Top Industry Leaders in the Construction Lubricants Market

The construction lubricants market is a dynamic space fueled by the ever-evolving infrastructure landscape. Understanding the key players, their strategies, and the evolving market dynamics is crucial for navigating this growing sector. Let's delve into the competitive landscape, exploring market share factors, industry news, and recent developments to paint a comprehensive picture.

Strategies for Success:

-

Product Innovation: Leading players like Shell, ExxonMobil, and Chevron are investing heavily in research and development, creating high-performance lubricants specific to construction equipment needs. Bio-based and environmentally friendly lubricants are gaining traction, catering to sustainability concerns. -

Strategic Partnerships: Collaboration with equipment manufacturers and construction companies allows lubricant manufacturers to gain valuable insights and tailor their offerings. ExxonMobil's collaboration with Caterpillar and Shell's partnership with Volvo Construction Equipment exemplify this trend. -

Focus on Emerging Markets: Asia-Pacific, with its booming infrastructure projects, is a key growth engine. Companies like ExxonMobil and TotalEnergies are expanding their presence in this region through acquisitions and partnerships. -

Digital Adoption: Embracing digital tools like telematics and oil condition monitoring (OCM) is becoming essential. These technologies offer real-time performance data, enabling predictive maintenance and optimized lubricant usage, thereby reducing downtime and costs. -

Sustainability Initiatives: Building environmentally responsible solutions is gaining importance. Renewable lubricants, extended drain intervals, and responsible waste management are becoming priorities for many players.

Factors Shaping Market Share:

-

Brand Reputation: Established brands like Shell, ExxonMobil, and Chevron hold significant market share due to their long-standing reputation for quality and reliability. -

Product Portfolio Breadth: Offering a diverse range of lubricants for various construction equipment types and operating conditions broadens appeal and caters to specific needs. -

Distribution Network: Robust distribution networks ensure timely and efficient delivery, vital for construction projects with tight deadlines. -

Price Competitiveness: Balancing quality with competitive pricing is crucial, especially in regions with cost-sensitive markets. -

Technical Expertise: Providing technical support and guidance on lubricant selection and application ensures optimal performance and equipment longevity.

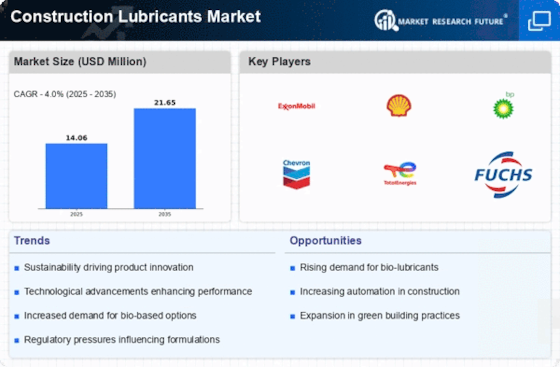

Key Players

PetroChina Company Ltd (China), Sinopec Corporation (China), Fuchs Petrolub SE (Germany), Phillips 66 Company (US), Lucas Oil Products, Amsoil Inc (US), Valvoline Inc (US),Clariant (Switzerland), Quaker Chemical Corporation (US), Calumet Specialty Products Partners, L.P (US), Chevron Corporation (US), BP PLC (UK), Exxon Mobil Corporation (US), Royal Dutch Shell PLC (Netherlands), Total (France), Lukoil (Russia), Petronas (Malaysia), Yushiro Chemical Industry (Japan), Morris Lubricants (UK), Rock Valley Oil and Chemical Co (US), Indian Oil Corporation Limited (India) and Gulf Oil India (India) are some of the key players operating in the global market.

Recent Developments:

September 2023: TotalEnergies and Valeo announce a partnership to develop an innovative battery coolant for electric vehicles using a high-performance dielectric liquid, improving EV efficiency and sustainability.

October 2023: The International Construction Equipment Expo (CONEXPO) showcases the latest construction lubricants and technologies.

November 2023: The European Union proposes stricter regulations on lubricant waste disposal, pushing manufacturers toward eco-friendly solutions.

March 2022

Schwing Stetter India is now a part of two MoUs with HPCL and Gulf Oil for the launch of a line of oils for construction equipment. The partnership with HPCL and Gulf Oil will bring to the market a series of products including hydraulic oil, axle oil, engine oil, high-end synthetic gear oil and gear oil for batching plant, concrete pump, self-loading mixer, concrete mixture and the complete range of construction equipment.

In June 2022, Volvo Construction Equipment introduced Volvo Hydraulic Oil 98611 HO103 into the market place that revolutionized construction lubricants. This oil increases service intervals on Volvo crawler excavators up to 3000 hours, thus improving machine performance and lifespan. Thus, it provides different viscosity options with optimized fuel efficiency reduced oil consumption compared to most other kinds of oils available today, thus marking a significant progress in lubricant technology.

In March 2022, BPCL launched four new MAK lubrication products. They have been designed to provide better customer performance, dependability & durability. In February 2020, Chevron debuted Delo600 ADF, a new diesel engine oil designed to assist in lessening particulate matter emissions from diesel engines used in construction machinery. Chevron’s Delo600ADF has an exclusive formulation with advanced additive technology aimed at reducing ash buildup within diesel particulate filters (DPFs). Reduction of ash accumulation facilitates DPF longevity, thereby ensuring the efficacy of such filters in curtailing particulate emissions.