Rising Air Travel Demand

The Commercial aircraft leasing Market is experiencing a notable surge in demand for air travel, driven by increasing disposable incomes and a growing middle class in various regions. This trend is reflected in the International Air Transport Association's projections, which indicate that passenger numbers could reach 8.2 billion by 2037. Consequently, airlines are seeking to expand their fleets to accommodate this influx of travelers. Leasing aircraft allows airlines to quickly adapt to market demands without the substantial capital outlay associated with purchasing new aircraft. This flexibility is particularly appealing in a competitive landscape where operational efficiency is paramount. As a result, the demand for leased aircraft is expected to rise, further propelling the growth of the Commercial Aircraft Leasing Market.

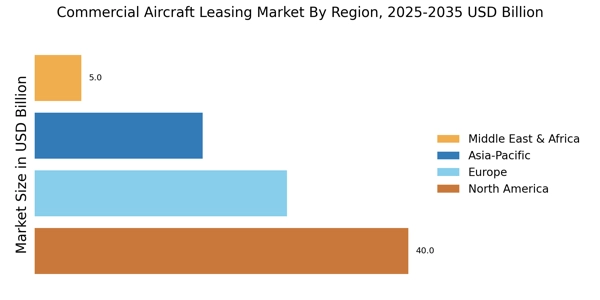

Emerging Markets and Regional Growth

The Commercial Aircraft Leasing Market is increasingly influenced by the emergence of new markets and regional growth. Countries in Asia, Africa, and Latin America are experiencing rapid economic development, leading to a surge in air travel demand. As these regions invest in their aviation infrastructure, airlines are looking to expand their fleets to meet the growing passenger traffic. Leasing provides a practical solution for airlines in these emerging markets, allowing them to acquire modern aircraft without the significant capital investment required for purchases. This trend is supported by forecasts indicating that air traffic in these regions is expected to grow at a faster rate than in mature markets. Consequently, the Commercial Aircraft Leasing Market is likely to see substantial opportunities arising from the expansion of aviation in these developing regions.

Increased Competition Among Airlines

The Commercial Aircraft Leasing Market is witnessing heightened competition among airlines, compelling them to optimize their operations and fleet management strategies. As new entrants emerge and established carriers expand their routes, the need for a diverse and modern fleet becomes critical. Leasing offers airlines the flexibility to scale their operations in response to market dynamics without the long-term commitment associated with purchasing aircraft. This competitive pressure is further exacerbated by fluctuating fuel prices and changing consumer preferences, which necessitate agile responses from airlines. Consequently, the leasing model is becoming increasingly attractive, as it allows carriers to maintain a competitive edge while managing costs effectively. This trend is likely to continue shaping the Commercial Aircraft Leasing Market in the foreseeable future.

Regulatory Support for Aviation Growth

The Commercial Aircraft Leasing Market is benefiting from supportive regulatory frameworks that promote aviation growth. Governments and regulatory bodies are increasingly recognizing the economic importance of the aviation sector, leading to policies that facilitate fleet expansion and modernization. Initiatives aimed at reducing bureaucratic hurdles and enhancing safety standards are encouraging airlines to invest in new aircraft, often through leasing arrangements. For instance, favorable tax incentives and financing options are being introduced to stimulate investment in the aviation sector. This regulatory support not only fosters a conducive environment for airlines but also enhances the attractiveness of leasing as a viable option for fleet expansion. As a result, the Commercial Aircraft Leasing Market is poised for continued growth, driven by these favorable regulatory conditions.

Technological Advancements in Aircraft

The Commercial Aircraft Leasing Market is significantly influenced by rapid technological advancements in aircraft design and manufacturing. Innovations such as fuel-efficient engines, advanced materials, and enhanced avionics systems are reshaping the aviation landscape. These advancements not only improve operational efficiency but also reduce environmental impact, aligning with the industry's increasing focus on sustainability. As airlines seek to modernize their fleets, leasing becomes an attractive option, allowing them to access the latest aircraft without the financial burden of ownership. According to industry estimates, the market for fuel-efficient aircraft is projected to grow, with a substantial portion of new deliveries likely to be leased rather than purchased. This trend underscores the importance of technological evolution in driving the Commercial Aircraft Leasing Market.