Growing Geriatric Population

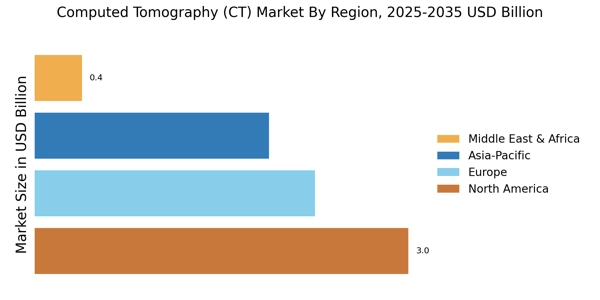

The aging population is a significant factor influencing the Computed Tomography (CT) Market. As individuals age, they are more susceptible to various health issues that necessitate diagnostic imaging. The World Health Organization projects that the number of people aged 60 years and older will double by 2050, leading to an increased demand for medical imaging services. CT scans play a crucial role in diagnosing age-related conditions, such as osteoporosis and tumors, making them indispensable in geriatric care. This demographic shift is likely to drive investments in CT technology, as healthcare providers aim to meet the needs of an older patient population.

Increased Healthcare Expenditure

Rising healthcare expenditure across various regions is a notable driver of the Computed Tomography (CT) Market. Governments and private sectors are allocating more resources to healthcare, which includes investments in advanced diagnostic technologies. This trend is evident in many countries, where healthcare budgets are expanding to accommodate the growing demand for medical services. Enhanced funding allows healthcare facilities to upgrade their imaging equipment, including CT scanners, thereby improving diagnostic capabilities. As healthcare systems prioritize quality and efficiency, the CT market is poised for growth, reflecting the broader commitment to enhancing patient care.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and respiratory ailments is a primary driver of the Computed Tomography (CT) Market. As these conditions become more common, the demand for advanced diagnostic imaging solutions rises. According to recent statistics, chronic diseases account for a significant portion of healthcare expenditures, prompting healthcare providers to invest in technologies that enhance diagnostic accuracy. CT scans are particularly valued for their ability to provide detailed cross-sectional images, aiding in early detection and treatment planning. This trend is likely to continue, as healthcare systems strive to improve patient outcomes and reduce long-term costs associated with chronic disease management.

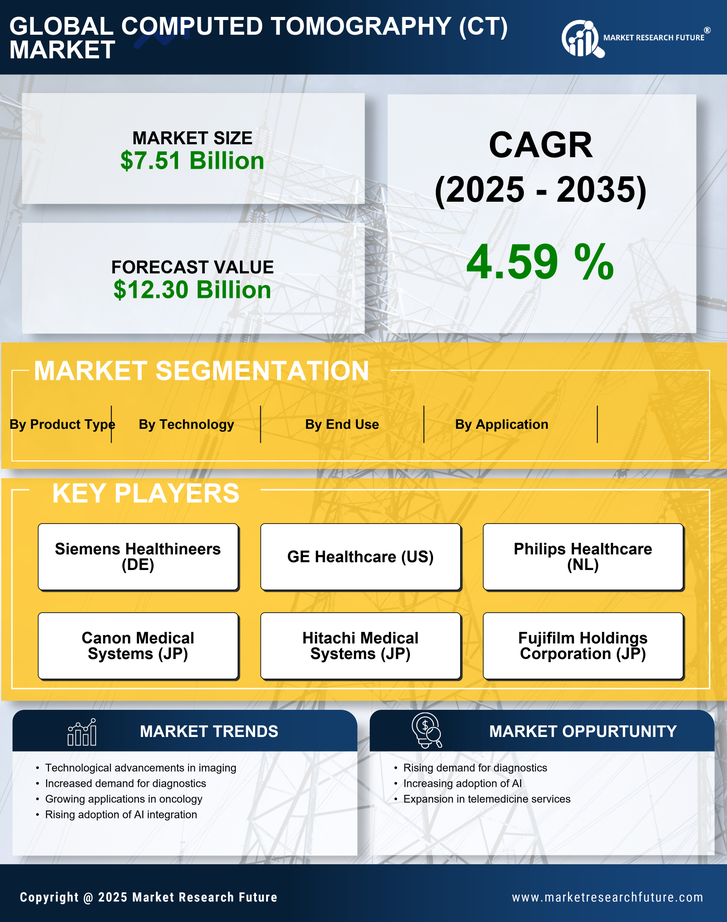

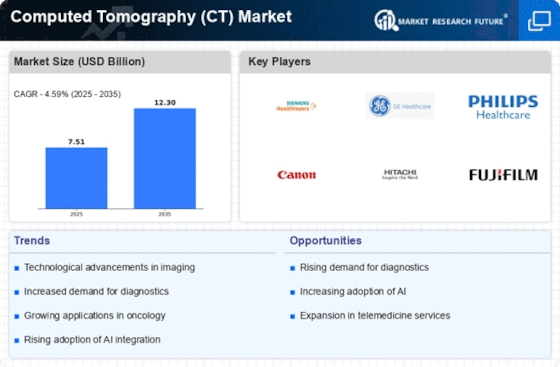

Technological Innovations in Imaging

Technological advancements in imaging modalities are propelling the Computed Tomography (CT) Market forward. Innovations such as iterative reconstruction techniques, dual-energy CT, and portable CT scanners are enhancing image quality while reducing radiation exposure. These developments not only improve diagnostic capabilities but also expand the applications of CT imaging in various medical fields, including oncology and emergency medicine. The market is witnessing a shift towards more sophisticated systems that integrate advanced software for better image analysis. As healthcare facilities seek to adopt cutting-edge technologies, the demand for state-of-the-art CT systems is expected to grow, reflecting a broader trend towards precision medicine.

Expansion of Diagnostic Imaging Centers

The proliferation of diagnostic imaging centers is significantly impacting the Computed Tomography (CT) Market. These centers are increasingly being established to provide specialized imaging services, catering to the rising demand for quick and accurate diagnostics. The convenience and accessibility of these facilities attract patients seeking timely medical attention. Furthermore, many imaging centers are adopting advanced CT technologies to differentiate themselves in a competitive market. This expansion not only increases the availability of CT services but also encourages innovation in imaging techniques. As more centers emerge, the overall utilization of CT scans is expected to rise, further driving market growth.