Advancements in 5G Technology

The rollout of 5G technology is poised to have a profound impact on the Consumer Electronics MLCC Market. As telecommunications companies expand their 5G networks, the demand for devices capable of supporting this advanced connectivity is surging. MLCCs are essential components in 5G-enabled devices, facilitating high-frequency operations and ensuring signal integrity. By 2025, it is projected that 5G subscriptions will reach over 1 billion globally, driving the need for enhanced electronic components. This trend suggests that MLCC manufacturers must innovate to meet the specific requirements of 5G applications, positioning themselves favorably in a rapidly evolving market landscape.

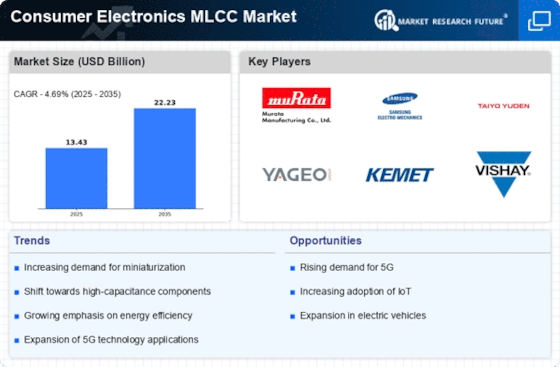

Rising Demand for Consumer Electronics

The Consumer Electronics MLCC Market is experiencing a notable surge in demand, primarily driven by the increasing adoption of smart devices. As consumers gravitate towards smartphones, tablets, and wearables, the need for multilayer ceramic capacitors (MLCCs) has escalated. In 2025, the market for consumer electronics is projected to reach approximately 1 trillion USD, with MLCCs playing a crucial role in enhancing device performance and efficiency. This trend indicates a robust growth trajectory for the MLCC sector, as manufacturers strive to meet the evolving needs of consumers. Furthermore, the proliferation of Internet of Things (IoT) devices is likely to further amplify the demand for MLCCs, as these components are essential for ensuring reliable connectivity and functionality in a myriad of applications.

Miniaturization of Electronic Components

The trend towards miniaturization in the Consumer Electronics MLCC Market is reshaping the landscape of electronic design. As devices become smaller and more compact, the demand for high-capacitance, low-profile MLCCs is increasing. This shift is evident in the smartphone and laptop markets, where manufacturers are seeking to optimize space without compromising performance. In 2025, the average size of MLCCs is expected to decrease by 20%, while their capacitance values are projected to increase. This dual advancement suggests that MLCCs will continue to be integral in the design of next-generation consumer electronics, enabling manufacturers to create sleeker, more efficient products that cater to consumer preferences for portability and functionality.

Increased Focus on Consumer Safety and Quality

The Consumer Electronics MLCC Market is witnessing a heightened emphasis on safety and quality standards. As consumers become more discerning regarding the reliability of electronic products, manufacturers are compelled to ensure that their MLCCs meet stringent quality benchmarks. This focus is reflected in the growing adoption of international safety certifications and compliance with regulatory standards. In 2025, it is anticipated that the market for certified MLCCs will expand significantly, as consumers prioritize products that guarantee safety and performance. This trend not only enhances consumer trust but also drives innovation within the industry, as manufacturers invest in research and development to produce higher-quality MLCCs that align with evolving consumer expectations.

Growth of Electric Vehicles and Renewable Energy

The Consumer Electronics MLCC Market is also influenced by the burgeoning electric vehicle (EV) sector and the shift towards renewable energy solutions. As EV adoption accelerates, the demand for high-performance MLCCs is expected to rise, given their critical role in power management systems. In 2025, the EV market is anticipated to surpass 10 million units sold, creating a substantial opportunity for MLCC manufacturers. Additionally, the integration of MLCCs in solar inverters and energy storage systems is likely to enhance their market presence. This convergence of consumer electronics with sustainable technologies indicates a promising avenue for growth, as manufacturers align their strategies with the global push for greener energy solutions.

Leave a Comment