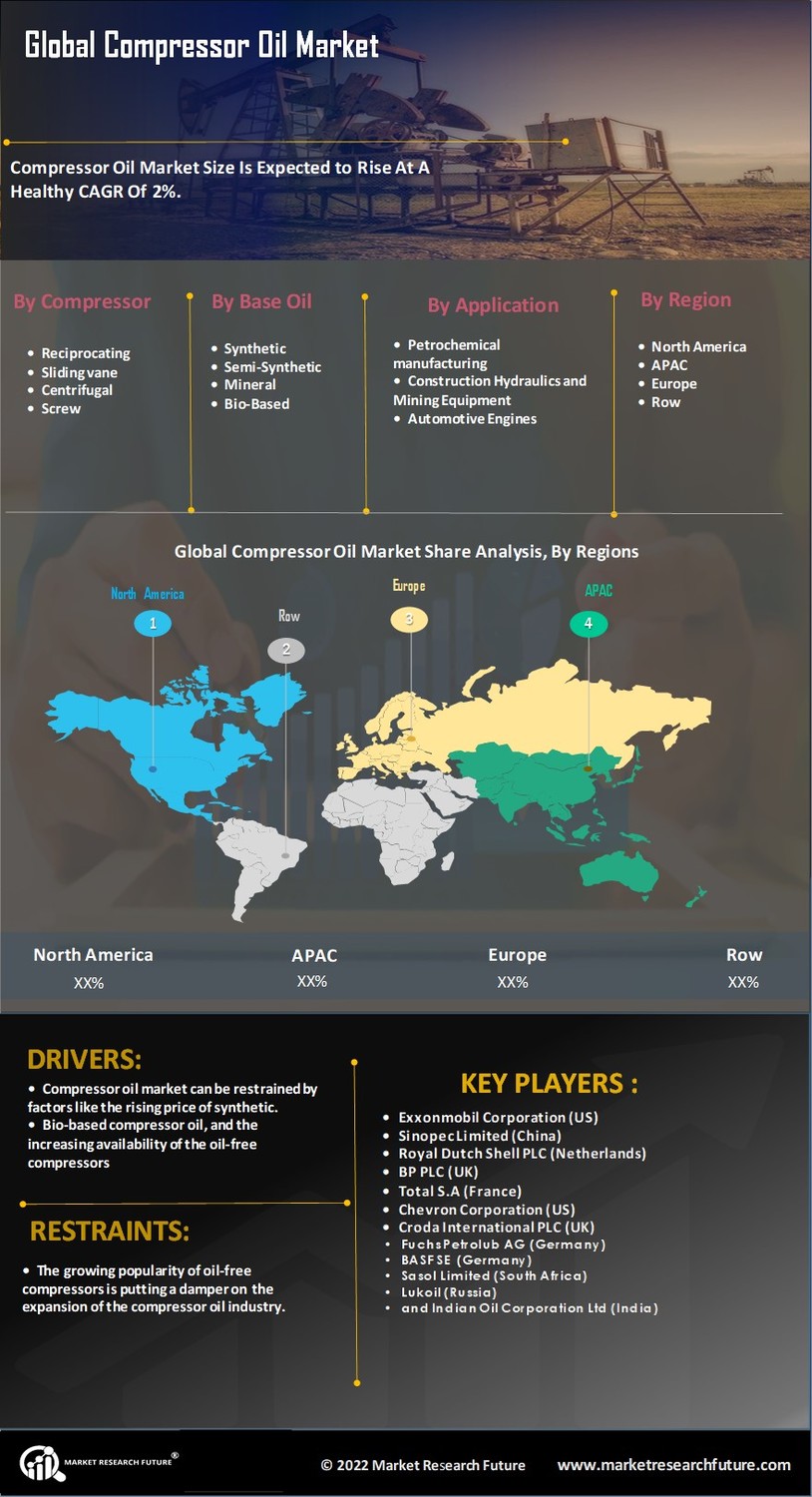

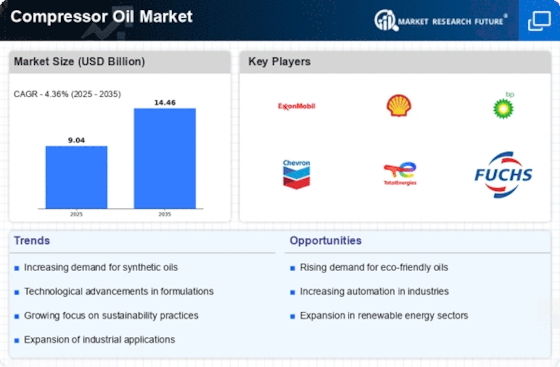

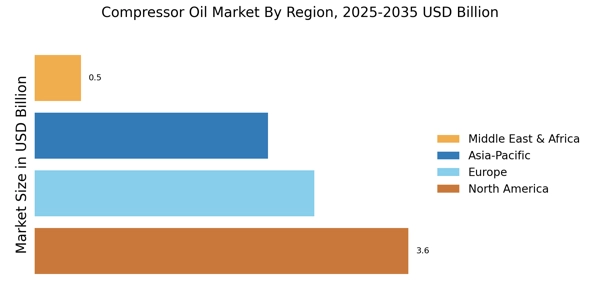

North America : Market Leader in Innovation

North America is the largest market for compressor oil, holding approximately 40% of the global share. The region's growth is driven by the booming manufacturing sector, increasing demand for energy-efficient solutions, and stringent environmental regulations promoting the use of high-quality lubric

ants. The U.S. and Canada are the primary contributors, with a focus on technological advancements and sustainability initiatives. The competitive landscape is characterized by major players such as ExxonMobil, Chevron, and Valvoline, who are investing heavily in R&D to enhance product performance. The presence of these key players, along with a robust distribution network, ensures a steady supply of high-quality compressor oils. The market is also witnessing a trend towards synthetic oils, which offer better performance and longer service life, further driving growth.

Europe : Regulatory-Driven Market Growth

Europe is the second-largest market for compressor oil, accounting for around 30% of the global market share. The region's growth is significantly influenced by stringent environmental regulations and a strong push towards sustainability. Countries like Germany and France are leading the charge, with policies that encourage the adoption of eco-friendly lubricants and energy-efficient technologies, thereby boosting demand for high-performance compressor oils. The competitive landscape in Europe is marked by key players such as Shell, BP, and TotalEnergies, who are actively innovating to meet regulatory standards. The market is also seeing an increase in partnerships and collaborations aimed at developing advanced lubricant solutions. The focus on reducing carbon footprints and enhancing operational efficiency is driving the demand for synthetic and bio-based compressor oils, positioning Europe as a leader in sustainable practices.