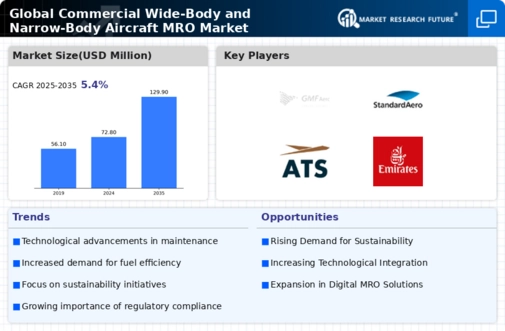

Increasing Air Traffic Demand

The rising demand for air travel is a primary driver for the Commercial Wide-Body and Narrow-Body Aircraft MRO Market. As more passengers opt for air travel, airlines are expanding their fleets to accommodate this growth. According to recent data, the number of air passengers is projected to reach 8.2 billion by 2037, necessitating a corresponding increase in aircraft maintenance, repair, and overhaul services. This surge in demand for air travel directly influences the need for efficient MRO services, as airlines strive to maintain operational efficiency and safety standards. Consequently, the Commercial Wide-Body and Narrow-Body Aircraft MRO Market is likely to experience significant growth as airlines invest in maintaining their fleets to meet passenger expectations.

Fleet Modernization Initiatives

Airlines are increasingly focusing on fleet modernization as a strategy to enhance operational efficiency and reduce maintenance costs, which significantly impacts the Commercial Wide-Body and Narrow-Body Aircraft MRO Market. The transition to newer aircraft models, which often feature advanced materials and systems, necessitates specialized MRO services tailored to these technologies. As airlines retire older aircraft and invest in modern fleets, the demand for MRO services that cater to these new models is expected to rise. This trend not only drives growth in the MRO sector but also encourages innovation in maintenance practices, as providers adapt to the unique requirements of modern aircraft.

Regulatory Compliance and Safety Standards

The stringent regulatory environment surrounding aviation safety is a crucial driver for the Commercial Wide-Body and Narrow-Body Aircraft MRO Market. Regulatory bodies impose rigorous maintenance and safety standards that airlines must adhere to, ensuring the airworthiness of their fleets. Compliance with these regulations necessitates regular maintenance and inspections, thereby driving demand for MRO services. The Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) continuously update their guidelines, which influences MRO practices. As airlines prioritize safety and compliance, the Commercial Wide-Body and Narrow-Body Aircraft MRO Market is likely to see sustained growth, as MRO providers adapt to meet evolving regulatory requirements.

Technological Advancements in MRO Services

Technological innovations are reshaping the landscape of the Commercial Wide-Body and Narrow-Body Aircraft MRO Market. The integration of advanced technologies such as predictive maintenance, artificial intelligence, and data analytics is enhancing the efficiency and effectiveness of MRO operations. For instance, predictive maintenance can reduce aircraft downtime by anticipating maintenance needs before they become critical. This shift towards technology-driven solutions is expected to streamline MRO processes, reduce costs, and improve turnaround times. As airlines increasingly adopt these technologies, the Commercial Wide-Body and Narrow-Body Aircraft MRO Market is poised for transformation, with a focus on enhancing service quality and operational efficiency.

Growing Emphasis on Sustainability Practices

The increasing emphasis on sustainability within the aviation sector is emerging as a vital driver for the Commercial Wide-Body and Narrow-Body Aircraft MRO Market. Airlines are under pressure to reduce their carbon footprint and enhance environmental performance, prompting them to adopt more sustainable MRO practices. This includes the use of eco-friendly materials, waste reduction strategies, and energy-efficient processes. As airlines seek to align with global sustainability goals, the demand for MRO services that support these initiatives is likely to grow. Consequently, the Commercial Wide-Body and Narrow-Body Aircraft MRO Market may witness a shift towards greener practices, reflecting the broader trend of environmental responsibility in aviation.