Content Delivery Network Size

Market Size Snapshot

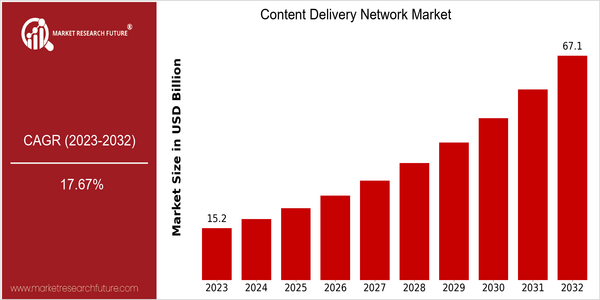

| Year | Value |

|---|---|

| 2023 | USD 15.17 Billion |

| 2032 | USD 67.14 Billion |

| CAGR (2024-2032) | 17.67 % |

Note – Market size depicts the revenue generated over the financial year

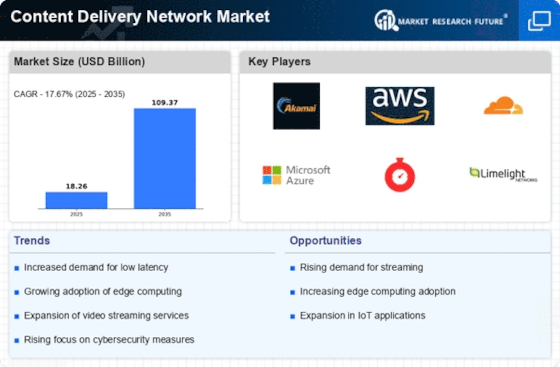

Content Delivery Network (CDN) market is expected to reach around USD 15,17 billion by 2023. This growth is a result of a CAGR of 17.67% from 2024 to 2032, indicating a strong demand for CDN services, as businesses increasingly prioritise content delivery and enhanced user experience. The growth of the market can be attributed to several factors, including the increase in digital content consumption, the proliferation of streaming services, and the growing demand for enhanced website performance and security. As companies continue to embrace digital transformation, their need for CDNs to optimize content delivery and reduce latency will increase. Further driving the growth of the market are technological advancements such as the integration of edge computing and the adoption of 5G networks. These innovations enable faster data processing and delivery, thereby improving the overall performance of digital services. Meanwhile, the major players in the market, including Akamai Technologies, Cloudflare, and Amazon Web Services, are launching new products, entering into strategic alliances, and acquiring smaller companies to strengthen their positions in the market. These strategic alliances, which aim to expand the companies’ global reach and improve their service offerings, will also help to ensure the continued growth of the market.

Regional Market Size

Regional Deep Dive

Content delivery network (CDN) market is growing fast across the globe. The growth is mainly driven by the increase in demand for high-quality content delivery, the rise of streaming services, and the e-commerce boom. Each region has its own characteristics, which are influenced by technological progress, legal frameworks, and consumer behavior. North America leads in innovation and infrastructural development. Europe is focused on compliance and data privacy. The Asia-Pacific region is experiencing high growth due to the increase in Internet penetration. The Middle East and Africa are growing fast due to the rise of mobile content delivery. Latin America is catching up with the digital economy and is preparing to support the CDN market.

Europe

- In Europe, the General Data Protection Regulation (GDPR) has led to a heightened focus on data privacy and compliance, prompting CDN providers to adapt their services to meet stringent regulatory requirements.

- The rise of 5G technology is facilitating faster content delivery, with companies like Vodafone and Deutsche Telekom investing in infrastructure to support enhanced CDN capabilities across the region.

Asia Pacific

- The Asia-Pacific region is witnessing rapid growth in CDN adoption, driven by increasing internet penetration and the popularity of video streaming platforms like Tencent Video and iQIYI.

- Government initiatives in countries like India, such as the Digital India program, are promoting digital infrastructure development, which is expected to boost CDN services and accessibility.

Latin America

- Latin America is experiencing a digital transformation, with increased investments in broadband infrastructure, which is essential for the growth of CDN services in the region.

- Local players like UOL Diveo are emerging, focusing on providing tailored CDN solutions to meet the specific needs of the Latin American market, particularly in sectors like e-commerce and media.

North America

- The North American CDN market is heavily influenced by major players like Akamai, Cloudflare, and Amazon Web Services, which are continuously innovating to enhance service delivery and security features.

- Recent trends show a significant shift towards edge computing, with companies investing in edge CDN solutions to reduce latency and improve user experience, particularly in sectors like gaming and video streaming.

Middle East And Africa

- In the Middle East and Africa, the growing mobile user base is driving demand for CDN services, with companies like Telkom and MTN investing in mobile-optimized content delivery solutions.

- The region is also seeing increased collaboration between local governments and tech companies to enhance digital infrastructure, which is crucial for the growth of CDN services.

Did You Know?

“Did you know that by 2025, it is estimated that 82% of all internet traffic will be video content, significantly increasing the demand for efficient CDN services?” — Cisco Annual Internet Report

Segmental Market Size

The Content Distribution Networks (CDN) play a key role in ensuring the speed and reliability of web content delivery. And they are currently experiencing very fast growth. Demand is being driven by the rising popularity of high-bandwidth content, such as streaming media and gaming, and the increasing demand for a better, faster and more reliable web experience. Also, the proliferation of IoT devices is putting pressure on the content distribution system, further driving growth. The current market is characterized by the rapid expansion of large players, such as Akamai, Cloudflare and Amazon Cloudfront. These companies are deploying CDNs in many industries, including e-commerce, media and health, to optimize the delivery of content. Use cases include VOD, live streaming of gaming data and the distribution of secure content for sensitive applications. The trend towards remote working and the increase in digital activity due to the e-revolution will also continue to drive growth. The emergence of edge computing and the use of machine learning for analysis will also influence the future of CDN technology.

Future Outlook

From 2023 to 2032, the content delivery network market is expected to grow from $13.13 billion to $67.13 billion, at a CAGR of 17.67 percent. It is mainly driven by the booming demand for high-definition video streaming, the emergence of e-games, and the growing reliance on cloud services. Content delivery solutions are increasingly in demand as more and more companies migrate to digital platforms, and the penetration rate of content delivery network services in various industries such as e-commerce, media and entertainment is expected to increase. In 2032, more than 70% of companies will use content delivery solutions to enhance their digital presence and optimize the experience of their users. , compared with about 40% in 2023. The content delivery network market will be further driven by the integration of edge computing and artificial intelligence. These two major innovations will help companies deliver content more quickly and securely, making content delivery networks indispensable for enterprises that want to optimize their digital presence. As data privacy and regulatory compliance become more and more important, the use of content delivery networks with higher security features will also increase. In addition, the emergence of 5G and the Internet of Things will also bring opportunities for real-time content delivery and real-time applications. The content delivery network market will be re-shaped by technological innovation and the evolution of users' habits, and will become an indispensable part of the digital landscape.

Leave a Comment