Research Methodology on Cord Blood banking Services Market

Introduction

Cord blood banking services are medical procedures that store and preserve parts of the umbilical cord and placenta after a baby’s birth. Cord blood banking services are usually done through public and private banking. The use of cord blood banking services is on the rise, as parents seek to ensure their newborn's health and well-being by preserving traditional stem cells. These services also play an important role in the medical community, as they can be used to provide life-saving therapies for people with certain blood diseases or disorders.

Market Research Future (MRFR) has conducted an extensive research study on the market of cord blood banking services to analyze the growth of the market and provide valuable insights to the industry stakeholders. The report’s findings are expected to act as a comprehensive guide for industry participants by highlighting key market segments, major players, and their respective engagement strategies in the market.

Research Methodology

For this research, Market Research Future deployed both qualitative and quantitative approaches for researching the global Cord Blood Banking Services market. MRFR utilized both primary research and secondary research sources, through discussions with market participants and stakeholders. For primary research, MRFR gathered data from market surveys and interviews with key executives and stakeholders from the industry. A combination of these data sources gives a holistic understanding of the market and its dynamics.

Furthermore, MRFR conducted a survey designed to gain insights from senior and middle-level management executives who work in the Cord Blood Banking Services domain. The interviews are conducted over the telephone and face-to-face. We received responses from participants in countries such as the US, EU, and India. Our secondary research method includes accumulating information from various paid and unpaid industry databases, government sources, SEC filings, articles, journals, and industry-related activities to build an exhaustive database that can serve as an authentic source of key industry insights.

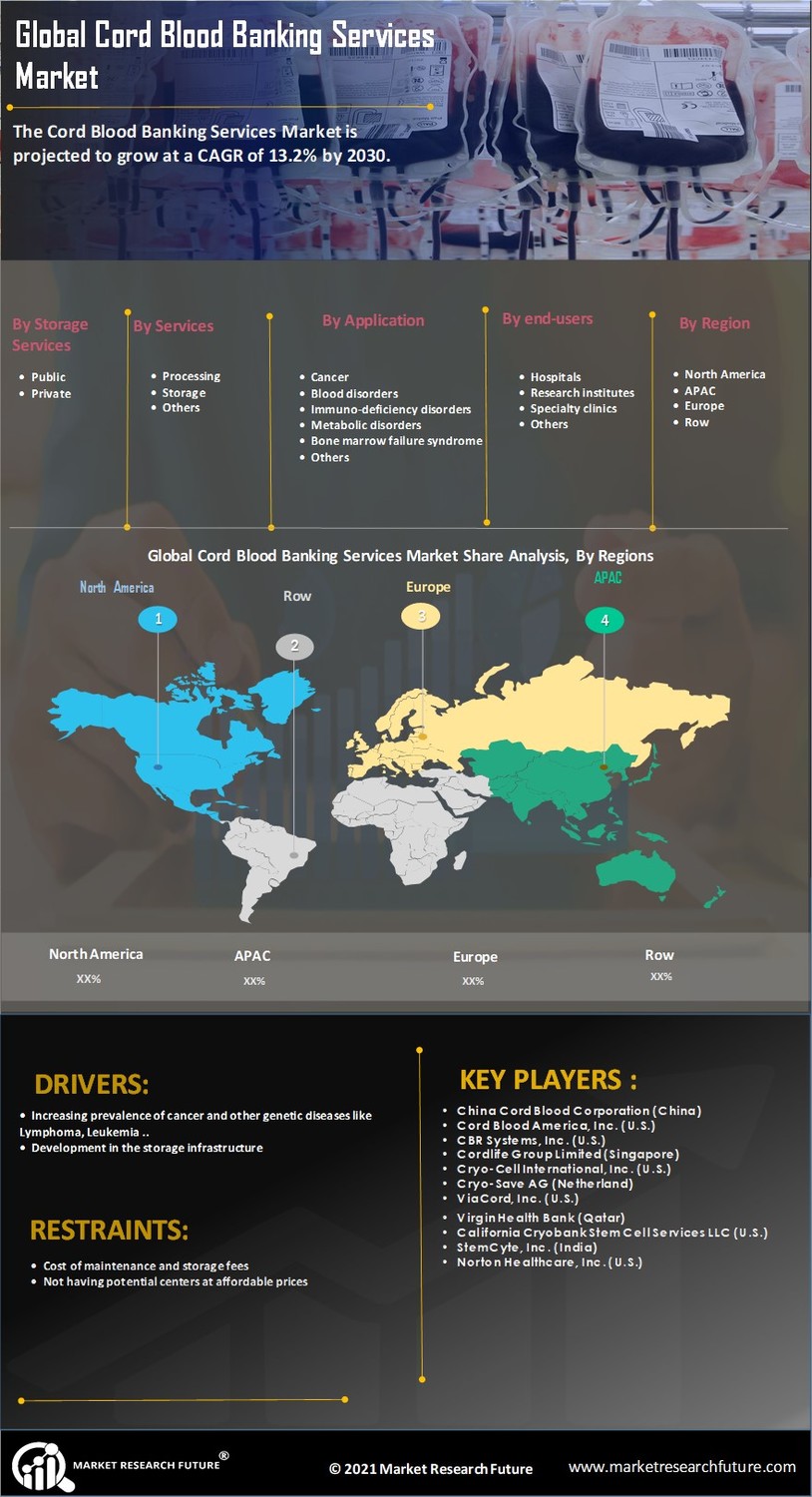

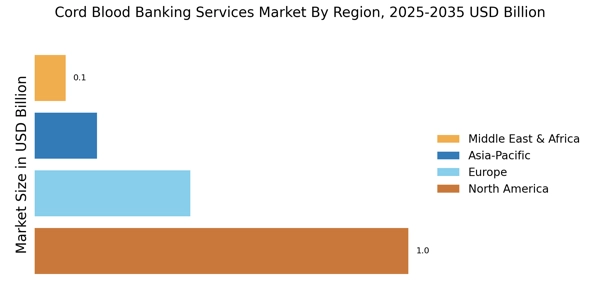

The market is segmented according to product type, end-user, and application. The segmentation further explored geographical regions and countries. The countries included in the study are the United States, Canada, Mexico, Germany, France, the United Kingdom, Italy, Spain, India, China, and Japan. In order to understand the competitive environment in the Cord Blood Banking Services market, MRFR conducted detailed competitive analyses, which included PESTLE analysis and Porter’s Five Forces analysis.

To analyze the global Cord Blood Banking Services market and its performance, certain analytical tools were used such as market attractiveness and customer loyalty analysis. Moreover, to explore the market trends, the market is further segmented based on product type, end-user, and application. Furthermore, historical and forecast analysis of the market is done to gain a comprehensive understanding of the market.

Discussion of the results obtained is done based on these primary and secondary research channels and internal databases. MRFR also leveraged econometric tools to estimate the total demand for Cord Blood Banking Services globally. In addition, the research includes the qualitative and quantitative aspects of the market. Furthermore, qualitative and quantitative analysis of the data helped us understand the initial market scenarios and identify the trends in the market.

Conclusion

In conclusion, MRFR conducted a comprehensive market research study to gain valuable insights into the Cord Blood Banking Services market. The report provides a comprehensive analysis of market drivers, trends, restraints, and opportunities. MRFR performed extensive primary and secondary research in order to gather extensive data and insights. Additionally, it uses a combination of qualitative and quantitative approaches to gain a better understanding of the market and its dynamics. The market is segmented based on product type, end users, and applications. In-depth market analysis and competitive intelligence are included to understand the competitive scenario of the market. The report also covers regional analysis and strategic recommendations to gain a better market presence.