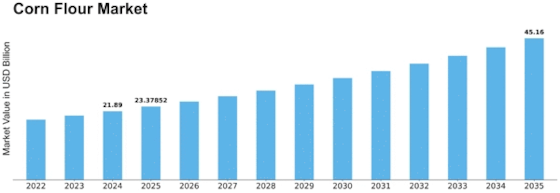

Corn Flour Size

Corn Flour Market Growth Projections and Opportunities

The corn flour market dynamics reflect a complex interplay of various factors, including shifting consumer preferences, agricultural trends, economic influences, and technological advancements. Corn flour, a versatile ingredient derived from ground corn kernels, is widely used in food and beverage applications, including baking, cooking, and snack production. Understanding the market dynamics is essential for stakeholders, including corn flour producers, suppliers, manufacturers, and distributors, to navigate challenges and capitalize on opportunities within the industry.

One significant driver of market dynamics in the corn flour market is changing consumer preferences and dietary trends. With growing awareness of health and wellness, consumers are increasingly seeking out gluten-free and non-GMO alternatives to traditional wheat flour. Corn flour, which is naturally gluten-free and can be produced from non-genetically modified corn varieties, has gained popularity among health-conscious consumers looking to incorporate alternative grains into their diets. Additionally, the rise of plant-based diets and the demand for vegan-friendly ingredients have further fueled the demand for corn flour as a versatile and plant-derived option for cooking and baking.

Moreover, the agricultural landscape and crop yields play a crucial role in shaping the dynamics of the corn flour market. Corn is a major commodity crop cultivated in various regions worldwide, including the United States, China, Brazil, and Argentina. Factors such as weather conditions, soil fertility, pest and disease management, and government policies can impact corn production and supply levels, thereby influencing corn flour prices and market availability. Fluctuations in corn prices and supply chain disruptions due to factors like extreme weather events or trade disputes can create volatility in the corn flour market, affecting both producers and consumers.

Furthermore, economic factors such as income levels, consumer spending patterns, and food inflation rates also influence market dynamics in the corn flour industry. In regions where corn is a staple food crop, such as Latin America and parts of Africa and Asia, changes in corn prices can have significant implications for food security and household budgets. Rising incomes and urbanization in emerging markets have led to increased demand for convenience foods and processed snacks, driving growth in the corn flour market as a key ingredient in snack production and food manufacturing.

Additionally, technological advancements in food processing and manufacturing have contributed to the evolution of the corn flour market dynamics. Innovations in milling techniques, such as fine grinding and particle size reduction, have resulted in the production of high-quality corn flour with improved texture, flavor, and functionality. Furthermore, advancements in packaging technology, such as vacuum-sealed bags and modified atmosphere packaging, have extended the shelf life of corn flour products, enabling manufacturers to meet the demand for convenience and freshness in the marketplace.

Moreover, regulatory frameworks and food safety standards also shape the dynamics of the corn flour market, particularly in terms of product labeling, quality control, and food additive regulations. Compliance with regulatory requirements and adherence to industry standards are essential for corn flour producers and manufacturers to ensure product safety, traceability, and consumer trust. Additionally, certifications such as organic, kosher, and halal play a role in market differentiation and consumer perception, providing assurance of quality and authenticity to discerning consumers.

Leave a Comment