Growing Environmental Awareness

The rising awareness of environmental issues is a significant driver for the Commercial Aircraft Cabin Trash Compactors Market. Passengers are increasingly concerned about the ecological impact of air travel, prompting airlines to adopt more sustainable practices. This shift in consumer behavior is leading to a greater demand for efficient waste management solutions, including trash compactors that minimize waste volume and promote recycling. Airlines are recognizing that implementing effective waste management systems can enhance their brand image and attract environmentally conscious travelers. Market projections indicate that the demand for eco-friendly waste management solutions will continue to rise, as airlines strive to align their operations with sustainability goals and reduce their carbon footprint.

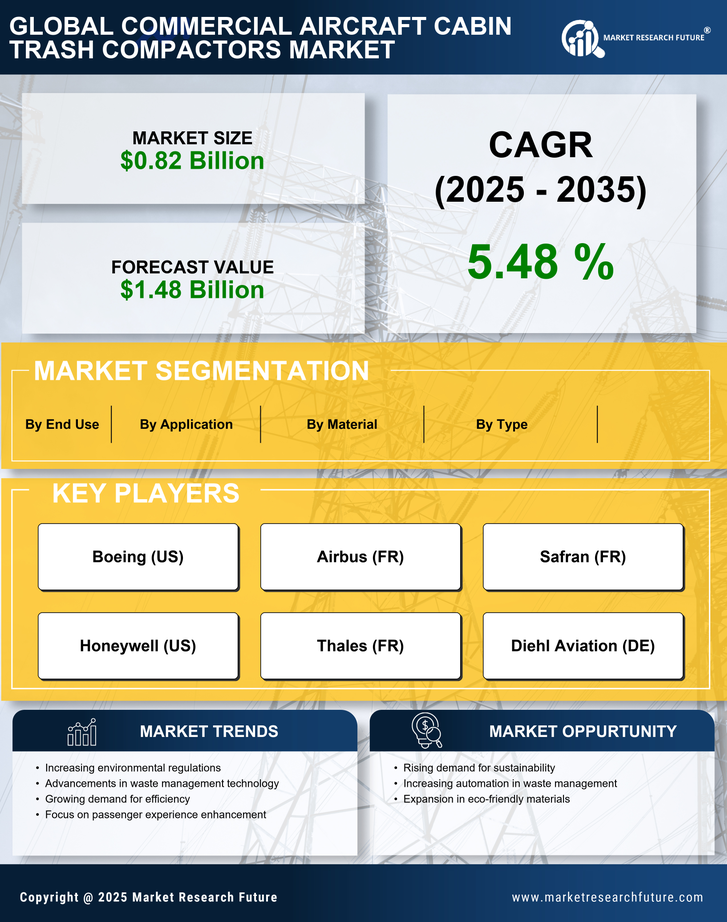

Increased Focus on Waste Management

The Commercial Aircraft Cabin Trash Compactors Market is experiencing a heightened emphasis on effective waste management solutions. Airlines are increasingly recognizing the importance of maintaining cleanliness and hygiene in aircraft cabins, which directly influences passenger satisfaction. As a result, the demand for efficient trash compactors is on the rise. According to industry estimates, the market for cabin waste management solutions is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This growth is driven by the need for airlines to optimize space and reduce operational costs associated with waste disposal. Furthermore, the integration of compactors that can handle diverse waste types is becoming essential, as airlines strive to enhance their waste management strategies.

Cost Efficiency and Operational Optimization

Cost efficiency remains a critical driver in the Commercial Aircraft Cabin Trash Compactors Market. Airlines are under constant pressure to reduce operational costs while maintaining high service standards. Efficient waste management systems, including advanced trash compactors, can significantly lower disposal costs by reducing the frequency of waste collection and optimizing storage space. By investing in compactors that enhance waste processing efficiency, airlines can achieve substantial savings in their overall waste management expenditures. Furthermore, the potential for reduced labor costs associated with waste handling adds to the appeal of these solutions. As airlines continue to seek ways to streamline operations and improve profitability, the demand for cost-effective trash compaction solutions is expected to grow.

Regulatory Pressures and Compliance Standards

The Commercial Aircraft Cabin Trash Compactors Market is significantly influenced by regulatory pressures and compliance standards. Governments and aviation authorities are implementing stringent regulations regarding waste management practices in the aviation sector. Airlines are compelled to adopt more efficient waste disposal methods to comply with these regulations, which often include guidelines on waste segregation and recycling. This regulatory landscape is driving the demand for advanced trash compactors that can meet these compliance requirements. As a result, manufacturers are focusing on developing compactors that not only comply with existing regulations but also anticipate future standards. The need for compliance is expected to propel market growth, as airlines prioritize investments in waste management technologies.

Technological Innovations in Compacting Solutions

Technological advancements are playing a pivotal role in shaping the Commercial Aircraft Cabin Trash Compactors Market. Innovations such as smart compactors equipped with sensors and automated systems are gaining traction. These technologies not only improve the efficiency of waste compaction but also provide real-time data on waste levels, enabling airlines to optimize collection schedules. The introduction of lightweight materials and energy-efficient designs further enhances the appeal of modern trash compactors. As airlines seek to reduce their environmental footprint, the adoption of these advanced solutions is likely to increase. Market analysts suggest that the integration of IoT technology in waste management systems could lead to a more streamlined and effective approach to cabin waste disposal.