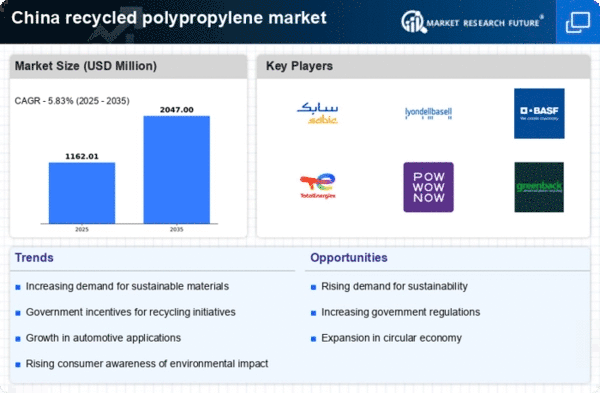

Government Incentives and Policies

Government initiatives aimed at promoting recycling and reducing plastic waste are playing a crucial role in shaping the China Recycled Polypropylene Market. Policies that incentivize the use of recycled materials, such as tax breaks and subsidies for manufacturers, are becoming more prevalent. In 2025, it is anticipated that the Chinese government will implement stricter regulations on plastic waste, further encouraging the adoption of recycled polypropylene. These measures not only support environmental goals but also stimulate economic growth within the recycling sector. As a result, the China Recycled Polypropylene Market is likely to benefit from enhanced regulatory frameworks that promote sustainable practices and increase the competitiveness of recycled materials.

Growing Applications Across Industries

The versatility of recycled polypropylene is contributing to its growing applications across various industries, thereby driving the China Recycled Polypropylene Market. From packaging to automotive components, the demand for recycled polypropylene is expanding as manufacturers seek to reduce their environmental footprint. In 2025, it is projected that the automotive sector will account for a significant portion of recycled polypropylene usage, as companies increasingly incorporate sustainable materials into their production processes. This diversification of applications not only broadens the market base but also enhances the overall demand for recycled polypropylene, indicating a robust growth trajectory for the China Recycled Polypropylene Market.

Increasing Demand for Sustainable Materials

The rising awareness regarding environmental sustainability is driving the demand for recycled materials, particularly in the China Recycled Polypropylene Market. As consumers and businesses alike prioritize eco-friendly products, the market for recycled polypropylene is expected to expand. In 2025, the demand for recycled polypropylene is projected to grow by approximately 15%, reflecting a shift towards sustainable practices. This trend is further supported by the increasing number of companies committing to sustainability goals, which often include the use of recycled materials in their supply chains. Consequently, the China Recycled Polypropylene Market is likely to witness a surge in investment and innovation aimed at enhancing the quality and availability of recycled polypropylene.

Technological Innovations in Recycling Processes

Advancements in recycling technologies are significantly impacting the China Recycled Polypropylene Market. Innovations such as improved sorting and processing techniques are enhancing the efficiency and quality of recycled polypropylene. In 2025, it is expected that new technologies will enable the recycling of polypropylene at a higher rate, potentially increasing the overall supply of recycled materials. This could lead to a reduction in production costs and an increase in the market share of recycled polypropylene compared to virgin materials. As these technologies continue to evolve, the China Recycled Polypropylene Market may experience a transformation that enhances its sustainability and economic viability.

Consumer Preferences Shifting Towards Eco-Friendly Products

Consumer preferences are increasingly shifting towards eco-friendly products, which is positively influencing the China Recycled Polypropylene Market. As awareness of environmental issues grows, consumers are more inclined to choose products made from recycled materials. This trend is reflected in market data, which suggests that sales of products containing recycled polypropylene are expected to rise by 20% in 2025. Retailers and manufacturers are responding to this shift by expanding their offerings of sustainable products, thereby driving demand for recycled polypropylene. Consequently, the China Recycled Polypropylene Market is likely to see a significant increase in market penetration as eco-conscious consumers continue to influence purchasing decisions.