Growing Emphasis on Team Collaboration

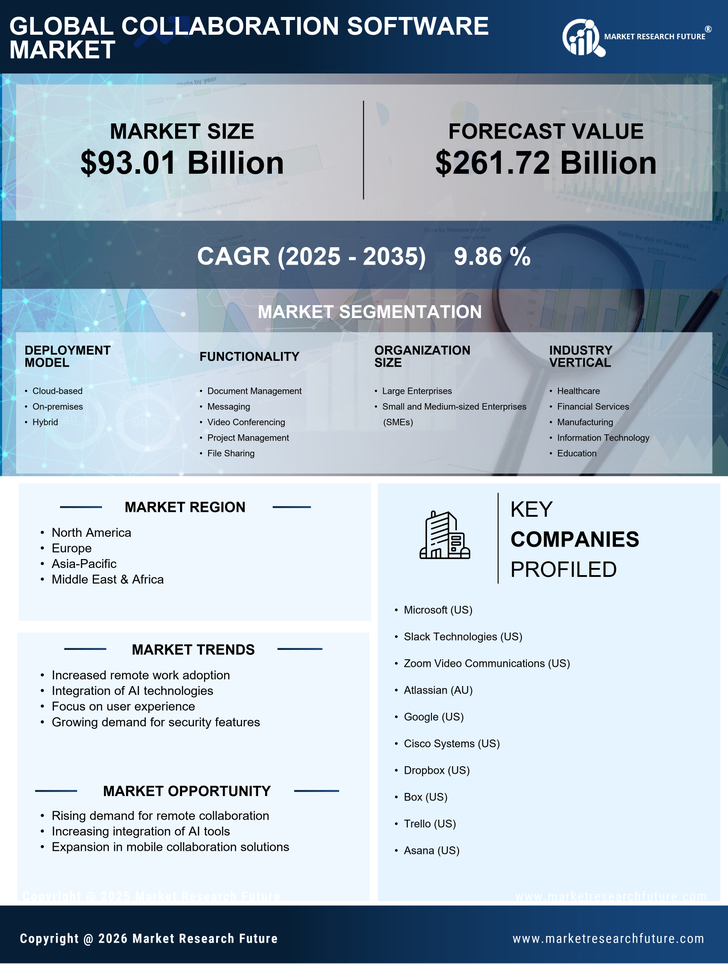

The Collaboration Software Market is significantly influenced by the growing emphasis on team collaboration. Organizations are increasingly recognizing the value of fostering teamwork to drive innovation and efficiency. Research suggests that companies with strong collaborative cultures are 5 times more likely to be high-performing. This realization propels investments in collaboration software that supports real-time communication, file sharing, and project tracking. As a result, the Collaboration Software Market is poised for expansion, with businesses prioritizing tools that enhance collaborative efforts and streamline workflows.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into collaboration tools is transforming the Collaboration Software Market. AI capabilities, such as automated scheduling, intelligent task management, and predictive analytics, enhance user experience and operational efficiency. Data indicates that AI-driven collaboration tools can reduce project completion times by up to 30%. This technological advancement not only improves productivity but also enables teams to focus on strategic initiatives rather than administrative tasks. As organizations increasingly adopt AI-enhanced solutions, the Collaboration Software Market is expected to grow, driven by the demand for smarter, more efficient collaboration tools.

Increased Demand for Remote Work Solutions

The Collaboration Software Market experiences a notable surge in demand for remote work solutions. As organizations adapt to flexible work arrangements, the need for effective collaboration tools becomes paramount. According to recent data, approximately 70% of companies are investing in collaboration software to enhance productivity and communication among remote teams. This trend indicates a shift in workplace dynamics, where traditional office settings are being replaced by virtual environments. Consequently, the Collaboration Software Market is likely to witness substantial growth as businesses seek to implement tools that facilitate seamless interaction and project management across dispersed teams.

Rising Need for Enhanced Security Features

The Collaboration Software Market faces a rising need for enhanced security features as organizations prioritize data protection. With the increasing frequency of cyber threats, businesses are seeking collaboration tools that offer robust security measures, including end-to-end encryption and secure access controls. Recent statistics reveal that 60% of companies consider security a top priority when selecting collaboration software. This heightened focus on security is likely to drive innovation within the Collaboration Software Market, as vendors strive to develop solutions that not only facilitate collaboration but also safeguard sensitive information.

Expansion of Mobile Collaboration Solutions

The expansion of mobile collaboration solutions is a key driver in the Collaboration Software Market. As mobile device usage continues to rise, organizations are increasingly adopting collaboration tools that enable employees to connect and collaborate on-the-go. Data shows that over 50% of employees prefer using mobile applications for work-related tasks. This trend underscores the necessity for collaboration software that is optimized for mobile platforms, allowing for flexibility and accessibility. Consequently, the Collaboration Software Market is likely to experience growth as vendors enhance their offerings to meet the demands of a mobile workforce.