Research Methodology on Cloud-Managed Services Market

Introduction

This research report proposes to study the global cloud managed services market which covers various enterprise and industry segments. The research aims to analyze the market and its progress in the past five years to estimate the market value over the forecast period 2023-2030. The pertinent questions to be answered revolve around the estimation of the size and value of the market and the impact of its dynamics on the industry developments during this period.

The research process is designed to explore the market dynamics and assess their influence on the growth of the cloud-managed services market in terms of revenue and market size. The short-term and long-term objectives of the research are cited in detail. The overall methodology of the research is described so that the research goals and approach can be recognized clearly. The population, data sources, and collection of data are mentioned at length. Appropriate stratification, scalarization and analysis methods are also discussed to evaluate the market progress.

Research Goals and Objectives

The primary aim of the research report is to provide a comprehensive assessment of the cloud-managed services market and its trends since 2022, and to estimate its growth rate and market size for the period 2023-2030. The research caters to the needs of stakeholders in the industry, by providing them a strategic understanding of the actions and decisions taken by them.

The short-term objectives of the research:

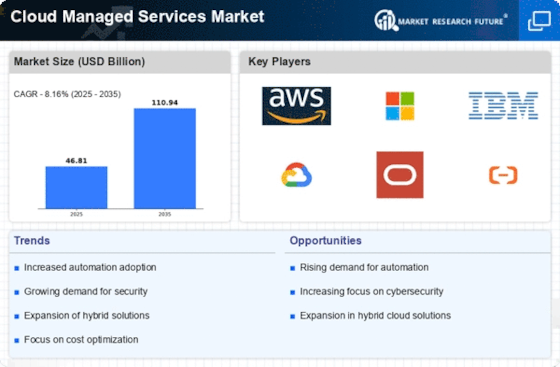

- To evaluate the market size and forecast the value of the cloud-managed services market during the period 2023-2030.

- To analyze the market dynamics and trends associated with cloud-managed services over the forecast period 2023 to 2030.

- To provide an in-depth analysis of the vendor landscape and the key players in the cloud-managed services market.

The long-term objectives of the research include:

- To analyze the impact of emerging technologies on the cloud-managed services market.

- To provide insights into emerging market opportunities for the introduction of new offerings.

- To understand the demand for cloud-managed services in various industry verticals.

Research Methodology

The research process includes primary and secondary data from various sources such as industry-specific reports, white papers, and research journals. The Market Research Future (MRFR) experts also conducted a market survey to obtain a more in-depth understanding of the market. The surveys are designed to obtain a more accurate assessment of the market trends and dynamics.

Further, the market survey captures data from a broad-based set of vendors, organizations, and associations. With the use of the gathered data, the MRFR team aims to analyze the market size, the technological developments, and the application of cloud-managed services. In addition, the research identifies the potential vendors in the industry and their products, pricing structures and market strategies.

Population, Sample and Data Collection

The population for the research include both suppliers and consumers of cloud-managed services. The survey had a sample size of 1000 respondents, who were dynamic and computer-literate. The survey was conducted with the help of email, interviews, and questionnaires. The respondents include CXOs, directors, company executives, and business owners among others.

The scope of the study includes the collection of data from various sources such as industry publications, reports, and white papers. In addition, the data is collected from online sources, magazines, and press releases of the industry. The collected data is further validated by the experts and senior management, before further analysis.

Data Stratification and Analysis

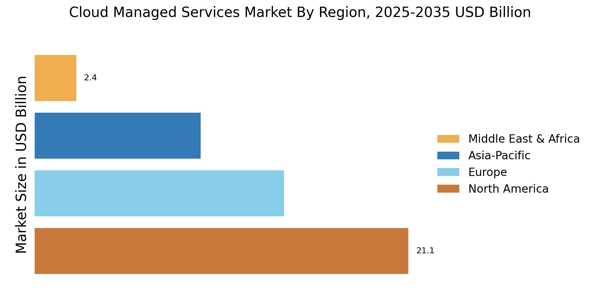

The data gathered is stratified based on geographical location, market size, and segmentation. Further, the data is scalarized to arrive at the market size. This is followed by the analysis of the data concerning the market overview, market performance analysis, the vendor landscape, and the analysis of the market trends.

The market performance analysis involves using statistical methods such as the SWOT analysis and Porter’s five forces model to comprehend the growth opportunities and the threats faced by the industry. The market overview is achieved through extensive interviews held with the key players in the market. The study of the market trends is to identify any upcoming opportunities in the market.

The final analysis of the results is done by experts who apply their industry knowledge to understand the impact of the market dynamics on the market. The results of the research are presented in the form of a market report with details of the market size, key players, and market trends.

Conclusion

This research report discusses the research methodology deployed by Market Research Future ( MRFR) to analyze the global cloud-managed services market. The research employed a combination of primary and secondary data collection techniques for obtaining an in-depth understanding of the market. Household surveys and estimated research data techniques were used to assess the market size and trends from 2023-2030. The market is analyzed using market performance analysis, a technological overview, the vendor landscape, and an analysis of the market trends. With the help of the conducted analysis, the research aims to provide stakeholders with a better understanding of the market and its demand in various industry verticals.