Research Methodology on Cloud Backup Market

Abstract

The aim of this research report is to investigate the global cloud backup market, its trends, and the impact of the COVID-19 pandemic on it. Data is collected using different primary and secondary research methods, such as surveys, interviews, market reports, and published research papers.

Introduction

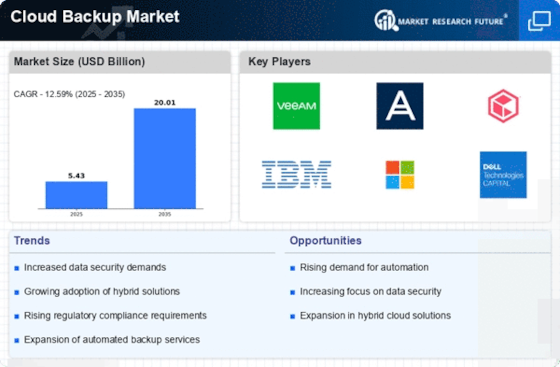

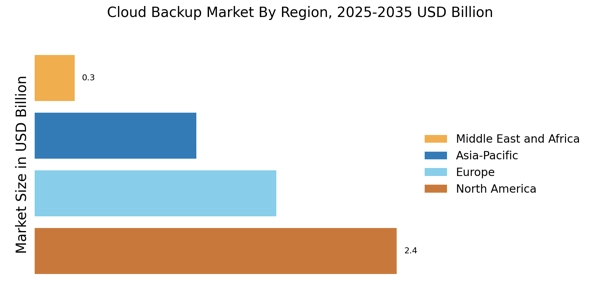

The cloud backup market is one of the fastest-growing segments in the global IT sector. Cloud storage is considered a convenient and efficient electronic storage platform that provides robust, secure, and cost-effective storage services. The global cloud backup market is expected to expand rapidly during 2023-2030, due to various factors such as increasing demand for secure long-term storage and data protection from data breaches and natural disasters. This report provides an overview of this market, current trends, growth drivers and restraints.

Research Methodology

To investigate the global cloud backup market and its impact on the international market, Market Research Future (MRFR) has conducted an extensive analysis of the current market conditions. MRFR utilizes both primary and secondary methodologies to collect and analyze data.

Primary Research Method

The primary data is collected from surveys and interviews conducted with various industry experts and market practitioners. The survey and interview aimed to understand the market dynamics and current trends in the cloud backup market. The primary data is collected through direct interviews and face-to-face interactions with industry experts, market practitioners, end-users, and stakeholders.

Secondary Research Method

MRFR also collected secondary data from published market reports, journals, whitepapers, and other sources and this data is then used to analyze the market size and the future trends of the cloud backup market. The secondary research method includes an analysis of the industry trends, growth drivers, and key players in the market.

Data Analysis

The data collected through primary and secondary research is analyzed and tabulated using various market analysis techniques. The data is grouped by various factors such as revenue, end-user segment, deployment model, industry type, service type, region, and other parameters. The data is then analyzed and compared to study the market trends and draw accurate conclusions.

Findings

The results of the research showed that the cloud backup market is expected to grow at an impeccable growth rate during the forecast period of 2023-2030. This expansion is due to the increasing demand for secure long-term storage and data protection from data breaches and natural disasters.

Conclusion

The global cloud backup market is expected to record significant growth over the next seven years. The increasing demand for robust and secure long-term storage services, cost-efficiency, and data protection from data breaches and natural disasters are the key drivers of this expansion.