Growing Investment in Aerospace R&D

The increasing investment in research and development within the aerospace sector is fostering innovation in the Composite Materials and Aluminum Alloys in Aerospace Market. Companies are allocating substantial resources to explore new composite formulations and alloy compositions that can withstand extreme conditions while maintaining lightweight characteristics. This focus on R&D is anticipated to yield breakthroughs that enhance the performance and durability of aerospace components. With the global aerospace R&D expenditure projected to exceed USD 20 billion by 2025, the implications for the composite materials market are profound, as new materials are developed to meet the evolving demands of the industry.

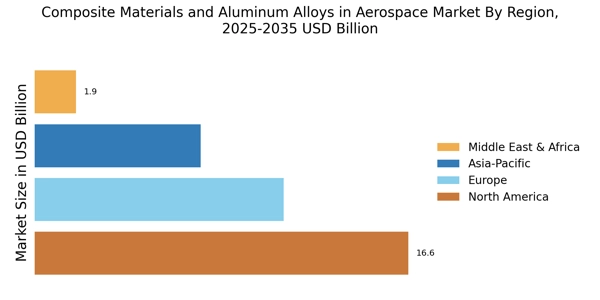

Rising Demand for Commercial Aircraft

The resurgence in demand for commercial aircraft is significantly impacting the Composite Materials and Aluminum Alloys in Aerospace Market. As air travel continues to rebound, manufacturers are ramping up production to meet the needs of airlines and private operators. This surge in aircraft production is driving the need for advanced materials that can provide the necessary performance and efficiency. Analysts predict that the commercial aircraft market will require over 40,000 new planes in the next two decades, which will likely result in a corresponding increase in the demand for composite materials and aluminum alloys, as these materials are integral to modern aircraft design.

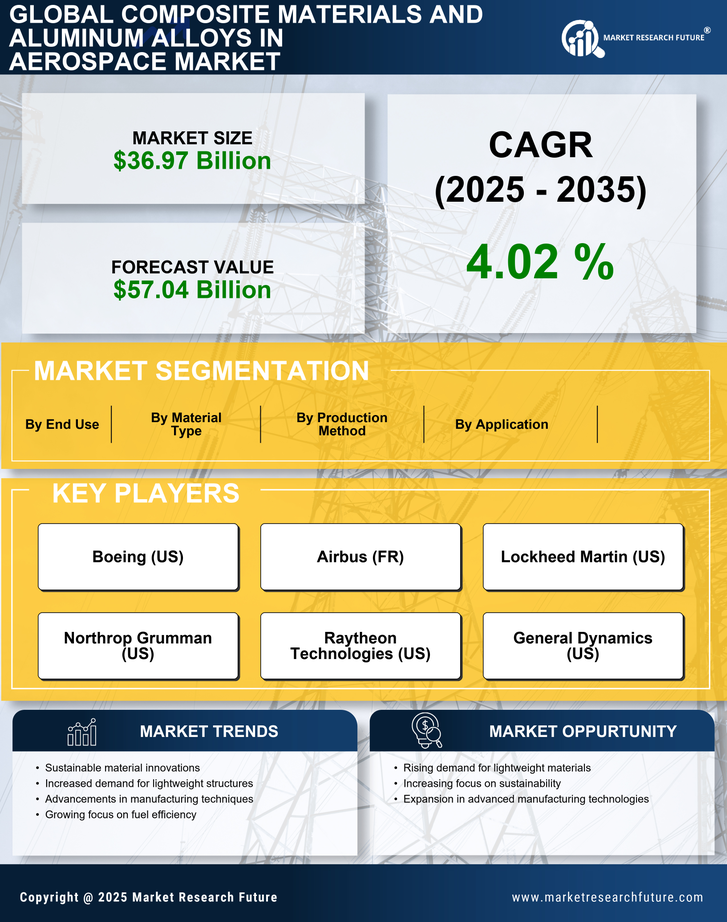

Increasing Demand for Lightweight Materials

The aerospace sector is witnessing a pronounced shift towards lightweight materials, primarily driven by the need for enhanced fuel efficiency and reduced emissions. Composite Materials and Aluminum Alloys in Aerospace Market are at the forefront of this trend, as they offer superior strength-to-weight ratios compared to traditional materials. The demand for these materials is projected to grow, with estimates suggesting that the market for composite materials alone could reach approximately USD 30 billion by 2026. This increasing demand is largely attributed to the aerospace industry's commitment to sustainability and operational efficiency, prompting manufacturers to adopt advanced materials that contribute to lower operational costs and improved performance.

Regulatory Support for Sustainable Aviation

Regulatory frameworks aimed at promoting sustainable aviation practices are playing a crucial role in shaping the Composite Materials and Aluminum Alloys in Aerospace Market. Governments and international bodies are implementing stringent emissions regulations, which compel aerospace manufacturers to seek out materials that contribute to lower carbon footprints. This regulatory support is likely to accelerate the adoption of composite materials, which are known for their lightweight properties and potential to enhance fuel efficiency. As a result, the market for aluminum alloys is also expected to grow, as they are often used in conjunction with composites to achieve optimal performance in aircraft design.

Technological Innovations in Manufacturing Processes

Technological advancements in manufacturing processes are significantly influencing the Composite Materials and Aluminum Alloys in Aerospace Market. Innovations such as automated fiber placement and additive manufacturing are enhancing the production efficiency and precision of composite materials. These technologies not only reduce waste but also enable the creation of complex geometries that were previously unattainable. As a result, manufacturers are increasingly investing in these advanced techniques, which are expected to drive market growth. Reports indicate that the adoption of such technologies could lead to a reduction in production costs by up to 20%, thereby making composite materials more accessible to a wider range of aerospace applications.