Increased Focus on Sustainability

Sustainability has emerged as a pivotal driver in the cosmetics original design manufacturing odm Market, influencing both consumer choices and manufacturing practices. Brands are increasingly held accountable for their environmental impact, prompting ODM manufacturers to adopt sustainable practices throughout the supply chain. This includes sourcing eco-friendly materials, reducing waste, and implementing energy-efficient production methods. Market Research Future indicates that consumers are willing to pay a premium for sustainable products, with approximately 70% of consumers expressing a preference for brands that demonstrate environmental responsibility. As a result, ODM manufacturers are not only enhancing their brand image but also tapping into a lucrative market segment. The emphasis on sustainability is likely to continue shaping product development and marketing strategies within the Cosmetics Original Design Manufacturing ODM Market.

Rising Demand for Natural Ingredients

The Cosmetics Original Design Manufacturing ODM Market is witnessing a pronounced shift towards natural and organic ingredients. Consumers increasingly prioritize products that are free from harmful chemicals, which has led to a surge in demand for formulations that utilize botanical extracts and sustainable sourcing. According to recent data, the market for natural cosmetics is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is not merely a passing phase; it reflects a broader consumer consciousness regarding health and environmental impact. As a result, ODM manufacturers are adapting their product lines to meet these evolving preferences, thereby enhancing their market competitiveness. The integration of natural ingredients into cosmetic formulations is likely to become a defining characteristic of successful brands in the Cosmetics Original Design Manufacturing ODM Market.

E-commerce Growth and Online Retailing

The rise of e-commerce has significantly impacted the Cosmetics Original Design Manufacturing ODM Market, transforming how consumers discover and purchase beauty products. Online retailing platforms have expanded access to a diverse range of cosmetic offerings, allowing consumers to explore brands that may not be available in traditional retail settings. Recent statistics reveal that e-commerce sales in the beauty sector are expected to account for over 30% of total sales by 2026. This shift necessitates that ODM manufacturers develop products that cater to online consumer preferences, including attractive packaging and effective digital marketing strategies. Additionally, the ability to gather consumer data through online channels enables manufacturers to refine their product offerings and enhance customer engagement. Consequently, the growth of e-commerce is reshaping the competitive landscape of the Cosmetics Original Design Manufacturing ODM Market.

Emerging Markets and Demographic Shifts

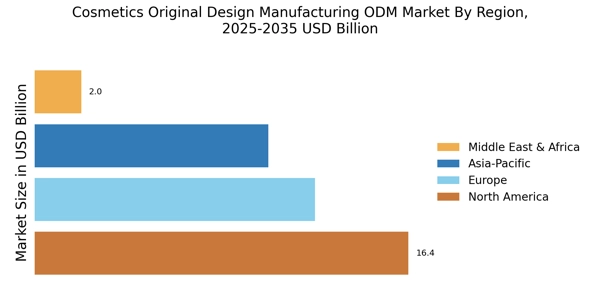

The Cosmetics Original Design Manufacturing ODM Market is experiencing growth driven by emerging markets and shifting demographics. As disposable incomes rise in developing regions, there is an increasing demand for cosmetic products among a burgeoning middle class. Additionally, younger consumers, particularly millennials and Gen Z, are becoming key drivers of market growth, with their preferences for innovative and trendy products. Data suggests that the cosmetics market in Asia-Pacific is expected to grow at a rate of 8% annually, outpacing other regions. This demographic shift compels ODM manufacturers to tailor their offerings to meet the unique preferences and cultural nuances of diverse consumer bases. Consequently, understanding these emerging markets and demographic trends is essential for ODM manufacturers aiming to thrive in the Cosmetics Original Design Manufacturing ODM Market.

Technological Advancements in Production

Technological innovations are reshaping the Cosmetics Original Design Manufacturing ODM Market, enabling manufacturers to enhance efficiency and product quality. Automation and advanced manufacturing techniques, such as 3D printing and AI-driven formulation, are becoming increasingly prevalent. These technologies facilitate rapid prototyping and customization, allowing brands to respond swiftly to market trends and consumer demands. Data indicates that companies adopting these technologies can reduce production costs by up to 20%, thereby improving profit margins. Furthermore, the ability to produce small batches of customized products aligns with the growing consumer desire for personalized beauty solutions. As such, the integration of cutting-edge technology is not only streamlining operations but also positioning ODM manufacturers as leaders in innovation within the Cosmetics Original Design Manufacturing ODM Market.