Growing Food Service Sector

The expansion of the food service sector in China is a notable driver for the used cooking-oil market. With the rise of fast-food chains, restaurants, and catering services, the volume of used cooking oil generated has increased substantially. In 2025, the food service industry is expected to contribute to over 60% of the total used cooking oil supply. This growth presents a unique opportunity for the used cooking-oil market to establish efficient collection and recycling systems. Moreover, as consumer preferences shift towards dining out, the demand for sustainable practices in food service operations is likely to rise. This trend may lead to partnerships between food service providers and recycling companies, further enhancing the market's growth potential.

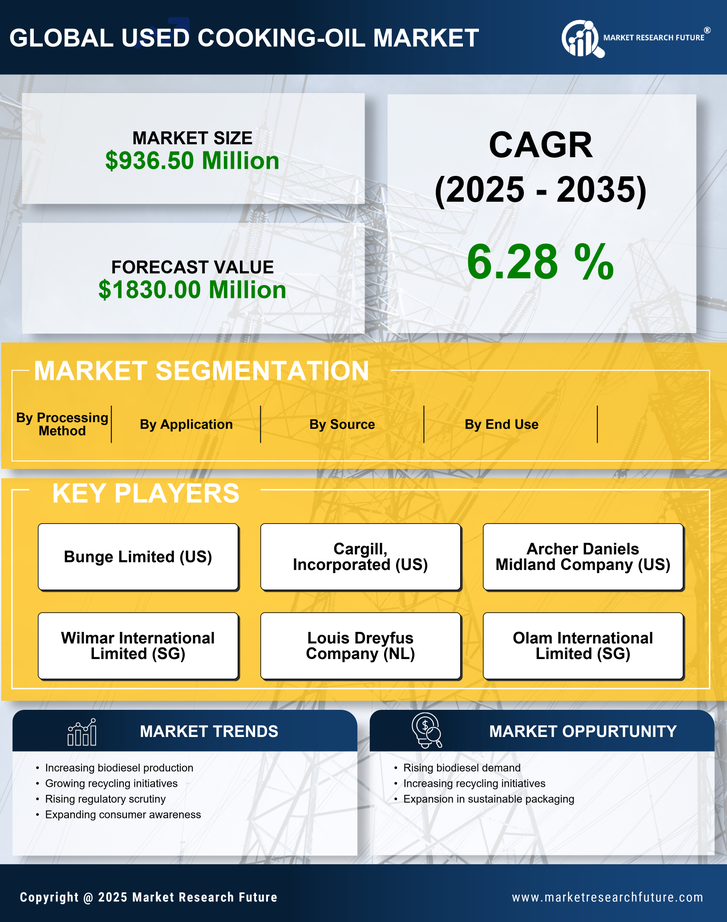

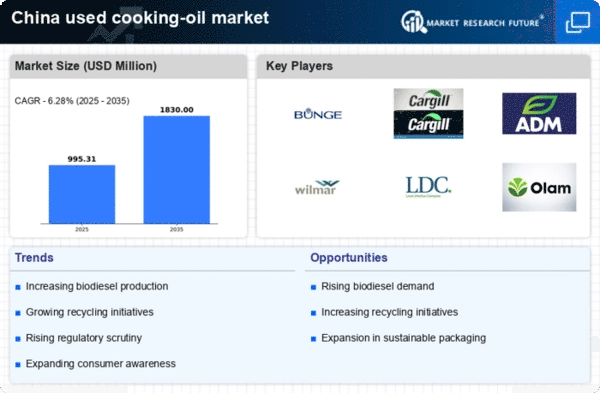

Rising Demand for Biodiesel

The increasing demand for biodiesel in China is a crucial driver for the used cooking-oil market. As the government promotes renewable energy sources, biodiesel production from used cooking oil has gained traction. In 2025, biodiesel production is projected to reach approximately 3 million tonnes, with a significant portion sourced from used cooking oil. This shift not only supports energy diversification but also aligns with environmental sustainability goals. The used cooking-oil market benefits from this trend, as more food service establishments and households are encouraged to recycle their used oils. The potential for biodiesel to reduce greenhouse gas emissions by up to 80% compared to fossil fuels further enhances its appeal, thereby driving the demand for used cooking oil as a feedstock.

Government Incentives for Recycling

Government initiatives aimed at promoting recycling practices are significantly influencing the used cooking-oil market. In recent years, various policies have been introduced to encourage the collection and processing of used cooking oil. For instance, financial incentives and subsidies for businesses that recycle their used oils have been implemented. These measures not only enhance the economic viability of recycling but also contribute to waste reduction. The used cooking-oil market is likely to see an increase in participation from small and medium-sized enterprises, which may lead to a more robust collection network. As a result, the market could experience a growth rate of around 15% annually, driven by these supportive policies.

Environmental Regulations and Standards

The implementation of stringent environmental regulations in China is shaping the used cooking-oil market. Authorities are increasingly focusing on waste management and pollution control, which has led to the establishment of standards for the disposal of used cooking oil. Non-compliance with these regulations can result in hefty fines, prompting businesses to seek proper disposal methods. The used cooking-oil market is thus positioned to benefit from this regulatory landscape, as companies are incentivized to recycle their used oils rather than dispose of them improperly. This shift could potentially increase the market size by 20% over the next few years, as more businesses recognize the importance of adhering to environmental standards.

Technological Innovations in Oil Processing

Technological advancements in oil processing are playing a pivotal role in the evolution of the used cooking-oil market. Innovations in extraction and purification techniques have improved the efficiency of converting used cooking oil into biodiesel and other valuable products. In 2025, it is anticipated that new processing technologies will reduce production costs by up to 30%, making the recycling of used cooking oil more economically attractive. The used cooking-oil market stands to gain from these advancements, as they enable higher yields and better quality end products. Furthermore, the integration of automation and data analytics in processing facilities may enhance operational efficiency, thereby fostering growth in the market.