Increased Investment in R&D

The remotely operated-vehicle market in China is experiencing a surge in investment directed towards research and development. This trend is driven by both government initiatives and private sector funding, which aim to enhance the technological capabilities of these vehicles. In 2025, it is estimated that R&D expenditures in this sector could reach approximately $1 billion, reflecting a commitment to innovation. The focus on developing advanced sensors, improved battery life, and enhanced communication systems is likely to propel the market forward. As companies strive to create more efficient and capable remotely operated vehicles, the competitive landscape is expected to intensify, fostering a culture of continuous improvement and technological advancement.

Growing Demand from Industrial Sectors

The remotely operated-vehicle market is witnessing a notable increase in demand from various industrial sectors in China, particularly in oil and gas, mining, and agriculture. These industries are increasingly adopting remotely operated vehicles for tasks such as inspection, monitoring, and data collection. For instance, the oil and gas sector is projected to account for over 30% of the market share by 2025, as companies seek to enhance operational efficiency and safety. The ability of these vehicles to operate in hazardous environments without putting human lives at risk is a compelling factor driving their adoption. This growing industrial reliance on remotely operated vehicles is expected to significantly contribute to market expansion.

Advancements in Communication Technologies

The remotely operated-vehicle market is benefiting from advancements in communication technologies, which are crucial for the effective operation of these vehicles. Innovations such as 5G networks and satellite communication systems are enhancing the connectivity and control of remotely operated vehicles, enabling real-time data transmission and remote operation over vast distances. In 2025, it is expected that the integration of these technologies could improve operational efficiency by up to 40%, making remotely operated vehicles more reliable and effective in various applications. This technological evolution is likely to attract more users to the market, as enhanced communication capabilities facilitate a broader range of operational scenarios.

Expansion of Underwater Exploration Activities

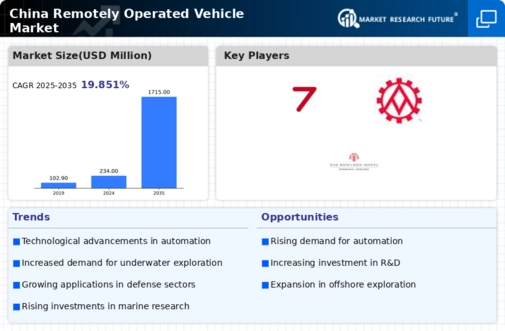

The remotely operated-vehicle market is significantly influenced by the expansion of underwater exploration activities in China. With the country's increasing focus on marine resource management and environmental monitoring, the demand for remotely operated vehicles capable of underwater operations is on the rise. The market for underwater remotely operated vehicles is projected to grow by 20% annually, driven by applications in marine research, oil and gas exploration, and underwater construction. This growth is indicative of a broader trend towards utilizing advanced technologies for exploring and managing underwater environments, thereby enhancing the capabilities and applications of remotely operated vehicles in the market.

Environmental Regulations and Sustainability Initiatives

In recent years, China has implemented stringent environmental regulations aimed at promoting sustainability across various sectors. The remotely operated-vehicle market is positively impacted by these initiatives, as these vehicles are often designed to minimize environmental footprints. For example, the use of electric-powered remotely operated vehicles is becoming more prevalent, aligning with China's goals to reduce carbon emissions. By 2025, it is anticipated that the market for electric remotely operated vehicles could grow by 25%, driven by both regulatory compliance and a shift towards greener technologies. This alignment with sustainability objectives is likely to enhance the appeal of remotely operated vehicles in the market.

Leave a Comment