Market Trends

Key Emerging Trends in the Construction Mining Equipment Market

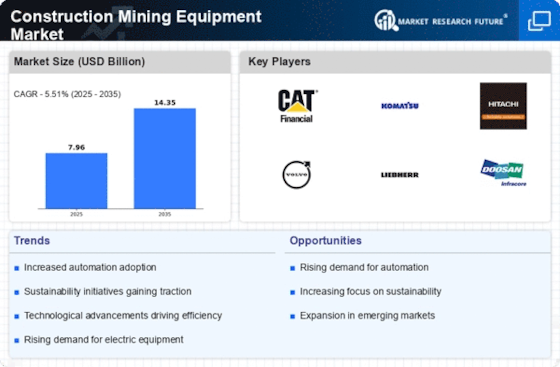

An increasing number of people want building and mining tools that can work on its own or with some help. Automated machines are safer, use less labor, and do more correct work, among other things. As companies become more aware of these advantages, they spend money on research and development to create more advanced self-driving equipment. As more people care about the environment, it is clear that mining and building equipment is becoming more durable and eco-friendly. Companies are spending money to make hybrid and electric tools that are better for the environment and will help cut down on pollution in mines and building. The world is trying to make all businesses better, and this trend fits in with that. Building and mine places are getting digital more and more. Tools and methods for building are getting BIM, cloud-based project management, and digital tools for working together built in. Using digital tools makes it easier for everyone to work together, speeds up projects, and lowers the number of mistakes that happen. It's becoming more common to rent tools for building and digging. A lot of businesses would rather rent than buy because it gives them more choices for certain projects and doesn't tie them down for a long time. Also, rental services are getting better, with more tools and more help with fixes. Building projects all over the world have a direct effect on the need for mining and building tools. As nations spend money to build and improve their infrastructure, they need more advanced tools to make building and mining go faster. This is especially clear in emerging economies where cities are growing quickly. Even though the market for construction and mining equipment is growing, there are problems with the supply chain. The industry depends on getting raw materials and parts on time, so any problems can throw off production schedules. Fixing these problems is important to keep a steady flow of equipment to meet market needs. More and more equipment manufacturers and strategic partnerships are joining forces to share resources, build their global market presence, and use each other's strengths. This trend shows how the competitive landscape is changing to meet the needs of an industry that is becoming more dynamic.

Leave a Comment