Focus on Clean Label Products

The trend towards clean label products is significantly influencing the Cocoa Ingredients Market. Consumers are increasingly seeking transparency in food labeling, favoring products that contain natural and recognizable ingredients. This shift is prompting manufacturers to reformulate their offerings, reducing artificial additives and emphasizing the use of high-quality cocoa ingredients. Data indicates that the clean label market is expected to grow at a rate of 9% annually, reflecting consumer preferences for healthier options. As a result, cocoa ingredient suppliers are adapting to these demands by providing products that align with clean label standards. This focus on clean labeling is likely to enhance the appeal of cocoa ingredients, thereby driving growth within the Cocoa Ingredients Market.

Innovations in Cocoa Processing

Technological advancements in cocoa processing are transforming the Cocoa Ingredients Market. Innovations such as cold-pressing and advanced fermentation techniques are enhancing the flavor profiles and nutritional value of cocoa products. These methods not only improve the quality of cocoa ingredients but also increase their appeal to manufacturers seeking to create unique products. For instance, the introduction of specialty cocoa powders and butters has opened new avenues for product development in the confectionery and bakery sectors. As a result, the market for cocoa ingredients is expected to expand, with a projected growth rate of around 6% annually. This trend indicates that processing innovations are crucial for meeting evolving consumer demands and enhancing the overall Cocoa Ingredients Market.

Rising Demand for Dark Chocolate

The increasing consumer preference for dark chocolate is a notable driver in the Cocoa Ingredients Market. Dark chocolate is often perceived as a healthier alternative due to its higher cocoa content and lower sugar levels. This trend is supported by data indicating that the dark chocolate segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. As consumers become more health-conscious, they are gravitating towards products that offer potential health benefits, such as antioxidants found in cocoa. Consequently, manufacturers are focusing on enhancing their dark chocolate offerings, which in turn drives demand for cocoa ingredients. This shift in consumer behavior is likely to shape the Cocoa Ingredients Market significantly.

Growth of the Confectionery Sector

The expansion of the confectionery sector is a significant driver for the Cocoa Ingredients Market. As the global demand for confectionery products continues to rise, manufacturers are increasingly sourcing high-quality cocoa ingredients to meet consumer expectations. Data suggests that the confectionery market is expected to reach a valuation of over 200 billion dollars by 2026, with chocolate products accounting for a substantial share. This growth is attributed to changing lifestyles and the increasing popularity of indulgent treats. Consequently, cocoa ingredient suppliers are likely to benefit from this trend, as they provide essential components for chocolate and other confectionery items. The interplay between the confectionery sector and the Cocoa Ingredients Market is expected to foster further growth opportunities.

Emerging Markets and Consumer Trends

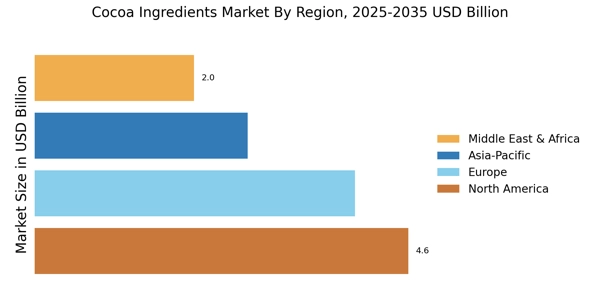

Emerging markets are becoming increasingly influential in the Cocoa Ingredients Market. As disposable incomes rise in regions such as Asia and Africa, there is a growing demand for chocolate and cocoa-based products. This trend is reflected in the increasing number of chocolate manufacturers entering these markets, seeking to capitalize on the expanding consumer base. Additionally, the rise of e-commerce platforms is facilitating access to cocoa products, allowing consumers to explore a wider range of offerings. Market analysts project that the demand for cocoa ingredients in these regions could grow by approximately 7% over the next few years. This shift indicates that emerging markets are likely to play a pivotal role in shaping the future of the Cocoa Ingredients Market.