Regulatory Compliance

The construction equipment repair and maintenance service market is also shaped by stringent regulatory compliance requirements. Governments and regulatory bodies are imposing more rigorous standards regarding equipment safety and environmental impact. This trend compels construction companies to ensure that their machinery is regularly maintained and repaired to meet these regulations. Failure to comply can result in hefty fines and project delays, which can be detrimental to business operations. As a result, the demand for repair and maintenance services is likely to increase as companies prioritize compliance to avoid penalties. This regulatory landscape creates a robust market for the construction equipment repair and maintenance service market, as service providers play a crucial role in helping companies adhere to these standards.

Technological Advancements

The construction equipment repair and maintenance service market is significantly influenced by technological advancements. Innovations such as telematics, IoT, and advanced diagnostic tools are transforming how equipment is monitored and maintained. These technologies enable real-time data collection and analysis, allowing for more efficient scheduling of maintenance activities. For instance, predictive maintenance, which utilizes data analytics to foresee potential equipment failures, is becoming increasingly prevalent. This shift not only enhances the longevity of construction equipment but also reduces downtime, thereby improving overall productivity. As a result, the integration of these technologies is likely to drive growth in the construction equipment repair and maintenance service market, as companies seek to leverage these advancements to optimize their operations.

Focus on Equipment Longevity

The construction equipment repair and maintenance service market is witnessing a growing emphasis on equipment longevity. As construction companies aim to maximize their return on investment, there is a heightened focus on maintaining existing machinery rather than purchasing new equipment. Regular maintenance and timely repairs are essential for extending the lifespan of construction equipment, which can be a significant cost-saving measure. Data indicates that well-maintained equipment can last up to 30% longer than poorly maintained counterparts. This trend is likely to drive demand for repair and maintenance services, as companies recognize the financial benefits of investing in the upkeep of their machinery. Consequently, the construction equipment repair and maintenance service market is positioned to thrive as businesses prioritize equipment longevity.

Increasing Construction Activities

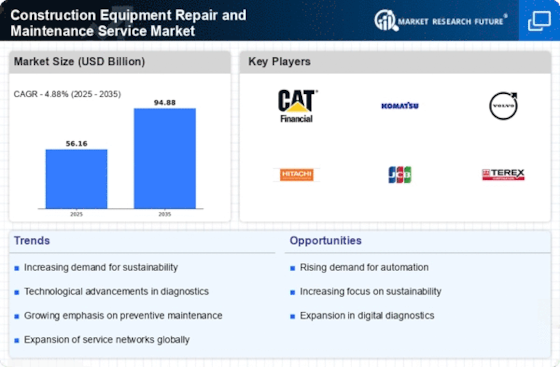

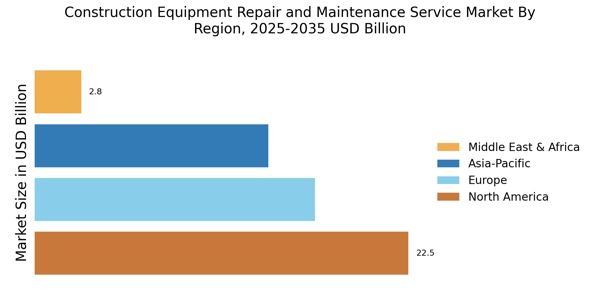

The construction equipment repair and maintenance service market is experiencing a surge due to the rising number of construction projects worldwide. As urbanization accelerates, the demand for infrastructure development, including roads, bridges, and buildings, is on the rise. This increase in construction activities necessitates regular maintenance and repair of heavy machinery, which is crucial for ensuring operational efficiency and safety. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. Consequently, this growth directly influences the construction equipment repair and maintenance service market, as more equipment will require servicing to meet the demands of ongoing projects.

Rising Demand for Skilled Technicians

The construction equipment repair and maintenance service market is currently facing a rising demand for skilled technicians. As equipment becomes more sophisticated, the need for technicians with specialized training and expertise is becoming increasingly critical. This demand is driven by the complexity of modern machinery, which often incorporates advanced technologies that require specific knowledge for effective maintenance and repair. The shortage of qualified technicians in the market poses a challenge for service providers, potentially impacting their ability to meet the growing needs of construction companies. As a result, the construction equipment repair and maintenance service market may see increased investment in training programs and partnerships with educational institutions to cultivate a skilled workforce capable of addressing these challenges.