Advancements in Nanotechnology

Technological advancements in nanotechnology are likely to play a crucial role in the evolution of the targeted liposomes-drug-delivery market. Innovations in liposome formulation and production techniques have enhanced the stability, targeting capabilities, and release profiles of liposomal drugs. For instance, the development of stimuli-responsive liposomes that release their payload in response to specific environmental triggers could revolutionize treatment protocols. The Chinese government has been actively promoting research in nanotechnology, with funding initiatives aimed at fostering innovation in drug delivery systems. This support may lead to a surge in the availability of novel liposomal formulations, thereby expanding the market's potential and attracting investment from pharmaceutical companies.

Regulatory Framework Enhancements

Recent enhancements in the regulatory framework governing drug development in China appear to be fostering a more conducive environment for the targeted liposomes-drug-delivery market. The National Medical Products Administration (NMPA) has streamlined approval processes for innovative therapies, including those utilizing liposomal delivery systems. This regulatory support is likely to encourage pharmaceutical companies to invest in the development of novel liposomal formulations. Furthermore, the establishment of clear guidelines for clinical trials and product registration may reduce the time to market for new therapies. As a result, the targeted liposomes-drug-delivery market could benefit from an influx of innovative products, ultimately improving treatment options for patients.

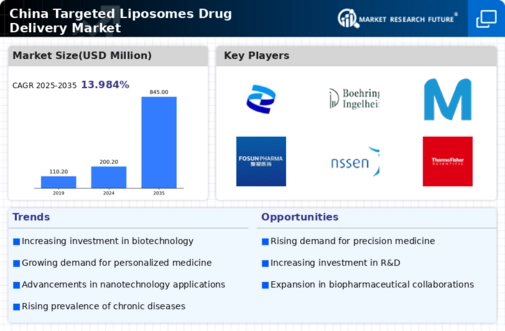

Growing Investment in Biotechnology

The increasing investment in biotechnology within China is expected to significantly impact the targeted liposomes-drug-delivery market. With the government prioritizing biotechnology as a key sector for economic growth, funding for research and development in drug delivery systems has surged. In 2025, the biotechnology sector is projected to receive over $50 billion in investments, which could facilitate the development of advanced liposomal therapies. This influx of capital may enable companies to innovate and bring new products to market more rapidly. As a result, the targeted liposomes-drug-delivery market could witness accelerated growth, driven by the introduction of cutting-edge therapies that leverage the unique properties of liposomes.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in China, such as cancer, diabetes, and cardiovascular disorders, appears to be a primary driver for the targeted liposomes-drug-delivery market. As the population ages and lifestyle-related health issues become more prevalent, the demand for effective drug delivery systems intensifies. Targeted liposomes offer a promising solution by enhancing the bioavailability and efficacy of therapeutic agents. According to recent estimates, the prevalence of cancer in China is projected to reach approximately 4.6 million cases by 2030, which could significantly boost the need for advanced drug delivery methods. This trend suggests that the targeted liposomes-drug-delivery market will likely experience substantial growth as healthcare providers seek innovative solutions to address these pressing health challenges.

Rising Awareness of Personalized Medicine

The growing awareness and acceptance of personalized medicine in China are likely to drive the targeted liposomes-drug-delivery market. As healthcare providers increasingly recognize the importance of tailoring treatments to individual patient profiles, the demand for targeted drug delivery systems that enhance therapeutic efficacy is expected to rise. Targeted liposomes can be engineered to deliver drugs specifically to diseased tissues, minimizing side effects and improving patient outcomes. This shift towards personalized approaches in medicine aligns with the broader trend of precision healthcare, which is gaining traction in China. Consequently, the targeted liposomes-drug-delivery market may experience robust growth as stakeholders seek to develop and implement personalized therapies.