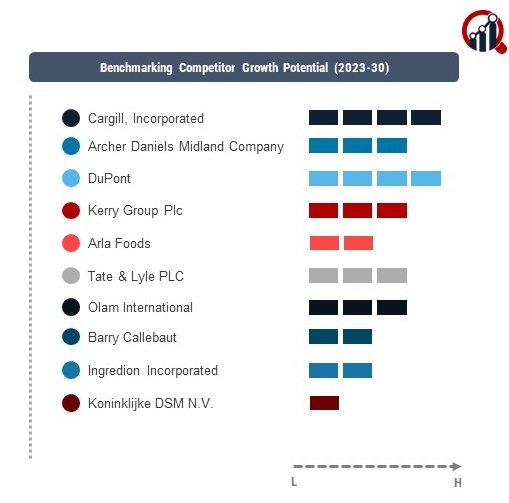

Top Industry Leaders in the Confectionery Ingredients Market

The Competitive Landscape of the Confectionery Ingredients Market is shaped by a mix of well-established industry leaders and emerging players, collectively contributing to the dynamic and evolving confectionery sector. As of 2023, key players in the market have strategically positioned themselves to address consumer demands for diverse, innovative, and high-quality confectionery products.

Key Players:

Cargill Incorporated (US)

Archer Daniels Midland Company (US)

DuPont (US)

Kerry Group Plc (Ireland)

Arla Foods (Denmark)

Tate & Lyle PLC (UK)

Olam International (Singapore)

Barry Callebaut (Switzerland)

Ingredion Incorporated (US)

Koninklijke DSM N.V. (Netherlands)

AAK AB (Sweden)

Strategies Adopted:

The Confectionery Ingredients Market revolve around product innovation, sustainability, and strategic partnerships. Product innovation involves introducing new ingredients, flavor profiles, and formulations to meet changing consumer preferences. Sustainability practices, such as responsibly sourced cocoa and palm oil, are increasingly important for consumer trust and meeting environmental standards. Strategic partnerships with confectionery manufacturers and retailers enhance market reach and provide insights into evolving market trends.

Market Share Analysis Factors:

The Confectionery Ingredients Market is influenced by factors such as brand reputation, product quality, pricing, and distribution efficiency. Companies that consistently deliver high-quality ingredients and have a strong brand presence often gain a competitive advantage. Pricing strategies involve finding the right balance between offering premium ingredients and maintaining affordability for a broader consumer base. Efficient distribution networks, partnerships with confectionery manufacturers, and an effective online presence contribute significantly to market share growth.

New & Emerging Companies:

New and emerging companies in the Confectionery Ingredients Market contribute to the competitive landscape by exploring unique formulations, clean-label ingredients, and health-conscious alternatives. Start-ups such as Beneo and Cémoi have entered the market, emphasizing natural and healthier confectionery ingredient options. While these companies may initially have smaller market shares compared to industry giants, their emphasis on clean-label trends and consumer health consciousness makes them noteworthy contributors to the market's diversity.

Industry Trends:

Industry trends provide insights into ongoing developments within the Confectionery Ingredients Market. A notable trend in 2023 is the increased focus on plant-based and alternative ingredients. Key players are investing in research and development to introduce confectionery ingredients that cater to the growing demand for plant-based and vegan products. Additionally, investments in sustainable sourcing practices and eco-friendly packaging align with broader industry trends toward environmental responsibility and meeting consumer expectations for ethically produced confectionery.

Competitive Scenario:

The Confectionery Ingredients Market remains dynamic, with companies adopting diverse strategies to gain a competitive edge. There is a notable emphasis on digital marketing and social media engagement, with companies leveraging online platforms to showcase new product launches, share confectionery recipes, and engage with consumers directly. Additionally, companies are exploring opportunities for geographical expansion, targeting regions where the demand for premium and specialty confectionery ingredients is on the rise.

Recent Development

The Confectionery Ingredients Market is the increasing interest in functional ingredients. Key players have introduced confectionery ingredients enriched with functional properties such as probiotics, vitamins, and minerals, aiming to align with consumer trends toward healthier indulgence. This development reflects the industry's recognition of the evolving consumer mindset, which seeks confectionery products that not only satisfy cravings but also offer added health benefits.