Rising Demand for Data Centers

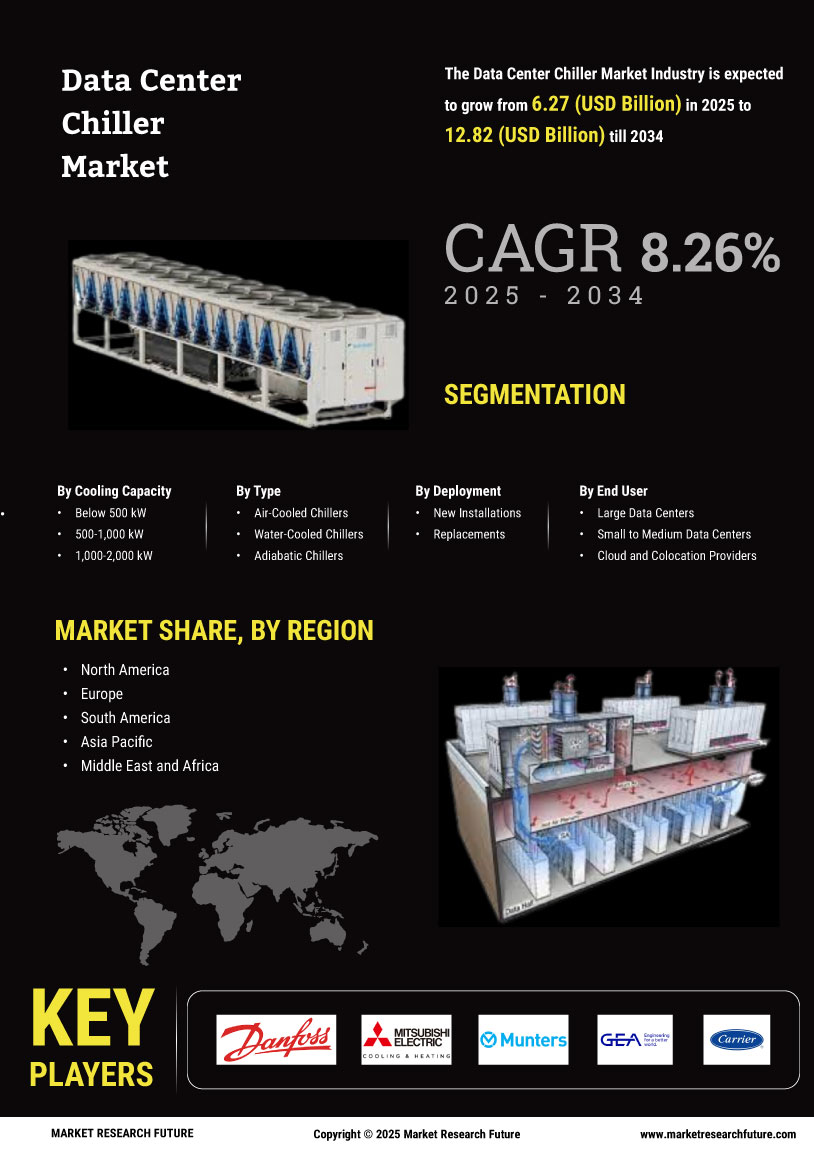

The increasing reliance on digital services and cloud computing has led to a surge in data center construction. As organizations expand their digital infrastructure, the demand for efficient cooling solutions becomes paramount. The Data Center Chiller Market is experiencing growth, driven by the need to maintain optimal operating temperatures in these facilities. According to recent estimates, the data center sector is projected to grow at a compound annual growth rate of approximately 10% over the next few years. This growth necessitates advanced chiller systems that can handle the heat generated by high-density server configurations, thereby propelling the Data Center Chiller Market forward.

Regulatory Compliance and Standards

Stringent regulations regarding energy consumption and environmental impact are influencing the Data Center Chiller Market. Governments and regulatory bodies are increasingly mandating energy efficiency standards for cooling systems. Compliance with these regulations not only helps in reducing operational costs but also enhances the sustainability profile of data centers. The Data Center Chiller Market is adapting to these requirements by innovating and developing chillers that meet or exceed these standards. As a result, companies are investing in advanced cooling technologies that align with regulatory expectations, thereby driving market growth.

Focus on Sustainability and Green Initiatives

Sustainability has become a critical focus for organizations operating data centers. The Data Center Chiller Market is responding to this trend by developing eco-friendly cooling solutions that minimize environmental impact. Companies are increasingly adopting chillers that utilize natural refrigerants and energy-efficient technologies. This shift is driven by both consumer demand for greener practices and corporate responsibility initiatives. The market is expected to grow as more data centers seek to reduce their carbon footprint and comply with sustainability goals. Consequently, the Data Center Chiller Market is likely to see a rise in the adoption of sustainable cooling technologies.

Technological Advancements in Cooling Solutions

The Data Center Chiller Market is witnessing rapid technological advancements that enhance cooling efficiency and reliability. Innovations such as variable speed compressors, advanced heat exchangers, and IoT-enabled monitoring systems are becoming increasingly prevalent. These technologies allow for real-time data analysis and optimization of cooling operations, which can lead to significant energy savings. The market is projected to benefit from these advancements, as they not only improve performance but also reduce the total cost of ownership for data center operators. As a result, the Data Center Chiller Market is likely to see a shift towards more sophisticated and integrated cooling solutions.

Increased Investment in Data Center Infrastructure

Investment in data center infrastructure is on the rise, driven by the growing need for data storage and processing capabilities. The Data Center Chiller Market is benefiting from this trend, as new facilities require advanced cooling systems to manage heat loads effectively. With the proliferation of big data, artificial intelligence, and the Internet of Things, the demand for robust data center infrastructure is expected to continue. This investment trend is likely to stimulate growth in the Data Center Chiller Market, as operators seek reliable and efficient cooling solutions to support their expanding operations.