Growing Focus on Sustainability

The growing focus on sustainability is reshaping the Commercial Aircraft In-Seat Power System Market. Airlines are increasingly prioritizing eco-friendly practices, which include the adoption of energy-efficient in-seat power systems. These systems are designed to minimize energy consumption and reduce the overall carbon footprint of aircraft operations. As environmental concerns gain prominence, airlines are likely to invest in technologies that support their sustainability initiatives. Market data indicates that the demand for sustainable aviation solutions is expected to rise, with a projected increase of 15% in investments towards green technologies over the next few years. This trend not only aligns with global sustainability goals but also enhances the reputation of airlines among environmentally conscious travelers. Thus, the emphasis on sustainability is a crucial driver for the Commercial Aircraft In-Seat Power System Market.

Increasing Passenger Expectations

The Commercial Aircraft In-Seat Power System Market is experiencing a notable shift driven by rising passenger expectations for in-flight amenities. As travelers increasingly seek comfort and convenience, airlines are compelled to enhance their offerings, including in-seat power systems. This demand is reflected in a projected growth rate of approximately 10% annually for in-seat power systems, as airlines recognize the necessity of providing charging options for personal devices. The integration of these systems not only improves passenger satisfaction but also serves as a competitive differentiator in a crowded market. Airlines that invest in advanced in-seat power solutions are likely to attract more customers, thereby enhancing their market share and profitability. Consequently, the focus on passenger experience is a critical driver for the Commercial Aircraft In-Seat Power System Market.

Competitive Pressure Among Airlines

Competitive pressure among airlines is a driving force in the Commercial Aircraft In-Seat Power System Market. As airlines strive to differentiate themselves in a saturated market, the provision of in-seat power systems has become a critical factor in attracting and retaining customers. Airlines that offer superior in-flight experiences, including reliable power sources for personal devices, are likely to gain a competitive edge. Market analysis suggests that airlines investing in advanced in-seat power solutions can expect to see an increase in passenger loyalty and satisfaction. This competitive dynamic is further intensified by the rise of low-cost carriers, which are also beginning to incorporate in-seat power options to enhance their service offerings. Consequently, the need to remain competitive is a significant driver for the Commercial Aircraft In-Seat Power System Market.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Commercial Aircraft In-Seat Power System Market. Governments and aviation authorities are implementing stringent regulations regarding the safety and reliability of in-flight power systems. Airlines must adhere to these regulations to ensure passenger safety and avoid potential liabilities. This compliance often necessitates investments in advanced power systems that meet or exceed regulatory requirements. As a result, the market is likely to see a surge in demand for certified in-seat power solutions, which can withstand rigorous safety tests. The emphasis on compliance not only enhances the safety of in-flight operations but also drives innovation within the industry, as manufacturers strive to develop systems that align with evolving standards. This regulatory landscape is a significant driver for the Commercial Aircraft In-Seat Power System Market.

Technological Advancements in Power Systems

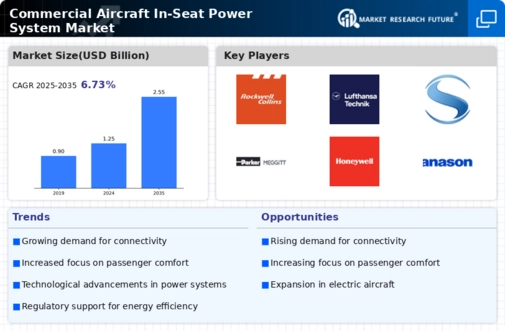

Technological advancements play a pivotal role in shaping the Commercial Aircraft In-Seat Power System Market. Innovations such as wireless charging and improved battery technologies are transforming how power is delivered to passengers. The introduction of more efficient power management systems is expected to reduce energy consumption, aligning with airlines' sustainability goals. Furthermore, the market is witnessing a shift towards lighter materials and compact designs, which enhance the overall efficiency of in-seat power systems. As airlines adopt these cutting-edge technologies, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 8% over the next five years. This technological evolution not only enhances passenger convenience but also contributes to operational efficiency, making it a key driver in the Commercial Aircraft In-Seat Power System Market.