Labor Shortages

Labor shortages are a pressing issue within the construction sector, significantly impacting the Construction Robot Market. As the workforce ages and fewer young individuals enter the trades, companies face challenges in finding skilled labor. This shortage drives construction firms to explore automation as a viable solution. Robots can fill gaps in labor availability, performing repetitive and labor-intensive tasks with precision and efficiency. The market is responding to this challenge, with projections indicating a substantial increase in the adoption of construction robots over the next few years. By leveraging robotic technologies, companies can maintain productivity levels and meet project deadlines despite the ongoing labor shortages.

Rising Labor Costs

The Construction Robot Market is experiencing a notable shift due to the rising labor costs across various regions. As construction projects become increasingly complex, the demand for skilled labor has surged, leading to higher wages. This trend compels construction companies to seek automation solutions to mitigate labor expenses. The integration of robots in construction processes not only reduces reliance on human labor but also enhances efficiency and productivity. According to recent data, labor costs in the construction sector have increased by approximately 20% over the past five years, prompting firms to invest in robotic technologies. Consequently, the Construction Robot Market is likely to expand as companies prioritize cost-effective solutions that maintain project timelines and quality.

Sustainability Initiatives

Sustainability initiatives are increasingly influencing the Construction Robot Market as stakeholders prioritize environmentally friendly practices. The construction sector is under pressure to reduce its carbon footprint and enhance resource efficiency. Robots can contribute to these goals by optimizing material usage, minimizing waste, and improving energy efficiency during construction processes. For example, robotic systems can precisely measure and cut materials, reducing excess waste. Furthermore, the integration of renewable energy sources in robotic operations aligns with sustainability objectives. As regulations and consumer preferences shift towards greener solutions, the Construction Robot Market is likely to see a surge in demand for robots that support sustainable construction practices.

Technological Advancements

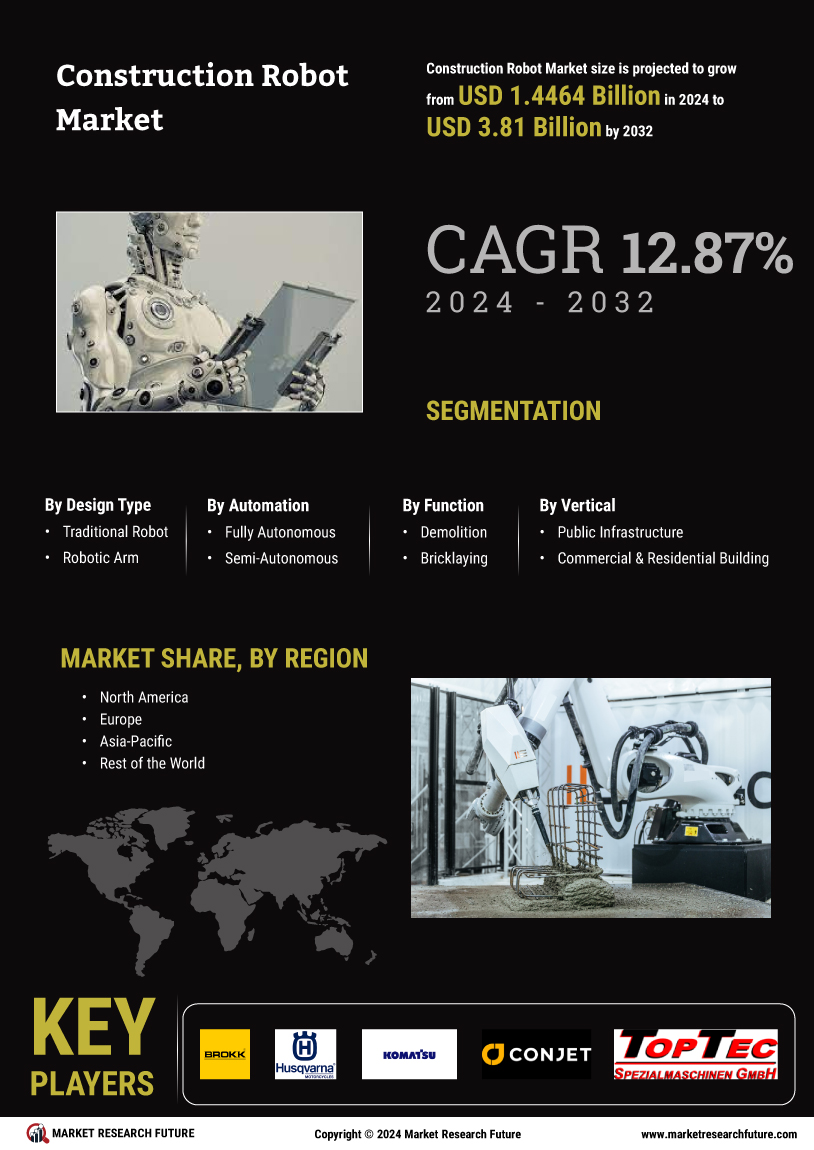

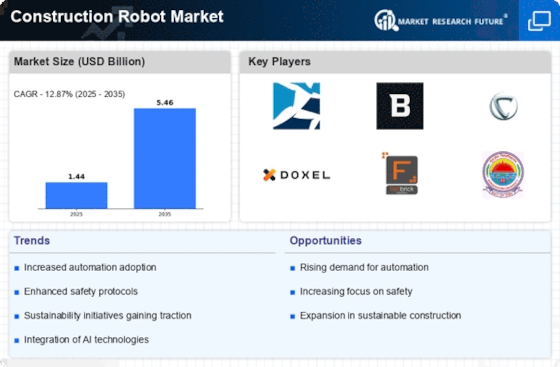

Technological advancements play a pivotal role in shaping the Construction Robot Market. Innovations in robotics, artificial intelligence, and machine learning are driving the development of sophisticated construction robots capable of performing complex tasks. These advancements enable robots to operate autonomously, adapt to various environments, and collaborate with human workers. For instance, the introduction of drones for site surveying and robotic arms for precise assembly has revolutionized construction practices. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 25% in the next five years. As technology continues to evolve, the Construction Robot Market is poised for substantial growth, attracting investments and fostering new applications.

Increased Infrastructure Development

The Construction Robot Market is benefiting from increased infrastructure development initiatives worldwide. Governments and private entities are investing heavily in infrastructure projects, including roads, bridges, and buildings, to support economic growth and urbanization. This surge in construction activity creates a favorable environment for the adoption of robotic technologies. Robots can enhance the speed and quality of construction, addressing the growing demand for infrastructure. Recent reports indicate that infrastructure spending is expected to reach trillions of dollars over the next decade, further propelling the Construction Robot Market. As projects become more ambitious, the reliance on advanced robotic solutions is likely to intensify.