Growing Energy Sector

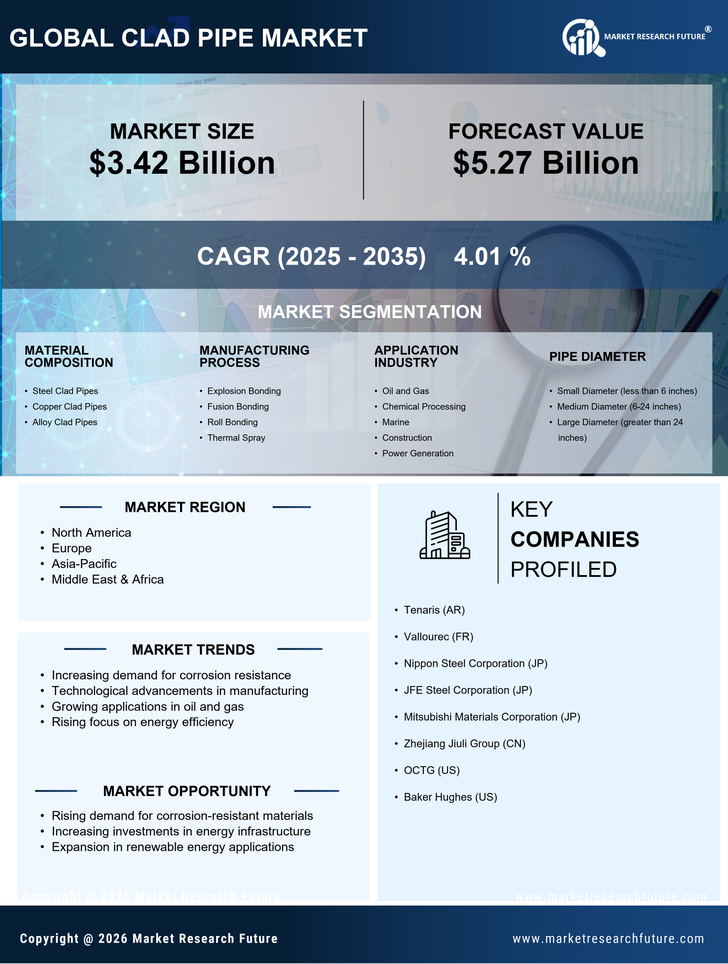

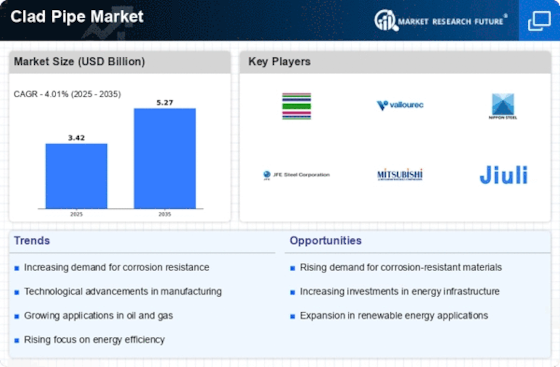

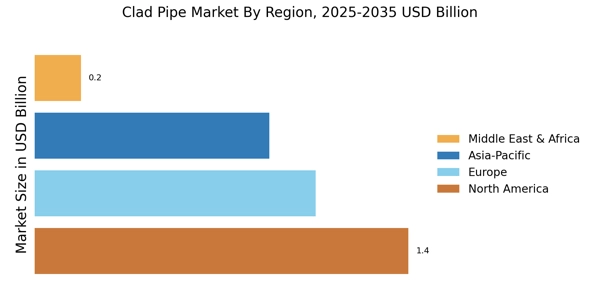

The Clad Pipe Market is significantly influenced by the expanding energy sector, particularly in oil and gas exploration and production. As energy demands continue to rise, the need for efficient and reliable transportation of resources becomes paramount. Clad pipes, known for their superior resistance to corrosion and wear, are increasingly being utilized in offshore and onshore applications. Recent statistics suggest that the oil and gas industry accounts for a substantial share of the clad pipe market, with projections indicating a steady growth rate of around 4% annually. This growth is likely to be driven by the need for advanced materials that can withstand harsh environmental conditions, thereby enhancing the overall efficiency of energy operations.

Rising Demand in Chemical Processing

The Clad Pipe Market is witnessing a notable increase in demand from the chemical processing sector, where the need for materials that can withstand aggressive chemicals is paramount. Clad pipes are increasingly being utilized in various applications, including the transportation of corrosive substances and in reactors. The chemical industry is projected to grow at a rate of approximately 3% annually, driven by the expansion of manufacturing capabilities and the need for efficient processing solutions. This growth is likely to bolster the demand for clad pipes, as they provide a reliable solution for maintaining the integrity of piping systems in challenging environments. As such, the clad pipe market is expected to see a sustained increase in demand from this sector.

Increasing Infrastructure Investments

The Clad Pipe Market is experiencing a surge in demand due to increasing investments in infrastructure projects across various sectors. Governments and private entities are allocating substantial budgets for the development of energy, water, and transportation infrastructure. For instance, the energy sector is witnessing a notable rise in the construction of pipelines for oil and gas transportation, which often require clad pipes for enhanced durability and corrosion resistance. According to recent data, infrastructure spending is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This trend indicates a robust market for clad pipes, as they are essential components in ensuring the longevity and reliability of these critical infrastructures.

Environmental Regulations and Standards

The Clad Pipe Market is also shaped by stringent environmental regulations and standards aimed at reducing emissions and promoting sustainability. As industries face increasing pressure to comply with these regulations, the demand for materials that can withstand corrosive environments while minimizing environmental impact is on the rise. Clad pipes, with their unique properties, offer a viable solution for companies looking to meet these standards. Recent data indicates that industries such as chemical processing and wastewater management are increasingly adopting clad pipes to ensure compliance with environmental regulations. This trend not only supports the growth of the clad pipe market but also encourages innovation in material science to develop even more sustainable solutions.

Technological Innovations in Material Science

The Clad Pipe Market is benefiting from ongoing technological innovations in material science, which are enhancing the performance and application of clad pipes. Advances in welding techniques and the development of new alloy compositions are enabling manufacturers to produce clad pipes that are lighter, stronger, and more resistant to corrosion. These innovations are particularly relevant in industries such as aerospace and automotive, where weight reduction and durability are critical. Market data suggests that the adoption of advanced manufacturing processes is expected to increase the efficiency of clad pipe production, potentially reducing costs and improving product availability. This technological evolution is likely to attract new players into the clad pipe market, further stimulating competition and growth.