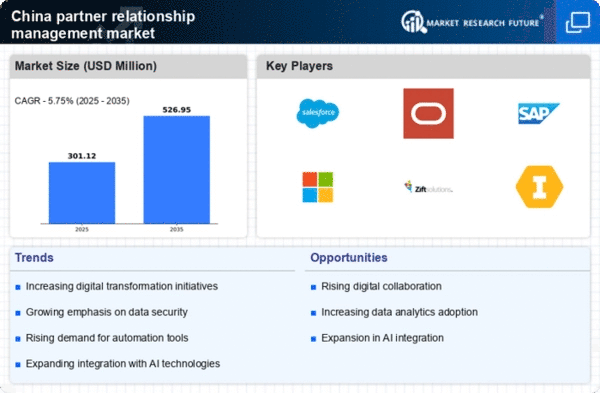

The rapid evolution of the digital ecosystem in China is a pivotal driver for the partner relationship-management market. As businesses increasingly adopt digital tools and platforms, the need for effective partner management solutions becomes paramount. In 2025, the digital economy in China is projected to reach approximately $6 trillion, indicating a robust environment for technology adoption. This growth fosters collaboration among businesses, necessitating advanced partner relationship-management systems to streamline interactions and enhance productivity. Companies are likely to seek solutions that integrate seamlessly with their existing digital infrastructure, thereby driving demand for innovative partner management tools. The emphasis on digital transformation compels organizations to invest in technologies that facilitate better communication and collaboration with partners, ultimately shaping the landscape of the partner relationship-management market.

Rise of Strategic Alliances

The rise of strategic alliances among businesses in China serves as a significant driver for the partner relationship-management market. Companies are increasingly recognizing the value of collaboration to enhance their competitive edge. In 2025, it is estimated that over 60% of businesses in China will engage in some form of strategic partnership. This trend necessitates robust partner relationship-management solutions to facilitate effective collaboration and communication. Organizations are likely to seek tools that enable them to manage multiple partnerships efficiently, track performance metrics, and align objectives. The growing complexity of partnerships requires advanced management systems that can adapt to diverse business needs. As strategic alliances become more prevalent, the demand for innovative partner relationship-management solutions is expected to surge, shaping the future of the market.

Adoption of Cloud-Based Solutions

The increasing adoption of cloud-based solutions in China is a crucial driver for the partner relationship-management market. As businesses transition to cloud technologies, they seek partner management systems that offer flexibility, scalability, and accessibility. By 2025, it is projected that cloud services will account for over 30% of IT spending in China, reflecting a significant shift in how organizations operate. Cloud-based partner relationship-management solutions enable businesses to manage partnerships from anywhere, fostering collaboration and real-time communication. This trend is likely to drive demand for solutions that integrate with other cloud applications, enhancing overall operational efficiency. As organizations continue to embrace cloud technologies, the partner relationship-management market is expected to experience substantial growth, driven by the need for adaptable and efficient management tools.

Growing Emphasis on Data Security

In an era where data breaches and cyber threats are increasingly prevalent, the emphasis on data security is a critical driver for the partner relationship-management market in China. Organizations are becoming more aware of the need to protect sensitive information shared with partners. By 2025, it is anticipated that over 70% of businesses will prioritize data security in their partner management strategies. This focus on security compels companies to invest in partner relationship-management solutions that offer robust security features, including encryption and access controls. As businesses seek to mitigate risks associated with data sharing, the demand for secure partner management systems is likely to rise. Consequently, the partner relationship-management market is expected to evolve, with an increasing number of solutions designed to address these security concerns.

Increased Focus on Customer Experience

In the competitive landscape of China, businesses are placing heightened emphasis on customer experience, which significantly influences the partner relationship-management market. Companies recognize that effective partner management is crucial for delivering superior customer service. As of 2025, studies indicate that organizations prioritizing customer experience are likely to achieve a 20% increase in customer satisfaction ratings. This trend compels businesses to enhance their partner management strategies, ensuring that partners are aligned with customer-centric goals. The integration of partner relationship-management solutions enables organizations to foster stronger relationships with partners, ultimately leading to improved service delivery and customer retention. As customer expectations continue to evolve, the demand for sophisticated partner management tools that support these objectives is expected to rise, thereby driving growth in the partner relationship-management market.