Rising Demand for Edible Oils

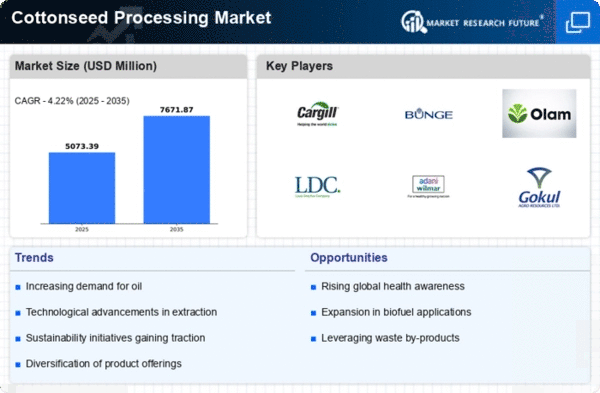

The Global Cottonseed Processing Market Industry experiences a notable increase in demand for edible oils, driven by the growing health consciousness among consumers. Cottonseed oil, known for its light flavor and high smoke point, is gaining popularity in cooking and food processing. In 2024, the market is valued at 4.87 USD Billion, reflecting the rising preference for vegetable oils over animal fats. This trend is expected to continue, with projections indicating that by 2035, the market could reach 7.67 USD Billion. The anticipated compound annual growth rate (CAGR) of 4.21% from 2025 to 2035 further underscores the potential for growth in this segment.

Increased Utilization in Animal Feed

The Global Cottonseed Processing Market Industry benefits from the increased utilization of cottonseed meal in animal feed. As livestock production expands globally, the demand for high-protein feed ingredients rises. Cottonseed meal, a byproduct of oil extraction, is rich in protein and is increasingly incorporated into feed formulations for cattle, poultry, and aquaculture. This trend is particularly evident in regions with significant livestock farming, where the nutritional value of cottonseed meal is recognized. The growing livestock sector not only supports the cottonseed processing industry but also enhances the overall sustainability of animal agriculture.

Expansion of Cotton Cultivation Areas

The Global Cottonseed Processing Market Industry is positively influenced by the expansion of cotton cultivation areas in various regions. As cotton production increases, the availability of raw materials for processing also rises. Countries such as India, China, and the United States are expanding their cotton farming practices, driven by favorable climatic conditions and advancements in agricultural techniques. This expansion not only supports the supply chain for cottonseed processing but also contributes to the overall growth of the industry. The increased availability of cottonseed is expected to enhance processing capacities and meet the rising global demand for cottonseed oil and meal.

Growing Awareness of Sustainable Practices

The Global Cottonseed Processing Market Industry is witnessing a shift towards sustainable practices, driven by consumer awareness and regulatory pressures. Stakeholders are increasingly focusing on environmentally friendly processing methods and sustainable sourcing of cotton. This trend is reflected in the adoption of practices that minimize waste and energy consumption during processing. Companies that prioritize sustainability are likely to gain a competitive edge, as consumers increasingly prefer products that align with their values. This growing emphasis on sustainability not only enhances the reputation of the industry but also opens new market opportunities for cottonseed-derived products.

Technological Advancements in Processing Techniques

Technological advancements in cottonseed processing techniques are transforming the Global Cottonseed Processing Market Industry. Innovations such as solvent extraction and cold pressing are enhancing oil yield and quality, making cottonseed oil more competitive with other vegetable oils. These advancements also contribute to improved efficiency and reduced waste in processing operations. As processors adopt modern technologies, they can meet the increasing demand for high-quality cottonseed oil and meal. This shift towards more efficient processing methods is likely to attract investments and foster growth within the industry, further solidifying its position in the global market.

Leave a Comment