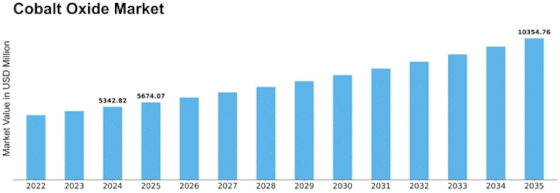

Cobalt Oxide Size

Cobalt Oxide Market Growth Projections and Opportunities

The Cobalt Oxide Market is shaped by various factors that collectively influence its trends and growth dynamics. One primary driver is the increasing demand for rechargeable batteries, particularly in the electric vehicle (EV) and portable electronic device sectors. Cobalt oxide, a crucial component in lithium-ion batteries, plays a pivotal role in enhancing battery performance and energy density. As the global push for sustainable and clean energy solutions intensifies, the demand for cobalt oxide in the production of batteries for EVs and electronic gadgets continues to rise.

Global economic conditions also significantly impact the Cobalt Oxide Market. Economic growth, industrialization, and infrastructural development contribute to increased demand for cobalt oxide in various applications, including ceramics, pigments, and catalysts. Developing economies, in particular, witness a surge in demand as they undergo rapid urbanization and technological advancements, fueling the need for cobalt oxide across diverse industries.

Geopolitical factors and trade dynamics play a role in shaping the Cobalt Oxide Market. Cobalt resources are concentrated in a few countries, and changes in trade relations, geopolitical tensions, and supply chain disruptions can impact the availability and pricing of cobalt oxide. Companies in the market must navigate these geopolitical uncertainties to ensure a stable supply chain and competitive pricing.

Furthermore, technological advancements in battery technology and cobalt extraction processes influence the market dynamics. Ongoing research and development efforts lead to innovations in battery chemistry, aiming to reduce or eliminate the dependence on cobalt oxide due to concerns about its supply chain sustainability and ethical mining practices. Companies that invest in alternative battery technologies or more sustainable cobalt extraction methods gain a competitive edge in a market increasingly focused on responsible sourcing.

Environmental and ethical considerations are becoming crucial factors in the Cobalt Oxide Market. The mining of cobalt has faced scrutiny due to environmental impacts and concerns about human rights violations in some mining regions. As a result, companies are under pressure to adopt ethical and sustainable sourcing practices, ensuring that their cobalt oxide supply chain aligns with environmental and social responsibility standards.

Fluctuations in cobalt prices also influence the Cobalt Oxide Market. The volatility in the cost of cobalt, driven by supply-demand imbalances and geopolitical factors, directly impacts production costs and pricing. Companies need to implement effective supply chain management and pricing strategies to navigate these raw material price dynamics.

The energy storage sector, beyond electric vehicles, contributes significantly to the Cobalt Oxide Market. As the importance of renewable energy sources grows, cobalt oxide continues to find applications in stationary energy storage systems, supporting grid stability and the integration of renewable energy into the power grid. The expansion of renewable energy projects globally contributes to the demand for cobalt oxide in energy storage solutions.

Consumer electronics, such as smartphones and laptops, also drive the market demand for cobalt oxide. As these devices become more advanced and energy-efficient, the need for high-performance batteries containing cobalt oxide remains integral to meet consumer expectations for longer battery life and faster charging.

Leave a Comment