Government Policy Support

The Chinese government actively promotes the smart government market through various policies and initiatives. This support is evident in the 14th Five-Year Plan, which emphasizes the integration of digital technologies in public administration. The government aims to enhance service delivery and improve citizen engagement by leveraging technologies such as AI, big data, and IoT. As a result, investments in smart government solutions are projected to reach approximately $30 billion by 2025. This policy-driven approach not only fosters innovation but also encourages public-private partnerships, thereby accelerating the growth of the smart government market.

Technological Advancements

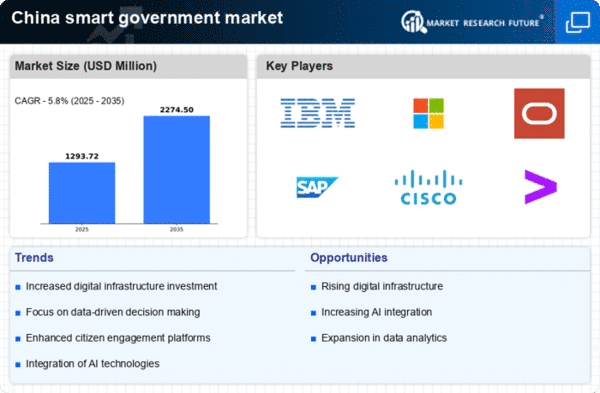

Technological advancements play a crucial role in shaping the smart government market in China. Innovations in AI, machine learning, and blockchain are transforming how governments operate and deliver services. For example, AI-driven analytics can enhance decision-making processes, while blockchain technology can improve transparency and security in public transactions. The market for these technologies is expected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of 25% over the next five years. Such advancements not only streamline operations but also create new opportunities within the smart government market.

Investment in Cybersecurity

As the smart government market expands, the need for robust cybersecurity measures becomes increasingly critical. The Chinese government recognizes the importance of protecting sensitive data and maintaining public trust. Consequently, investments in cybersecurity solutions are surging, with projections indicating a market size of $10 billion by 2025. This focus on cybersecurity not only safeguards government operations but also enhances the overall resilience of the smart government market. By prioritizing security, governments can foster a safer digital environment, encouraging further adoption of smart technologies.

Public Demand for Enhanced Services

There is a rising expectation among citizens for improved public services, which is driving the smart government market in China. Citizens increasingly seek efficient, transparent, and accessible government services. This demand has led to the adoption of digital platforms that facilitate online services, such as e-governance portals and mobile applications. According to recent surveys, over 70% of citizens express a preference for digital interactions with government agencies. This shift in public sentiment compels governments to invest in smart technologies, thereby expanding the smart government market.

Urbanization and Smart City Development

Rapid urbanization in China is a significant driver of the smart government market. With over 60% of the population residing in urban areas, cities face challenges such as traffic congestion, pollution, and resource management. The smart government market addresses these issues by implementing smart city solutions that enhance urban infrastructure and services. For instance, the deployment of smart traffic management systems and waste management solutions can lead to a 20% reduction in operational costs for municipalities. This trend indicates a growing demand for integrated smart solutions, further propelling the smart government market.