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the compressor oil market, holding approximately 25% of the global share. The region's expansion is fueled by increasing industrialization, urbanization, and a rising demand for energy-efficient solutions. Countries like China and India are at the forefront, with significant investments in manufacturing and infrastructure development, driving the need for high-quality compressor oils to support various applications. The competitive landscape is becoming increasingly dynamic, with both local and international players vying for market share. Key companies such as Fuchs Petrolub and Castrol are expanding their presence through strategic partnerships and product innovations. The growing awareness of the benefits of synthetic oils is also contributing to market growth, as industries seek to enhance operational efficiency and reduce maintenance costs, making Asia-Pacific a key region for future investments.

Middle East and Africa : Resource-Rich Market Dynamics

The Middle East and Africa (MEA) region is emerging as a significant player in the compressor oil market, accounting for about 5% of the global share. The growth is driven by the region's rich natural resources and increasing investments in oil and gas exploration. Countries like Saudi Arabia and South Africa are focusing on enhancing their industrial capabilities, which is boosting the demand for high-performance compressor oils to support various sectors, including energy and manufacturing. The competitive landscape in MEA is characterized by a mix of local and international players, with companies like Petro-Canada and Fuchs Petrolub establishing a foothold in the market. The region is also witnessing a trend towards the adoption of advanced lubricant technologies, driven by the need for improved efficiency and sustainability. As the industrial sector continues to grow, the demand for compressor oils is expected to rise, presenting lucrative opportunities for market players.