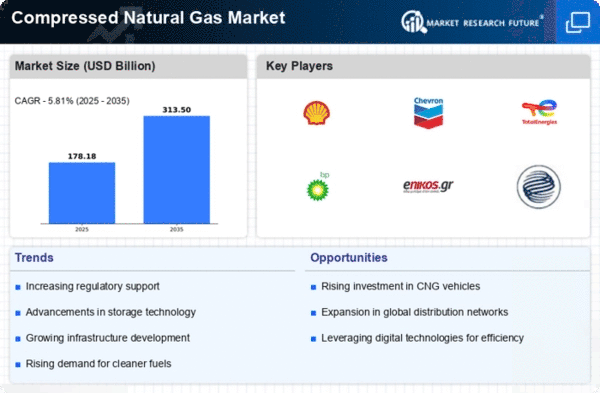

Market Growth Projections

The Global Compressed Natural Gas Market Industry is projected to experience substantial growth in the coming years, with forecasts indicating a market value of 156.0 USD Billion in 2024 and an anticipated increase to 296.2 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.0% from 2025 to 2035, reflecting the increasing adoption of CNG across various sectors. Factors contributing to this growth include rising environmental awareness, government incentives, and advancements in technology. The market's expansion is likely to create new opportunities for stakeholders, including manufacturers, suppliers, and service providers.

Rising Demand for Cleaner Fuels

The Global Compressed Natural Gas Market Industry is experiencing a notable surge in demand for cleaner fuels, driven by increasing environmental concerns and stringent regulations on emissions. Governments worldwide are implementing policies to reduce greenhouse gas emissions, leading to a shift from traditional fossil fuels to cleaner alternatives like compressed natural gas. For instance, countries such as the United States and various European nations are investing heavily in CNG infrastructure to promote its use in transportation. This transition is expected to propel the market, with projections indicating a market value of 156.0 USD Billion in 2024, highlighting the growing acceptance of CNG as a viable energy source.

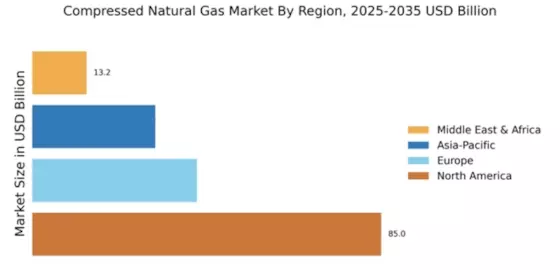

Increasing Natural Gas Production

The Global Compressed Natural Gas Market Industry is benefiting from the increasing production of natural gas, which enhances the availability of CNG. Advances in extraction technologies, such as hydraulic fracturing and horizontal drilling, have led to a significant rise in natural gas supply, particularly in regions like North America and the Middle East. This abundance of natural gas not only lowers the cost of CNG but also supports its competitiveness against other fuels. As a result, the market is poised for growth, with the potential for expanded applications in various sectors, including residential, commercial, and industrial uses.

Government Incentives and Policies

Government incentives and supportive policies play a crucial role in the expansion of the Global Compressed Natural Gas Market Industry. Many governments are offering tax breaks, subsidies, and grants to encourage the adoption of CNG vehicles and infrastructure development. For example, the U.S. Department of Energy has initiated programs aimed at increasing the number of CNG fueling stations across the country. Such initiatives not only enhance the accessibility of CNG but also stimulate investment in the sector. As a result, the market is projected to reach 296.2 USD Billion by 2035, reflecting the positive impact of these governmental measures on the industry's growth.

Growing Adoption in Transportation Sector

The transportation sector is increasingly adopting compressed natural gas as a cleaner alternative to diesel and gasoline, significantly impacting the Global Compressed Natural Gas Market Industry. Public transportation systems, including buses and taxis, are transitioning to CNG to reduce emissions and operational costs. For example, cities like Los Angeles and New York have integrated CNG buses into their fleets, showcasing the viability of this fuel. This trend is likely to continue, as more municipalities recognize the environmental benefits and cost savings associated with CNG. The rising adoption in transportation is expected to contribute to the market's growth, aligning with broader sustainability goals.

Technological Advancements in CNG Infrastructure

Technological advancements are significantly influencing the Global Compressed Natural Gas Market Industry by enhancing the efficiency and safety of CNG infrastructure. Innovations in compression technology, storage solutions, and fueling systems are making CNG more accessible and reliable for consumers. For instance, the development of high-capacity compressors and advanced storage tanks has improved the feasibility of CNG as a transportation fuel. These advancements not only reduce operational costs but also increase the attractiveness of CNG as an alternative fuel. Consequently, the market is expected to grow at a CAGR of 6.0% from 2025 to 2035, indicating a robust future driven by technological progress.