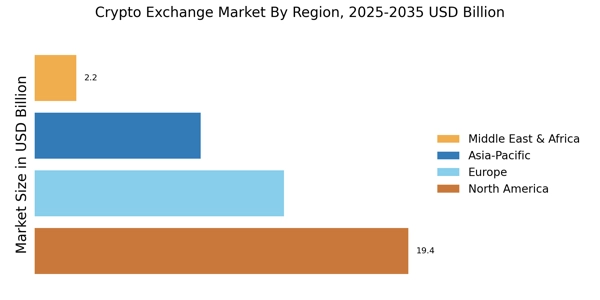

North America : Leading Innovation and Regulation

North America is the largest market for crypto exchanges, holding approximately 45% of the global market share. North America leads the global cryptocurrency market, driven by strong adoption of crypto trading platforms, regulatory clarity, and high engagement with bitcoin price graph and crypto prices monitoring. The region's growth is driven by increasing adoption of cryptocurrencies, favorable regulatory frameworks, and a robust technological infrastructure. The U.S. is the primary market, followed by Canada, which is rapidly expanding its crypto ecosystem. Regulatory clarity from agencies like the SEC has catalyzed growth, fostering a secure environment for investors and exchanges alike. The competitive landscape is characterized by major players such as Coinbase, Kraken, and Gemini, which dominate the market with innovative offerings and user-friendly platforms. The presence of these key players has led to a vibrant ecosystem, attracting both retail and institutional investors. Additionally, the U.S. government's focus on developing a regulatory framework for digital assets is expected to further enhance market stability and growth.

Europe : Regulatory Framework and Growth

Europe is witnessing significant growth in the crypto exchange market, holding around 30% of the global market share. Europe’s structured regulatory approach is supporting stable growth in cryptocurrency exchanges, enhanced transparency in cryptocurrency price discovery, and rising crypto market cap participation. The region benefits from a diverse regulatory landscape, with countries like Germany and Switzerland leading in crypto-friendly regulations. The European Union is also working on comprehensive regulations to ensure consumer protection and market integrity, which is expected to further boost market confidence and participation. Leading countries in this region include Germany, the UK, and Switzerland, which host several prominent exchanges. The competitive landscape is marked by established players like Bitstamp and Kraken, alongside emerging platforms. The presence of innovative fintech companies and supportive regulatory bodies is fostering a dynamic environment for crypto exchanges, making Europe a key player in the global market.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is rapidly becoming a powerhouse in the crypto exchange market, accounting for approximately 20% of the global market share. Asia-Pacific shows strong momentum in cryptocurrency trading, with high volumes across major crypto exchanges and increasing interest in coinmarket data and coin price movements. The region's growth is fueled by increasing cryptocurrency adoption, particularly in countries like China, Japan, and South Korea. Regulatory developments, such as Japan's proactive stance on crypto regulations, are enhancing market confidence and encouraging investment in digital assets. China remains a significant player, despite regulatory challenges, with exchanges like Huobi and Binance leading the market. Japan's regulatory framework supports a thriving crypto ecosystem, while South Korea's vibrant trading culture drives demand. The competitive landscape is dynamic, with numerous exchanges vying for market share, making Asia-Pacific a critical region for future growth in the crypto exchange market.

Middle East and Africa : Emerging Markets and Opportunities

The Middle East and Africa are emerging as significant players in the crypto exchange market, holding about 5% of the global market share. MEA markets are gaining traction as access to cryptocurrencies, mobile crypto wallet solutions, and localized crypto trading platforms expands. The region is characterized by a growing interest in cryptocurrencies, driven by increasing smartphone penetration and a young population. Countries like Nigeria and South Africa are leading the charge, with regulatory bodies beginning to establish frameworks to support crypto activities, which is expected to enhance market growth. In Africa, Nigeria has seen a surge in crypto adoption, with local exchanges gaining traction. The competitive landscape is evolving, with new players entering the market to cater to the growing demand. In the Middle East, countries like the UAE are fostering a favorable environment for crypto exchanges, attracting international players and investments, thus positioning the region for future growth.