Market Share

Cloud Managed Services Market Share Analysis

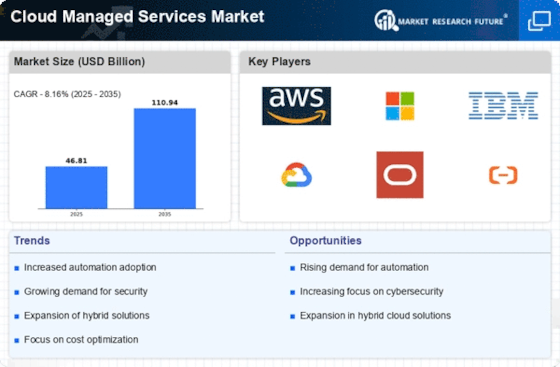

The Cloud Managed Services Market has grown exponentially due to industry adoption of cloud computing technologies. Companies are using market share positioning strategies to compete in this changing environment. Service providers often differentiate their products with unique features, specialized skills, or new solutions. Companies may attract a niche market and establish loyalty by delivering unique and useful services. The Cloud Managed Services Market also emphasizes cost leadership. In this strategy, firms aim to be the cheapest supplier without sacrificing quality. Cost-conscious clients like this technique, which may grow market share as organizations seek affordable cloud IT infrastructure management solutions. To control costs, cost leadership involves operational efficiency, economies of scale, and strategic relationships. Cloud Managed Services Market share positioning depends on strategic agreements and partnerships. Companies may increase their service offerings, capabilities, and client base by partnering with cloud service providers and technology suppliers. These relationships promote innovation and complete solutions, placing the firms as leaders in cloud managed services. Targeting verticals or industries is another successful market share positioning technique. Companies may become experts in healthcare, finance, and manufacturing by tailoring services to their needs and compliance requirements. This tailored strategy draws consumers in those sectors and builds a reputation for expertise and dependability, boosting market share and success. Cloud Managed Services Markets value client pleasure and loyalty, thus customer-centric initiatives are essential. Personalized solutions, fast assistance, and excellent customer service build loyalty and encourage customers to remain with a service provider. Industry word of mouth and favorable evaluations may boost a company's market share as pleased consumers recommend new business. Research and development of cutting-edge technologies gives organizations an edge in the Cloud Managed Services Market. Companies may meet changing client requirements by improving and keeping ahead of technology. Innovation-driven strategies gain market share and establish a firm as an industry thought leader, shaping the market. Geographical expansion targets new markets and areas to find new possibilities. Companies that expand into developing markets or strategically important areas may profit on the expanding demand for cloud managed services as businesses embrace cloud solutions internationally. This strategy demands a detailed awareness of local rules, cultural differences, and market dynamics to succeed in new markets.

Leave a Comment