Coated Paper Market Summary

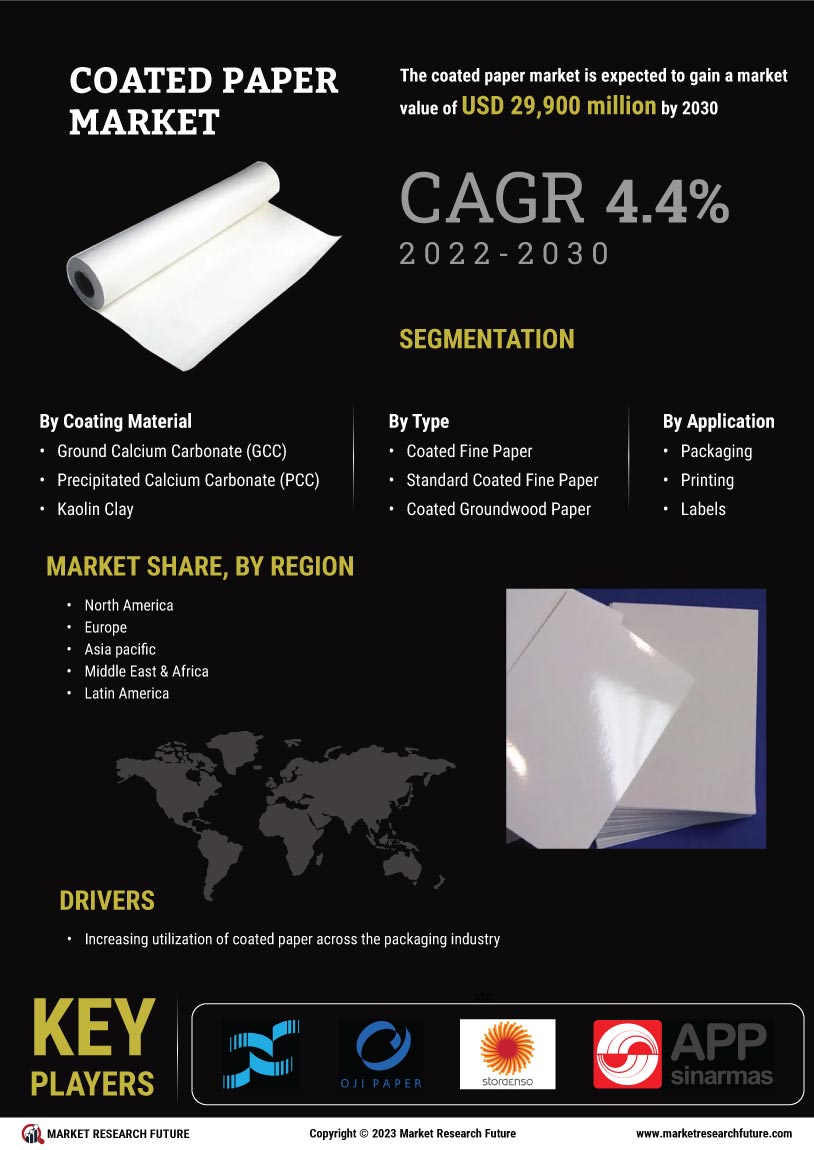

As per MRFR analysis, the Coated Paper Market Size was estimated at 8.3 USD Billion in 2024. The Coated Paper industry is projected to grow from 8.6 USD Billion in 2025 to 11.7 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.2% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Coated Paper Market is experiencing a dynamic shift driven by sustainability and technological advancements.

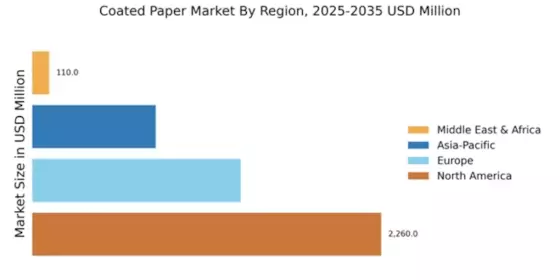

- North America remains the largest market for coated paper, driven by robust demand in the printing and publishing segments.

- Asia-Pacific is recognized as the fastest-growing region, with increasing investments in packaging and food and beverage applications.

- Customization and specialty products are gaining traction, reflecting a broader trend towards personalized consumer experiences.

- Sustainability initiatives and e-commerce growth are key drivers propelling the coated paper market forward.

Market Size & Forecast

| 2024 Market Size | 8.3 (USD Million) |

| 2035 Market Size | 8.6 (USD Million) |

| CAGR (2025 - 2035) | 11.7% |

Major Players

International Paper (USA), Stora Enso (Finland), UPM (Finland), Sappi (South Africa), Mondi Group (UK), DS Smith (UK), WestRock (USA), Nine Dragons Paper (China), Oji Holdings (Japan), BillerudKorsnäs (Sweden)