Expansion of Foodservice Outlets

The proliferation of foodservice outlets, including cafes, restaurants, and food trucks, significantly contributes to the growth of the commercial soft serve machine Market. With the increasing number of dining establishments, there is a corresponding rise in the demand for soft serve ice cream machines. Recent statistics indicate that the foodservice sector has seen a steady increase in new openings, with a notable rise in establishments focusing on dessert-centric menus. This trend is particularly pronounced in urban areas, where consumers are seeking quick and convenient dessert options. As foodservice operators recognize the profitability of offering soft serve products, investments in commercial soft serve machines are likely to increase. This expansion not only enhances the market landscape but also encourages innovation in product offerings within the Commercial Soft Serve Machine Market.

Rising Demand for Frozen Desserts

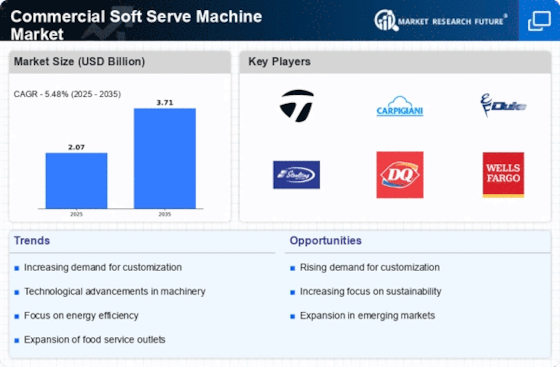

The increasing consumer preference for frozen desserts is a primary driver of the Commercial Soft Serve Machine Market. As more individuals seek indulgent yet convenient dessert options, the demand for soft serve ice cream has surged. According to recent data, the soft serve segment has experienced a growth rate of approximately 5% annually, reflecting a robust market trend. This rising demand is particularly evident in quick-service restaurants and ice cream parlors, where soft serve machines are essential for meeting customer expectations. The versatility of soft serve machines allows for a variety of flavors and toppings, further enhancing their appeal. As consumers continue to prioritize unique dessert experiences, the Commercial Soft Serve Machine Market is likely to expand, driven by the need for innovative and high-quality frozen dessert offerings.

Growing Popularity of Customization

The trend towards customization in food offerings is a significant driver of the Commercial Soft Serve Machine Market. Consumers increasingly desire personalized dessert experiences, prompting foodservice operators to invest in machines that allow for a variety of flavor combinations and toppings. This shift towards customization is evident in the rise of self-serve frozen yogurt shops and dessert bars, where customers can create their own unique soft serve creations. Market data suggests that establishments offering customizable dessert options have seen higher customer engagement and repeat visits. As the demand for personalized experiences continues to grow, the Commercial Soft Serve Machine Market is likely to expand, with operators seeking machines that facilitate this trend and enhance customer satisfaction.

Technological Innovations in Equipment

Technological advancements in commercial soft serve machines are transforming the Commercial Soft Serve Machine Market. Innovations such as energy-efficient models, automated controls, and improved hygiene features are becoming increasingly prevalent. These advancements not only enhance the operational efficiency of soft serve machines but also cater to the evolving needs of consumers and operators alike. For instance, machines equipped with smart technology allow for precise temperature control and monitoring, ensuring consistent product quality. Furthermore, the integration of user-friendly interfaces simplifies operation, making it easier for staff to manage production. As technology continues to evolve, the Commercial Soft Serve Machine Market is expected to witness a surge in demand for these advanced machines, as operators seek to improve service quality and reduce operational costs.

Increased Focus on Quality and Premium Products

The growing consumer inclination towards high-quality and premium dessert products is influencing the Commercial Soft Serve Machine Market. As consumers become more discerning about their food choices, there is a marked shift towards artisanal and gourmet soft serve options. This trend is reflected in the increasing number of establishments that prioritize quality ingredients and unique flavor profiles. Market analysis indicates that premium soft serve products command higher price points, thereby enhancing profitability for operators. Consequently, foodservice businesses are investing in advanced soft serve machines that can produce high-quality products consistently. This focus on quality not only meets consumer expectations but also positions the Commercial Soft Serve Machine Market for sustained growth as operators adapt to changing market dynamics.