Market Analysis

In-depth Analysis of China Recycled Polypropylene Market Industry Landscape

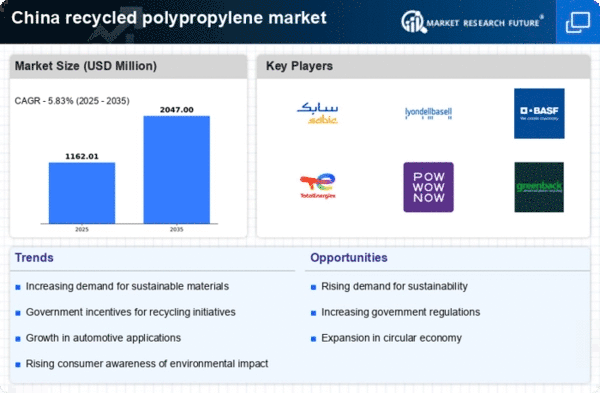

The China Recycled Polypropylene (PP) Market is changing rapidly due to environmental concerns, circular economy pushes, and the growing demand for affordable building materials. Recycled polypropylene from post-consumer or post-modern plastic waste is becoming a viable solution to plastic pollution and virgin plastic production. Growing concern for environmental sustainability drives market aspects. To reduce plastic waste's environmental impact, the Chinese government and industry partners are promoting round economy practices and recycled materials.

Mechanical advances in plastic recycling are shaping China's recovered polypropylene market. Recycled polypropylene is more viable than virgin plastic due to improvements in organizing, cleaning, and handling. As innovation continues, manufactures are poised to create recycled polypropylene with virgin-like qualities, contributing to market vibrancy.

With reusers and manufacturers using recycled polypropylene, the serious scene affects market factors. Market intensity is increased by product quality, accreditation, and coordinated actions with the entire value chain, including waste authorities and brand owners. In this growing industry, companies that reuse framework, provide a stable supply of post-customer plastic feedstock, and build strength for out win.

Administrative factors also shape China's recycled polypropylene market. The government has implemented policies to promote plastic recycling, reduce single-use plastics, and employ recycled materials in construction. Producers must follow these requirements to compete in the recycled polypropylene market. The company' ability to adapt and follow changing rules affects market elements as administrative systems improve to meet natural disasters.

Financial conditions and market demand for practical products also affect recycled polypropylene markets in China. Financial factors like recycled polypropylene's cost versus virgin plastic affect business purchases. The recycled polypropylene market is growing because to consumer goods, bundling, and car industries' demand for controllable materials.

Recycled polypropylene market factors include customer preferences in packaging, materials, and consumer products. Customers are becoming more eco-conscious and want recycled products and packaging. Manufacturers that offer practical and recycled content options consider evolving consumer preferences, which affect buying decisions and market factors.

The Chinese recycled polypropylene market is affected by global trends including the circular economy and plastic waste reduction. The circular economy, which emphasizes material reuse, fits China's goal of being more economically and asset-efficient. As global awareness of plastic contamination grows, recycled polypropylene will likely become more popular, helping to reduce plastic waste.

Leave a Comment