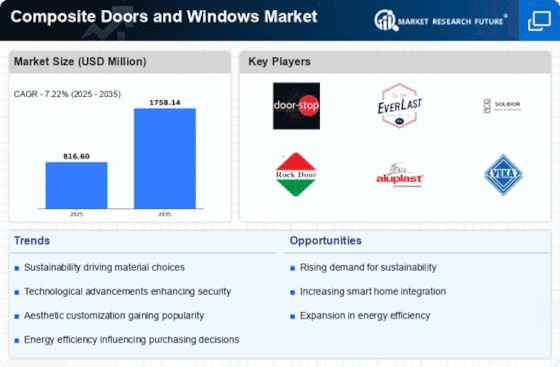

Top Industry Leaders in the Composite doors Windows Market

The composite doors and windows market has emerged as a thriving sector within the construction industry, driven by its superior performance, durability, and aesthetic appeal compared to traditional wood and PVC options. This market is characterized by a diverse group of players, each vying for a larger slice of the pie. Let's delve into the competitive landscape, exploring key strategies, market share factors, industry news, and recent developments.

Strategies Shaping the Market:

-

Product Innovation: Leading players are constantly innovating with new materials, designs, and functionalities. This includes incorporating advanced glazing technologies, enhancing security features, and developing sustainable composite materials. For instance, Veka launched its "Infinity" sliding door system with superior thermal insulation, while Vello Nordic introduced its "Nordic Light" window with a unique integrated blind system. -

Diversification: Many companies are expanding their product portfolios beyond traditional doors and windows, offering sunrooms, conservatories, and other building elements. This diversification helps cater to a wider range of customer needs and capture new market segments. -

Focus on Sustainability: Growing environmental awareness has propelled the demand for eco-friendly composite solutions. Companies are using recycled materials, developing energy-efficient designs, and minimizing their carbon footprint. This focus resonates with environmentally conscious consumers and building projects with sustainability goals. -

Digitalization: The industry is embracing digitalization to enhance efficiency and customer experience. This includes online configurators, 3D visualization tools, and e-commerce platforms. For example, Jeld-Wen launched its "Door and Window Builder" tool, allowing customers to design their own composite doors online.

Factors Influencing Market Share:

-

Brand Reputation: Established brands with a strong track record for quality and service tend to hold a larger share of the market. Companies like VELUX, YKK AP, and Deceuninck have built trust and loyalty among customers over decades. -

Distribution Network: Effective distribution channels play a crucial role in reaching customers and ensuring product availability. Extensive dealer networks, direct sales teams, and online platforms contribute significantly to market share. -

Product Differentiation: Offering unique features, designs, and value propositions sets companies apart from the competition. This can include advanced security features, innovative glazing technologies, or customization options. -

Price Competitiveness: While price is not the sole determinant, it can influence buying decisions, especially in budget-conscious projects. Companies need to strike a balance between offering competitive pricing and maintaining profit margins.

Key Companies in the Composite doors and Windows market includes

- Andersen Corporation

- Chem-Pruf

- Fiberline Building Profiles

- Pella Corporation

- Hardy Smith Designs Private Limited

- FiberTech Composite Pvt. Ltd.

- Nationwide Windows

- Vello Nordic AS

- Special-Lite

- Just Doors UK Ltd., among others

Recent News

Empower Brands in March 2023 successfully took over Koala Insulation and Wallaby Windows in March 2023, thereby significantly expanding its presence in the insulation and window installation industry. This strategic move strengthens Empower Brands' position in the industry, showing a commitment towards expansion as well as market diversification.

With the rapidly increasing Asian construction sector, Fenesta Building Systems established a new factory in India in November 2022. Fenesta’s new factory is a huge breakthrough given that it increases the firm’s production capacity by large margins thus meeting the rising demands from residential, commercial, along with institutional projects within the area.

Fenesta recognized in November 2022 that the installation of this new factory highlights the Firm’s efforts to enter into competition with other players within the Asian construction sector, hence providing innovative building solutions that have high-performance levels to customers.

In September 2022, Epwin Group completed buying Poly-Pure LTD, located in the UK dealing with plastic products. By purchasing Poly-Pure LTD, they were able to improve on their ability to produce plastics products making them more diverse in terms of what they offer as business entities. In this regard, Epwin Group will continue asserting itself as one of the leading UK construction suppliers.

These GRP doors are designed specifically for healthcare institutions; Dortek introduced them recently in December 2021. The doors are primarily meant for critical areas such as intensive care units (ICU), operating theaters, isolation rooms, X-ray theaters etc., which means that they have non-porous surfaces resistant to water or fumigation agents as well as durability against fumigation agents. They are also easy to clean, thus suitable for environments that require a high standard of hygiene.