Growth of the Beverage Industry

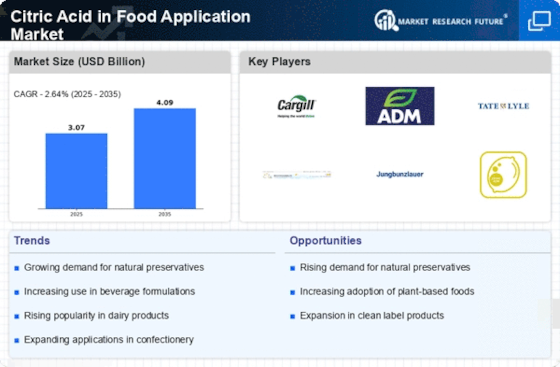

The expansion of the beverage industry serves as a significant driver for the Citric Acid in Food Application Market. With the increasing consumption of soft drinks, energy drinks, and flavored waters, the demand for citric acid is anticipated to rise correspondingly. Citric acid is widely used in these beverages for its flavor-enhancing properties and ability to act as a preservative. Recent market trends indicate that the non-alcoholic beverage sector is experiencing robust growth, with projections suggesting a compound annual growth rate that could exceed 5% in the coming years. This growth trajectory indicates a sustained demand for citric acid, as manufacturers seek to improve product quality and shelf life.

Increasing Health Consciousness

The rising awareness regarding health and wellness among consumers appears to be a pivotal driver in the Citric Acid in Food Application Market. As individuals become more discerning about their dietary choices, there is a marked shift towards products that are perceived as healthier. Citric acid, known for its natural preservative qualities and ability to enhance flavor, aligns well with this trend. Market data indicates that the demand for clean-label products, which often include citric acid as a key ingredient, has surged, with a notable increase in sales of organic and natural food items. This trend suggests that manufacturers are likely to incorporate citric acid more frequently in their formulations to cater to health-conscious consumers.

Versatility in Food Applications

Citric acid's multifunctional properties contribute significantly to its prominence in the Citric Acid in Food Application Market. It serves various roles, including as a flavor enhancer, preservative, and acidulant, making it an invaluable ingredient across diverse food categories. The versatility of citric acid allows it to be utilized in beverages, dairy products, confectionery, and sauces, among others. Market analysis reveals that the beverage sector, particularly soft drinks, accounts for a substantial share of citric acid consumption, with projections indicating continued growth in this segment. This adaptability not only meets the evolving preferences of consumers but also encourages food manufacturers to explore innovative applications of citric acid in their products.

Consumer Preference for Clean Label Products

The growing consumer preference for clean label products is emerging as a crucial driver in the Citric Acid in Food Application Market. Shoppers are increasingly seeking transparency in ingredient lists, favoring products that are free from artificial additives and preservatives. Citric acid, being a naturally derived ingredient, fits well within this clean label trend. Market Research Future indicates that products labeled as 'clean' are witnessing higher sales growth compared to conventional items. This shift in consumer behavior is prompting food manufacturers to reformulate their offerings, incorporating citric acid to meet the demand for cleaner, more natural products. As this trend continues, the role of citric acid in food applications is likely to expand.

Regulatory Support for Natural Preservatives

The increasing regulatory support for natural preservatives is likely to bolster the Citric Acid in Food Application Market. Governments and food safety authorities are progressively advocating for the reduction of synthetic additives in food products, thereby creating a favorable environment for natural alternatives like citric acid. This shift is evident in various regions, where regulations are being updated to promote the use of natural ingredients. As a result, food manufacturers are encouraged to reformulate their products, incorporating citric acid to comply with these regulations. Market data suggests that the demand for natural preservatives is expected to grow, with citric acid positioned as a leading choice due to its efficacy and safety profile.

.png)