- Commercial Aircraft Health Monitoring Systems Market Regional Insights

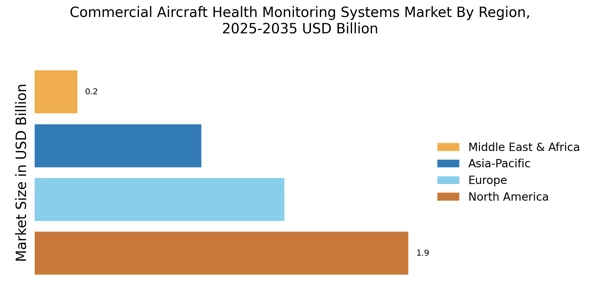

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North America Commercial Aircraft Health Monitoring Systems Market area will dominate this market. Due to the growing demand for commercial aircraft in this area, particularly in the U.S. and Canada, the North American market held the major revenue share in the worldwide Commercial Aircraft Health Monitoring Systems Market in 2022. The Region's expanding aerospace and aviation industries also fuel the market's revenue growth. In 2022, commercial aviation will contribute almost 1.25 trillion USD, or 5%, of the country's GDP.

Around 80 countries were served by 28,000 daily flights operated by American Airlines, connecting 2.5 million people and moving more than 58,000 tonnes of cargo. Moreover, rising commercial aircraft development is anticipated to fuel Commercial Aircraft Health Monitoring Systems Market revenue growth in the United States. Further, the major countries studied in the market report are The U.S., Canada, German, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

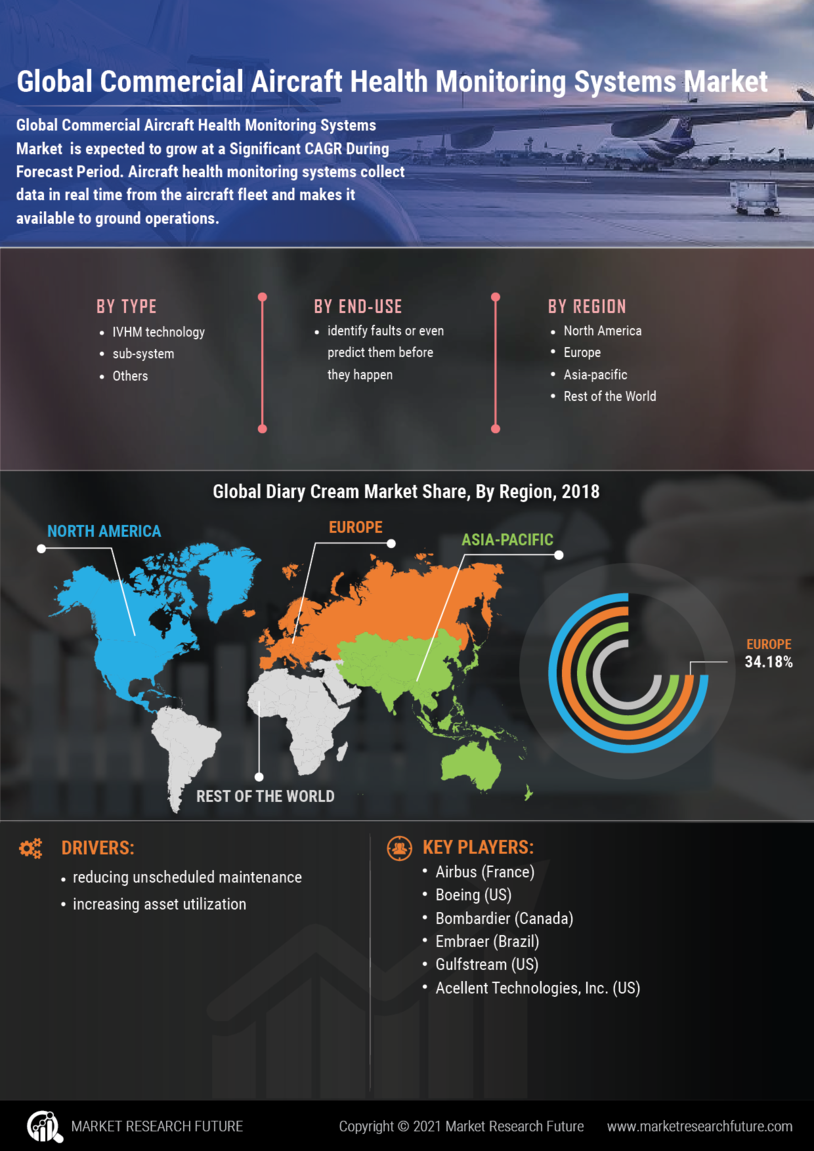

Figure 2: COMMERCIAL AIRCRAFT HEALTH MONITORING SYSTEMS MARKET SHARE BY REGION 2022 (%)

Source Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe Commercial Aircraft Health Monitoring Systems Market share the second highest growth during the forecast period. This is because more nations in this area, particularly the UK, Germany, Italy, and France, are adopting aircraft health monitoring in the commercial aviation industry. According to Eurostat, the number of flights in the European Union transporting people, goods, and mail grew by 25% between August 2021 and August 2022. There were over 597,000 commercial flights in August 2022.

In response to Russia's invasion of Ukraine, the German government announced in March 2022 that it would purchase up to 35 F-35 fighter jets made in the United States and 15 Eurofighter jets. This announcement is anticipated to increase demand for aircraft health monitoring and propel market revenue growth.

Further, the Germany Commercial Aircraft Health Monitoring Systems Market and the U.K. held the largest market share. The Commercial Aircraft Health Monitoring Systems Market was the fastest-growing market in the European Region. The Asia Pacific Commercial Aircraft Health Monitoring Systems Market is anticipated to have a considerably rapid revenue growth rate throughout the projected period. This results from the aviation sector's expanding expansion and the Region's growing awareness of airplane safety, particularly in China, Japan, and India. China's aviation sector has expanded significantly in recent years.

Chinese businesses like COMAC and AVIC have achieved considerable advancements in manufacturing commercial and military aircraft thanks to the government of China's significant investments in the industry's growth. At the end of 2020, China's civilian fleet comprised 6,795 aircraft, and its licensed pilot population stood at close to 69,500. The number of domestic flight routes in China will increase to 4,686 in 2020 due to the government's use of the home market to revitalize the country's civil aviation sector. In recent times, some Indian airlines have also used health monitoring systems.

For instance, the Indian airline IndiGo began utilizing Skywise Health Monitoring (SHM) in March 2022 to enhance its upcoming fleet's efficiency. Moreover, the China Commercial Aircraft Health Monitoring Systems Market held the largest market share. The India Commercial Aircraft Health Monitoring Systems Market was the fastest-growing market in the Asia-Pacific region.

Leave a Comment