Government Initiatives and Support

The Chinese government plays a pivotal role in fostering the growth of the robot software market through various initiatives and support programs. Policies aimed at promoting technological innovation and enhancing manufacturing capabilities are increasingly prevalent. For instance, the 'Made in China 2025' initiative emphasizes the importance of robotics and automation in achieving national economic goals. Financial incentives, grants, and subsidies are provided to companies investing in robot software development and implementation. As a result, the market is expected to witness substantial growth, with projections indicating an increase in market size by over 20% in the next five years. This supportive environment encourages collaboration between public and private sectors, ultimately strengthening the robot software market in China.

Advancements in Robotics Technology

Technological advancements significantly influence the robot software market in China, as innovations in robotics enhance capabilities and functionalities. The development of sophisticated algorithms, machine learning, and artificial intelligence integration allows robots to perform complex tasks with greater efficiency. In 2025, the market is anticipated to reach a valuation of approximately $10 billion, driven by these technological breakthroughs. The introduction of collaborative robots, or cobots, which can work alongside human operators, further expands the potential applications of robot software. This evolution in technology not only improves productivity but also fosters a safer working environment. Thus, the robot software market stands to gain from these advancements, as businesses increasingly adopt cutting-edge solutions to optimize operations.

Growing E-commerce and Logistics Sector

The rapid expansion of the e-commerce and logistics sector in China significantly impacts the robot software market. As online shopping continues to gain traction, companies are increasingly turning to automation to streamline their supply chain operations. The demand for robotic solutions in warehousing, inventory management, and last-mile delivery is on the rise. In 2025, the logistics automation market is projected to grow by over 25%, creating substantial opportunities for the robot software market. The integration of advanced software solutions enables real-time tracking, efficient order processing, and enhanced customer service. Consequently, businesses are likely to invest in robotic technologies to meet the growing demands of the e-commerce landscape, further driving the growth of the robot software market.

Rising Demand for Industrial Automation

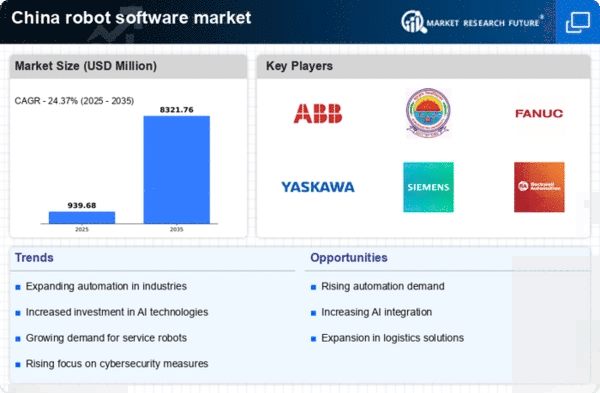

The robot software market in China experiences a notable surge in demand driven by the increasing need for industrial automation. As manufacturers seek to enhance productivity and reduce operational costs, the adoption of robotic systems becomes more prevalent. In 2025, the market is projected to grow at a CAGR of approximately 15%, reflecting a shift towards automated solutions across various sectors. This trend is particularly evident in industries such as automotive and electronics, where precision and efficiency are paramount. The integration of advanced robot software enables seamless operation and real-time data analysis, further propelling the market forward. Consequently, the robot software market is poised to benefit from this growing inclination towards automation, as companies invest in innovative technologies to remain competitive.

Increased Focus on Research and Development

Investment in research and development (R&D) is crucial for the evolution of the robot software market in China. Companies are increasingly allocating resources to innovate and improve their robotic solutions, aiming to stay ahead in a competitive landscape. The emphasis on R&D is expected to lead to the development of more sophisticated software that enhances the functionality and adaptability of robots. In 2025, R&D spending in the robotics sector is projected to increase by approximately 30%, reflecting the industry's commitment to innovation. This focus on developing cutting-edge technologies not only benefits the robot software market but also positions China as a leader in the global robotics arena. As firms strive to create unique solutions, the market is likely to witness a surge in new product offerings and enhanced capabilities.