- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

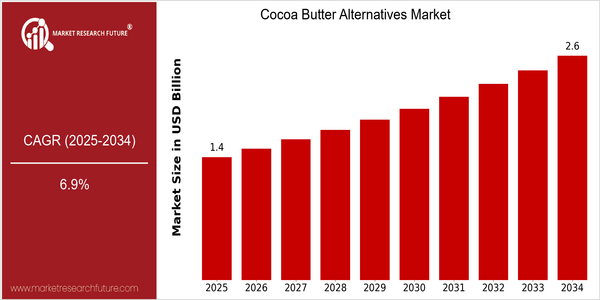

| Year | Value |

|---|---|

| 2025 | USD 1.44 Billion |

| 2034 | USD 2.62 Billion |

| CAGR (2025-2034) | 6.9 % |

Note – Market size depicts the revenue generated over the financial year

The Cocoa Butter Alternatives Market is poised for significant growth, with a current market size projected at USD 1.44 billion in 2025 and an anticipated increase to USD 2.62 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 6.9% over the forecast period. This upward trajectory indicates a strong demand for cocoa butter alternatives, driven by evolving consumer preferences and the increasing adoption of plant-based ingredients in food and cosmetic applications. Several factors are propelling this market expansion, including the rising health consciousness among consumers, which has led to a shift towards healthier and more sustainable product options. Additionally, technological advancements in food processing and formulation are enabling manufacturers to create high-quality cocoa butter alternatives that closely mimic the sensory and functional properties of traditional cocoa butter. Key players in the industry, such as Cargill, Barry Callebaut, and Olam International, are actively investing in research and development, forming strategic partnerships, and launching innovative products to capture a larger market share. These initiatives not only enhance product offerings but also align with the growing trend of sustainability and ethical sourcing in the food and cosmetics sectors.

Regional Market Size

Regional Deep Dive

The Cocoa Butter Alternatives Market is experiencing dynamic growth across various regions, driven by increasing consumer demand for plant-based and sustainable products. In North America, the market is characterized by a strong inclination towards health-conscious and ethical consumption, while Europe showcases a robust regulatory framework that promotes the use of alternative ingredients in food and cosmetics. The Asia-Pacific region is witnessing a surge in innovation and product development, particularly in the confectionery and personal care sectors, fueled by a growing middle class and changing consumer preferences. Meanwhile, the Middle East and Africa are gradually adopting cocoa butter alternatives, influenced by local culinary traditions and the rising popularity of vegan and organic products. Latin America, being a significant cocoa-producing region, is also exploring the potential of cocoa butter alternatives to enhance its export offerings and meet global demand.

Europe

- The European Union's stringent regulations on food safety and labeling are pushing manufacturers to adopt cocoa butter alternatives that meet these standards, with companies like Olam International leading the way in sustainable sourcing.

- Innovations in the cosmetic industry, particularly in clean beauty products, are driving the demand for cocoa butter alternatives, as brands like L'Oréal and Unilever seek to replace traditional ingredients with more sustainable options.

Asia Pacific

- The Asia-Pacific region is witnessing a surge in the confectionery market, with companies like Mondelez International and Nestlé investing in cocoa butter alternatives to cater to the growing demand for healthier snacks.

- Cultural shifts towards wellness and sustainability are influencing consumer preferences, prompting local manufacturers to explore cocoa butter alternatives in traditional sweets and desserts.

Latin America

- Latin America, being a key cocoa-producing region, is focusing on developing cocoa butter alternatives to enhance its product portfolio, with companies like Grupo Nutresa exploring innovative uses in their confectionery lines.

- The region's unique culinary traditions are being adapted to incorporate cocoa butter alternatives, as local chefs and food artisans experiment with these ingredients to create modern interpretations of traditional dishes.

North America

- The rise of veganism and plant-based diets in North America has led to increased demand for cocoa butter alternatives, with companies like Cargill and Barry Callebaut investing in product innovation to cater to this trend.

- Regulatory changes, such as the FDA's updated guidelines on food labeling, are encouraging manufacturers to explore alternative ingredients, thereby expanding the market for cocoa butter substitutes in food products.

Middle East And Africa

- In the Middle East, the growing popularity of vegan and organic products is leading to increased interest in cocoa butter alternatives, with local brands like Al Nassma Chocolate exploring these options in their offerings.

- Government initiatives aimed at promoting sustainable agriculture are encouraging farmers in Africa to diversify their crops, including the cultivation of cocoa butter alternatives, which could enhance local economies.

Did You Know?

“Cocoa butter alternatives can be derived from various sources, including shea butter and mango butter, which not only provide similar textures but also offer unique health benefits.” — International Journal of Food Science & Technology

Segmental Market Size

Cocoa Butter Alternatives (CBA) represent a dynamic segment within the broader cocoa market, primarily driven by the increasing demand for plant-based and sustainable ingredients in food and cosmetics. This segment is currently experiencing growth, fueled by consumer preferences for healthier and ethically sourced products. Key drivers include the rising awareness of health benefits associated with CBA, such as lower saturated fat content, and regulatory policies promoting sustainable sourcing practices in the food industry. Currently, the adoption of cocoa butter alternatives is in the scaled deployment stage, with companies like Cargill and AAK leading the charge in product innovation and market penetration. Primary applications include confectionery, bakery products, and personal care items, where CBA serves as a substitute for traditional cocoa butter. Trends such as the push for clean label products and sustainability initiatives are accelerating growth, while technologies like enzymatic processing and advanced extraction methods are shaping the segment's evolution, enabling manufacturers to create high-quality alternatives that meet consumer demands.

Future Outlook

The Cocoa Butter Alternatives Market is poised for significant growth from 2025 to 2034, with a projected market value increase from $1.44 billion to $2.62 billion, reflecting a robust compound annual growth rate (CAGR) of 6.9%. This growth trajectory is driven by rising consumer demand for plant-based and sustainable ingredients in food and cosmetics, as well as increasing awareness of the health benefits associated with cocoa butter alternatives. By 2034, it is anticipated that the penetration of cocoa butter alternatives in the confectionery and personal care sectors will reach approximately 25%, up from an estimated 15% in 2025, indicating a strong shift towards these alternatives in mainstream applications. Key technological advancements, such as improved extraction and processing methods, are expected to enhance the quality and functionality of cocoa butter alternatives, making them more appealing to manufacturers. Additionally, supportive policies promoting sustainable sourcing and production practices will further bolster market growth. Emerging trends, including the rise of clean label products and the increasing popularity of vegan and organic formulations, will also play a crucial role in shaping the market landscape. As consumers continue to prioritize health and sustainability, the Cocoa Butter Alternatives Market is well-positioned to capitalize on these trends, ensuring a dynamic and competitive environment through 2034.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.1 Billion |

| Market Size Value In 2023 | USD 1.17 Billion |

| Growth Rate | 6.91% (2023-2032) |

Cocoa Butter Alternatives Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.