Rising Construction Activities

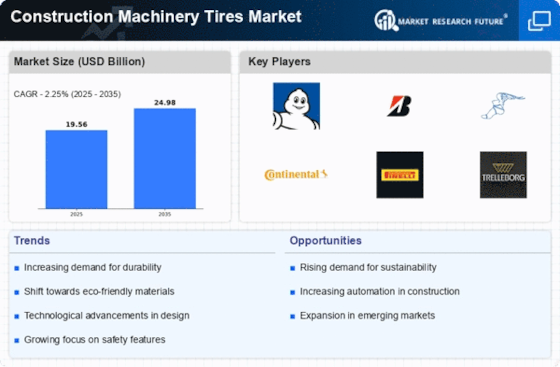

The Construction Machinery Tires Market is experiencing a surge in demand due to increasing construction activities across various sectors. Infrastructure development, residential projects, and commercial construction are driving the need for robust machinery, which in turn necessitates high-quality tires. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to enhance the demand for construction machinery, thereby boosting the Construction Machinery Tires Market. As construction companies seek to optimize their operations, the need for durable and efficient tires becomes paramount, indicating a positive trajectory for the market.

Increased Focus on Safety Regulations

The Construction Machinery Tires Market is also shaped by heightened safety regulations imposed on construction operations. Governments and regulatory bodies are emphasizing the importance of safety standards, which include the quality and performance of tires used in construction machinery. Compliance with these regulations is essential for construction companies to avoid penalties and ensure worker safety. Consequently, there is a growing demand for tires that meet stringent safety criteria, which is likely to drive innovation and quality improvements within the Construction Machinery Tires Market. This focus on safety not only protects workers but also enhances the overall efficiency of construction projects.

Sustainability and Eco-Friendly Practices

Sustainability initiatives are becoming increasingly relevant in the Construction Machinery Tires Market. As environmental concerns rise, construction companies are seeking eco-friendly tire options that minimize their carbon footprint. The development of tires made from sustainable materials and those that are recyclable is gaining traction. This shift towards sustainability is not only driven by regulatory pressures but also by consumer demand for environmentally responsible practices. The Construction Machinery Tires Market is likely to see a growing segment of products that align with these eco-friendly initiatives, potentially leading to a competitive advantage for manufacturers who prioritize sustainability in their offerings.

Technological Innovations in Tire Manufacturing

Innovations in tire manufacturing technology are significantly influencing the Construction Machinery Tires Market. Advances such as the development of smart tires equipped with sensors for monitoring pressure and wear are becoming increasingly prevalent. These innovations not only enhance the performance and longevity of tires but also contribute to safety and efficiency in construction operations. The integration of advanced materials and manufacturing techniques is expected to improve tire durability, which is crucial for heavy machinery operating in demanding environments. As a result, the Construction Machinery Tires Market is likely to witness a shift towards high-performance products that meet the evolving needs of construction companies.

Expansion of Rental Services for Construction Equipment

The expansion of rental services for construction equipment is influencing the Construction Machinery Tires Market. As more companies opt for renting machinery rather than purchasing, the demand for high-quality tires that can withstand varied usage patterns is increasing. Rental companies are focusing on maintaining their fleets with reliable and durable tires to ensure customer satisfaction and operational efficiency. This trend is expected to drive growth in the Construction Machinery Tires Market, as rental services become a preferred choice for many construction firms looking to manage costs effectively while still accessing the latest machinery.