Research Methodology on Civil Engineering Market

Introduction

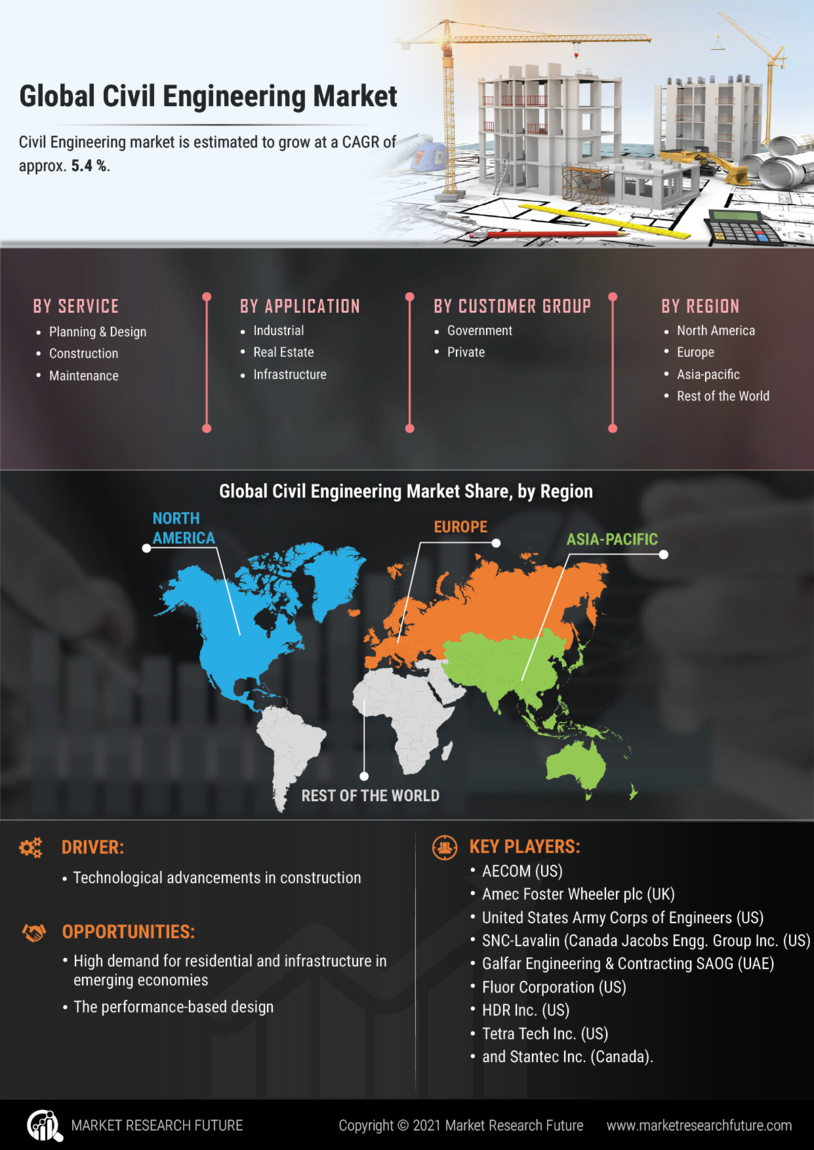

The global civil engineering market is estimated to witness amazing growth to reach its highest valuation during the forecast period 2023 to 2030. Civil engineering services include planning, design and construction of the physical and naturally built environment. Civil engineering is a professional engineering discipline that deals with the design, construction, and maintenance of the physical and naturally built environment, including works such as roads, bridges, canals, dams, and buildings. Civil engineering is one of the oldest engineering disciplines as it is traditionally subdivided into several smaller sub-disciplines including architectural engineering, structural engineering, transportation engineering, geotechnical engineering, coastal engineering, and others.

Research Methodology

The current research aims to estimate the size of the global civil engineering market during the forecast period from 2023 to 2030. In order to achieve this goal, a comprehensive research methodology is employed to collect the necessary data and information. The research methodology used for this report encompasses the following aspects:

Primary Research

Primary research involves an extensive nature of desk research, including extensive exploratory as well as secondary research for gaining insights into the civil engineering market worldwide. Secondary research sources such as company websites, reliable paid sources, industry magazines, journals and trade publications are referred to gain a precise understanding of the civil engineering market. Furthermore, detailed secondary research is conducted to gain an understanding of the market dynamics, related markets, market size, previous developments, current market trends and future outlook. Primary research is conducted to verify the data collected through secondary research and to gain an understanding of the dynamic aspects of the market. Companies such as technological firms, service providers, suppliers, distributors and original equipment manufacturers (OEMs) were contacted for primary interviews.

Secondary Research

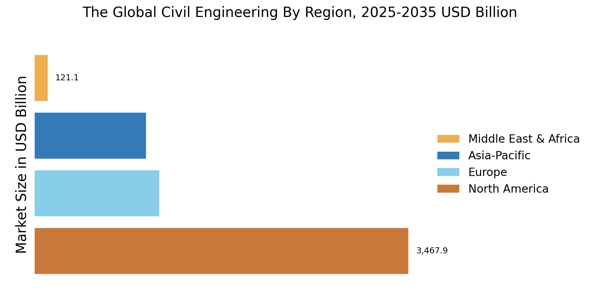

The secondary research includes analysis of the sector size in terms of value and volume, segmentation based on various parameters such as services offered, geographic regions, and demand/supply analysis. The various secondary sources that have been referred to while preparing the report include industry reports such as Civil Engineering Market by Market Research Future (MRFR), periodicals and magazines such as Civil Engineering Technology and Civil Engineering Magazine, electronic databases such as ProQuest, and other online and offline sources such as journal articles, industry reports, company websites, company databases, press releases, and technical papers.

Market Estimation

The bottom-up approach is used to estimate the market size of the global civil engineering market by analyzing the revenues of different market players in the industry. The market of civil engineering serves a plethora of applications and technologies, such as transportation engineering, structural engineering, geotechnical engineering, environmental engineering and others. The market size is calculated using data obtained from a combination of primary and secondary sources. The figures are then validated by conducting interviews with leading manufacturers and industry experts.

Data Triangulation

After arriving at the overall market size using the sum of the bottom-up approach, the market is split into different segments and sub-segments. These figures were further validated by triangulating the data obtained from primary and secondary research.

Report Assumptions

The report considers the market sizes of different civil engineering sectors, including transportation engineering, structural engineering, geotechnical engineering, environmental engineering and others. The other sectors considered in the report, such as material and formulation, installation and services, and others, are excluded from the scope of the report.