Market Trends

Introduction

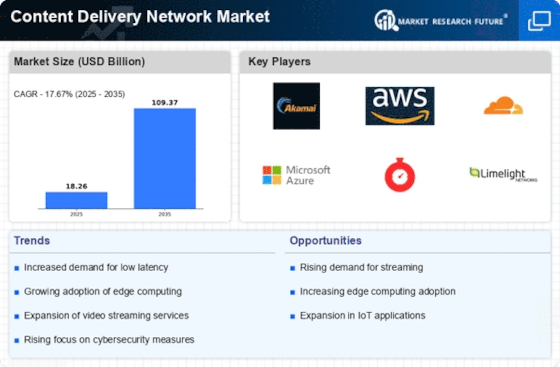

In 2023 the Content Distribution Network (CDN) market will be transformed by a confluence of macro-factors, such as the rapid development of technology, the changes in the regulatory environment, and the change in the habits of consumers. The increasing availability of high-speed Internet and the increasing demand for seamless digital experiences are driving companies to use CDN solutions to enhance performance and reliability. In addition, the regulatory pressures on privacy and security are causing companies to pay more attention to compliance with their CDN strategies. Moreover, the strategic importance of delivering high-quality, low-latency experiences is rising, as consumers increasingly demand instant access to content on multiple devices. Those who want to master the complexity of the market and exploit the opportunities must understand these trends.

Top Trends

-

Increased Demand for Edge Computing

Edge computing is reshaping the CDN strategy. Verizon, for example, is investing heavily in edge solutions. According to a recent study, by 2025, 70 percent of the enterprise will adopt edge computing. This move will lead to lower latency and improved user experience, especially for IoT applications. As more and more data processing takes place at the edge, the CDNs will have to adapt their architectures to support this trend. In the future, we may see closer ties between CDNs and edge computing platforms. -

Focus on Security Enhancements

The security features of the content delivery network have been gaining in importance. One example of this is the recent launch of advanced DDoS protection services by Akamai. The demand for security has been driven by a study which showed that 60 percent of organizations have experienced a security incident in the past year, which has resulted in a rise in demand for security services in the content delivery network. Not only does a higher level of security protect data, but it also increases customer trust, which in turn improves market competitiveness. The consequences of this are likely to be more strict regulations and compliance requirements for the content delivery network. -

Integration of AI and Machine Learning

Artificial intelligence and machine learning are more and more widely used in the field of CDN to optimize performance and resource allocation. Google uses AI to predict traffic patterns and improve content delivery efficiency by 30%. This kind of technology is very flexible and can be adjusted on the fly, and it also greatly improves the experience of users. With the continuous development of AI, the content management and distribution processes in the CDN will be further automated. -

Expansion of Video Streaming Services

The demand for streaming videos has grown so much, especially during the epidemic, that companies like Amazon have invested heavily in content delivery networks. The traffic from streaming videos will account for more than 80% of all Internet traffic in 2022, according to estimates. This trend will force the content delivery networks to increase their throughput and reduce latency, which will affect their operational strategies. Perhaps in the future there will be specialized content delivery networks for high-quality streaming services. -

Adoption of Multi-Cloud Strategies

In the interest of redundancy and speed, companies are increasingly embracing a multi-cloud strategy. IBM is leading the way in this field. A survey showed that more than a third of companies now use more than one cloud. This has increased the demand for a CDN that can integrate with different clouds. This is having an impact on the architecture and services of the CDNs. This trend is forcing the CDNs to develop more flexible solutions. The future may see increased competition between the CDNs for multi-cloud integration. -

Sustainability Initiatives in CDN Operations

And CDNs are beginning to think about sustainability. Limelight, for example, has vowed to operate at zero carbon. This may be a reaction to the fact that research shows that seven out of ten consumers prefer brands that act sustainably. Energy-saving technology not only reduces the impact on the environment, but also attracts clients who are also concerned about the environment. Future developments may lead to stricter standards for the environment and certification for CDNs. -

Growth of 5G Technology

5G will have a considerable effect on the speed of data transmission, reducing the latency and the time to reach the destination. At the forefront of 5G development is AT&T, which will be able to provide faster mobile content delivery. The use of the Internet will be increased tenfold, and the number of mobile data packets will be increased tenfold by 2025, which means that the content delivery network will have to be changed. There will be 5G-optimized services in the future. -

Personalization of Content Delivery

Personalization is a key part of the content delivery business, and companies are relying on data analytics to deliver more individualized experiences. As a result, engagement with content has increased, according to the Google Data and Personalization report. Personalization can increase conversion rates by up to 20 percent. This trend has affected CDN strategies, as content delivery networks must be able to deliver dynamic content. And in the future, these strategies may include advanced algorithms for real-time personalization. -

Emergence of Serverless Architectures

As we move into a new era of the serverless architecture, we see that this has opened up a whole new world of opportunities in the CDN market. AWS has blazed the trail with its serverless services that greatly reduce the operational overhead. A recent survey by the International Data Group shows that over 60% of developers prefer serverless solutions for their flexibility and efficiency. This trend will affect how the CDNs operate and how they deliver content. Future developments may see the serverless architecture being widely adopted across all industries. -

Enhanced Analytics and Reporting Tools

The demand for advanced analysis and reporting tools is growing as businesses seek to optimize their content delivery strategies. In response, content delivery networks are investing in their analytic capabilities. These investments are paying off as companies that use these tools can improve their decision-making by up to five times. This trend is having a positive effect on the value that content delivery networks can offer their clients. The next stage will be to include real-time analysis and prediction capabilities.

Conclusion: Navigating the CDN Competitive Landscape

The market for Content Distribution in 2023 is characterized by a high degree of competition and considerable fragmentation, with both established and new players competing for market share. The regional development shows a growing demand for localized content distribution solutions, which requires the vendors to adapt their strategies accordingly. The established players are relying on their existing platforms and distribution channels, while the new players are focusing on new capabilities such as artificial intelligence-based analytics, automation and sustainable initiatives to gain a competitive advantage. In the future, the ability to offer flexible and scalable solutions will be a decisive factor for market leadership. Vendors must therefore focus on these capabilities to be able to meet not only current but also future changes in customer behavior and technological development.

Leave a Comment