Research Methodology on Commercial Satellite Imaging Market

1. Introduction

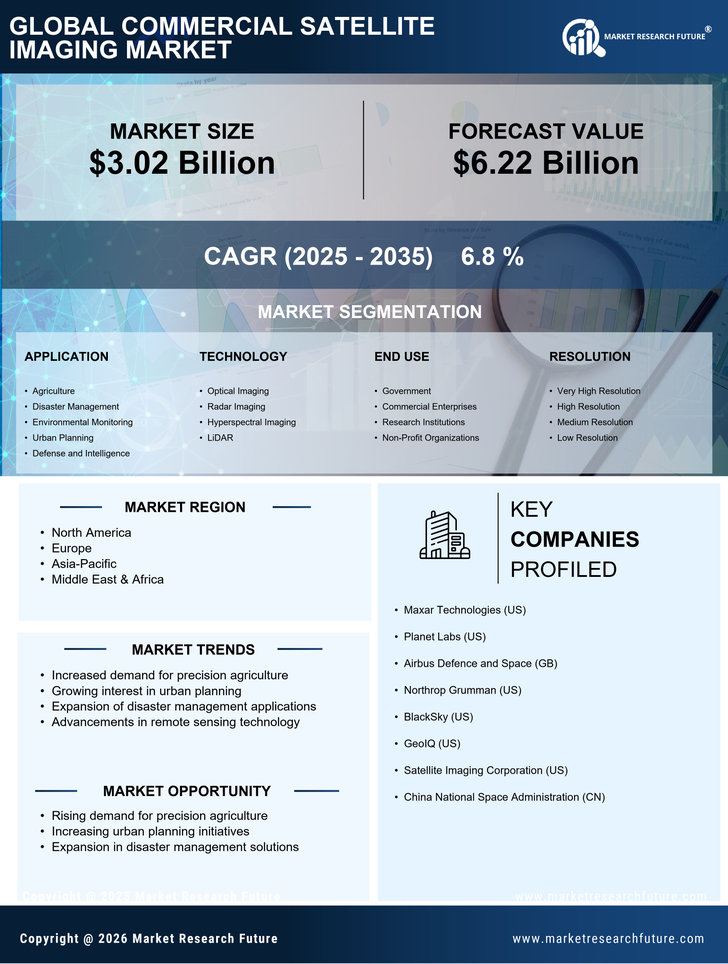

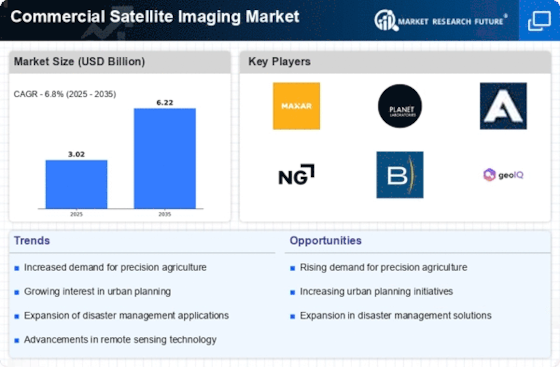

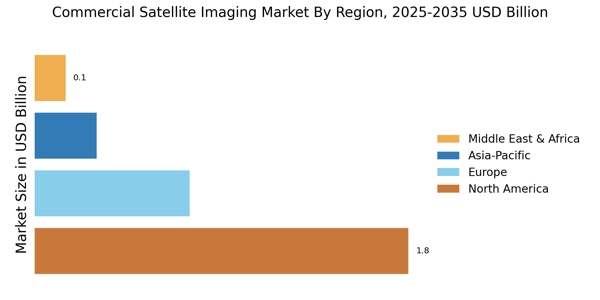

The overall objective of the research project is to analyze the current and future prospects of the global commercial satellite imaging market. The research process was conducted using an in-depth market analysis, taking into account the current and emerging trends, regulatory framework and supply chain of the commercial satellite imaging market. In the present market scenario, the global commercial satellite imaging market is expected to show tremendous growth potential due to the increasing demand for powerful data, on-demand services and satellite imaging technology. The research process was conducted in two stages: primary and secondary.

2. Primary Research

In the first phase of the research process, primary data was collected from various industry experts and market players, including satellite manufacturers and providers, satellite imaging solution providers, data service providers, software service providers, analytics service providers and telecom service providers. Detailed interviews were followed by market surveys to collect details about the current market dynamics and trends.

3. Secondary Research

In the second phase of the research process, secondary data was collected from reliable sources, such as published research papers and reports, industry journals, databases and government websites. Sources such as the World Bank, International Monetary Fund, World Trade Organization, World Intellectual Property Organization, and Global Innovation Index were also used to obtain information on the global commercial satellite imaging market. Reports from market research firms such as Market Research Future, Frost & Sullivan, Technavio and Technographics International were also referred for a comprehensive understanding of the global commercial satellite imaging market.

4. Data Analysis

The collected data were analyzed using qualitative and quantitative methods to gain insights into the current market situation and to assess the future prospects of the global commercial satellite imaging market. The collected data were further processed using descriptive analysis techniques to derive key findings and insights into the current market situation and future prospects of the global commercial satellite imaging market.

5. Market Modelling

After the analysis of the collected data, market modelling techniques were used to quantify the findings, calculate the market size and potential, and test the effects of various parameters on the global commercial satellite imaging market. The findings and insights derived from the research process were later used to validate the findings from the primary and secondary research stages and market modelling. The research model developed was validated using a quality check process, taking into account the results of the secondary and primary research data.

6. Results

The research process resulted in deep insights into the current market dynamics, trends and future prospects of the global commercial satellite imaging market. The research process resulted in the development of a market model and various statistics and forecast information on the global commercial satellite imaging market.

7. Conclusion

The research process was conducted through an in-depth understanding of the current market scenario, drivers, challenges and trends of the global commercial satellite imaging market along with forecast till 2030. The research process concluded with the development of a comprehensive market model and statistics on the global commercial satellite imaging market in terms of market size, market share, and growth prospects.