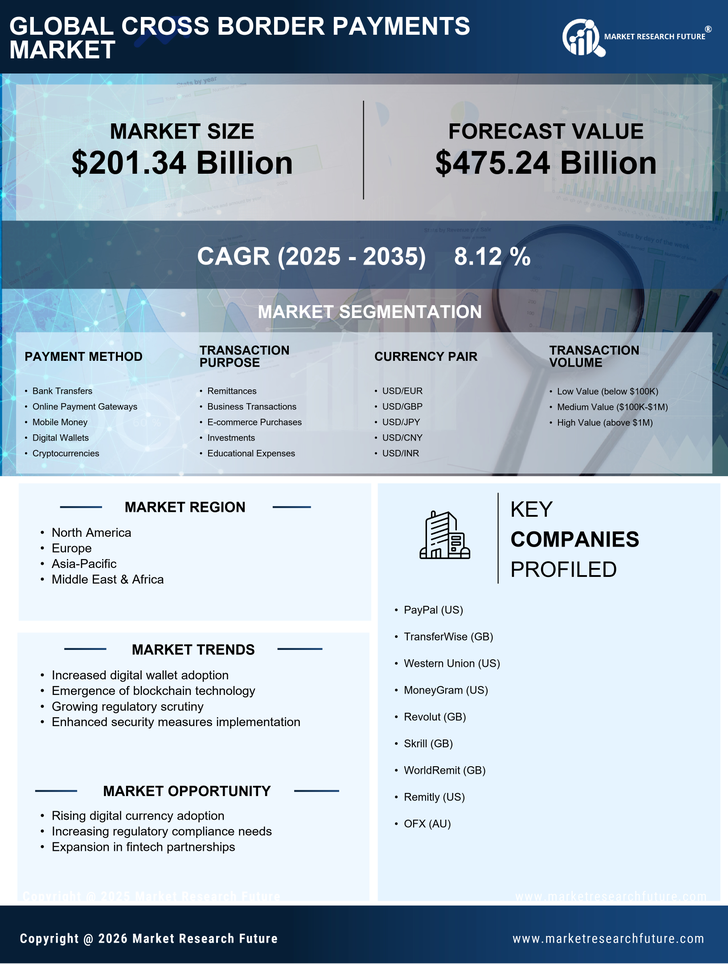

Regulatory Developments

Regulatory developments play a crucial role in shaping the Cross Border Payments Market. Governments and regulatory bodies are increasingly focusing on creating frameworks that facilitate cross-border transactions while ensuring consumer protection and compliance with anti-money laundering (AML) regulations. In 2025, it is anticipated that new regulations will emerge, promoting transparency and security in cross-border payments. These regulations may encourage traditional banks and fintech companies to collaborate, thereby enhancing the overall efficiency of the Cross Border Payments Market. Such developments could lead to a more robust and trustworthy payment ecosystem.

Rising Demand for Remittances

The rising demand for remittances is a significant driver of the Cross Border Payments Market. With millions of individuals working abroad and sending money back home, the remittance market is projected to reach over 700 billion USD by 2025. This trend underscores the necessity for reliable and cost-effective payment solutions that cater to the needs of migrant workers and their families. As competition among service providers intensifies, innovations in pricing and service delivery are likely to emerge, further stimulating growth in the Cross Border Payments Market.

Increased E-commerce Activities

The rise in e-commerce activities has been a pivotal driver for the Cross Border Payments Market. As consumers increasingly engage in online shopping, the demand for seamless cross-border transactions has surged. In 2025, it is estimated that e-commerce sales will reach approximately 6 trillion USD, with a substantial portion attributed to international purchases. This trend necessitates efficient payment solutions that can handle multiple currencies and provide competitive exchange rates. Consequently, businesses are compelled to adopt advanced payment technologies to cater to this growing consumer base, thereby propelling the Cross Border Payments Market forward.

Emergence of Fintech Innovations

Fintech innovations are reshaping the landscape of the Cross Border Payments Market. The advent of blockchain technology and digital wallets has introduced new avenues for faster and more secure transactions. In recent years, the market has witnessed a significant increase in the adoption of these technologies, with blockchain transactions projected to exceed 1 trillion USD by 2025. This shift not only enhances transaction speed but also reduces costs associated with traditional banking methods. As fintech companies continue to innovate, they are likely to capture a larger share of the Cross Border Payments Market, driving further growth.

Consumer Preference for Speed and Convenience

Consumer preference for speed and convenience is increasingly influencing the Cross Border Payments Market. As individuals and businesses seek quicker transaction times, the demand for instant payment solutions is on the rise. In 2025, it is expected that nearly 50% of cross-border transactions will be processed in real-time, reflecting a shift towards more efficient payment methods. This trend compels payment service providers to enhance their offerings, ensuring that they meet the evolving expectations of consumers. Consequently, the Cross Border Payments Market is likely to experience accelerated growth as it adapts to these changing consumer preferences.