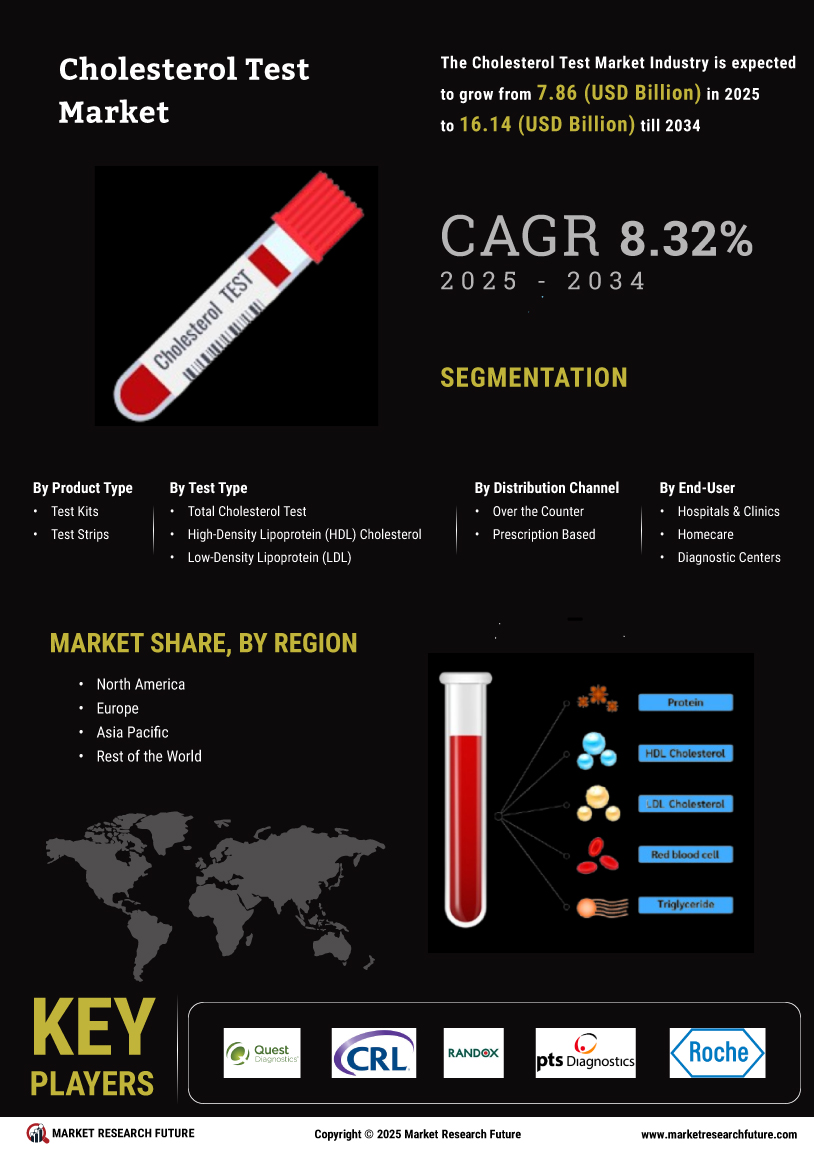

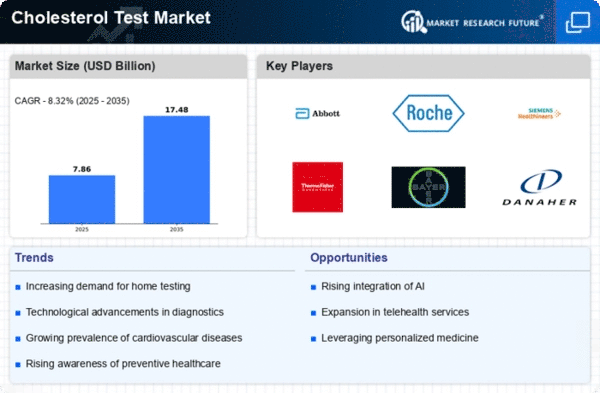

Market Growth Projections

The Global Cholesterol Test Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 7.26 USD Billion in 2024 and further escalate to 17.5 USD Billion by 2035, the industry is poised for a remarkable trajectory. The compound annual growth rate (CAGR) is expected to be around 8.32% from 2025 to 2035, indicating a robust expansion phase. This growth is likely driven by various factors, including technological advancements, increased health awareness, and government initiatives promoting cholesterol testing. The market's upward trend reflects a growing recognition of the importance of cholesterol management in overall health.

Government Initiatives and Health Campaigns

Government initiatives aimed at promoting cardiovascular health play a crucial role in shaping the Global Cholesterol Test Market Industry. Various health campaigns encourage regular cholesterol screenings as part of preventive healthcare measures. These initiatives often include public awareness programs that educate individuals about the risks associated with high cholesterol levels. By fostering a culture of regular health check-ups, governments are likely to increase the demand for cholesterol testing services. As a result, the market is expected to grow significantly, potentially reaching 17.5 USD Billion by 2035. Such proactive measures underscore the importance of cholesterol management in public health strategies.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases globally serves as a primary driver for the Global Cholesterol Test Market Industry. As heart-related ailments continue to rise, the demand for cholesterol testing becomes more pronounced. According to health statistics, cardiovascular diseases remain a leading cause of mortality, prompting healthcare providers to emphasize regular cholesterol screenings. This trend is likely to escalate the market's growth, with projections indicating that the Global Cholesterol Test Market could reach 7.26 USD Billion in 2024. The heightened awareness surrounding heart health is expected to further propel the need for cholesterol testing, thereby enhancing market dynamics.

Technological Advancements in Testing Methods

Innovations in cholesterol testing technologies significantly influence the Global Cholesterol Test Market Industry. The introduction of point-of-care testing devices and home testing kits has revolutionized how cholesterol levels are monitored. These advancements not only improve accessibility but also enhance the accuracy and speed of test results. For instance, portable devices allow patients to conduct tests in the comfort of their homes, fostering proactive health management. As these technologies become more prevalent, the market is poised for substantial growth, with an anticipated CAGR of 8.32% from 2025 to 2035. Such innovations are likely to attract a broader consumer base, further driving market expansion.

Aging Population and Increased Health Awareness

The global demographic shift towards an aging population is a significant driver of the Global Cholesterol Test Market Industry. Older adults are generally at a higher risk for elevated cholesterol levels and related health complications. As this demographic continues to expand, the demand for cholesterol testing is expected to rise correspondingly. Moreover, increased health awareness among older adults regarding the importance of monitoring cholesterol levels contributes to this trend. This growing focus on preventive healthcare is likely to bolster market growth, with projections indicating a robust expansion trajectory in the coming years. The intersection of aging and health consciousness presents a unique opportunity for market stakeholders.

Integration of Cholesterol Testing in Routine Health Check-ups

The integration of cholesterol testing into routine health check-ups is becoming increasingly common, thereby driving the Global Cholesterol Test Market Industry. Healthcare providers are recognizing the importance of monitoring cholesterol levels as part of comprehensive health assessments. This trend is particularly evident in primary care settings, where regular screenings are encouraged to identify potential health risks early. As more individuals undergo routine check-ups that include cholesterol testing, the market is expected to experience sustained growth. This shift towards preventive healthcare aligns with broader health trends, suggesting a favorable outlook for the industry in the coming years.

Leave a Comment