Expansion of Edge Computing

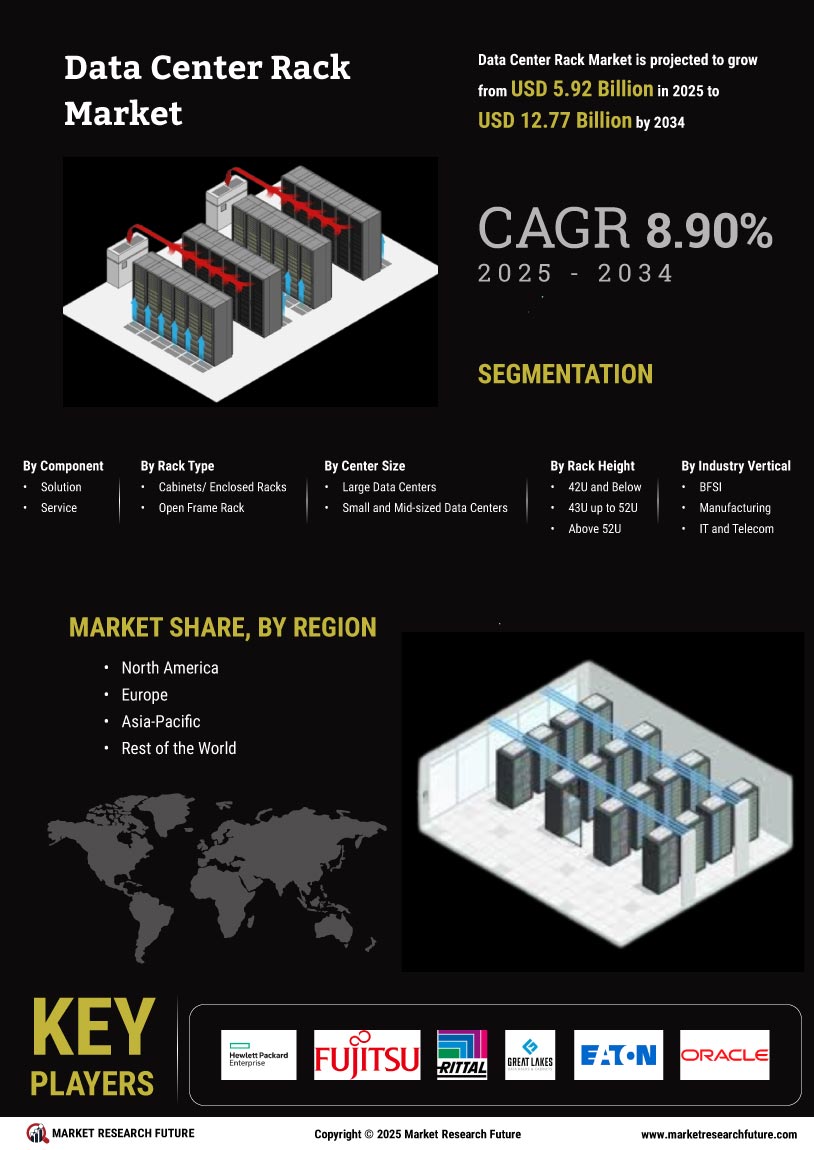

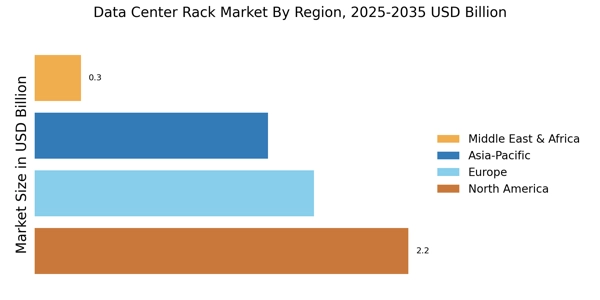

The rise of edge computing is emerging as a pivotal driver for the Data Center Rack Market. As businesses increasingly rely on real-time data processing and analytics, the need for localized data centers is becoming more pronounced. Edge computing reduces latency and enhances performance by processing data closer to the source. This trend necessitates the deployment of smaller, more efficient data center racks that can be installed in various locations, including remote sites and urban areas. The market for edge computing infrastructure is projected to grow significantly, with investments in edge data centers expected to reach billions by 2025. Consequently, the Data Center Rack Market is likely to experience a surge in demand for racks tailored to edge computing applications.

Rising Demand for Data Storage

The increasing volume of data generated by businesses and consumers is driving the Data Center Rack Market. As organizations seek to store, manage, and analyze vast amounts of information, the need for efficient data center infrastructure becomes paramount. According to recent estimates, the data generated globally is expected to reach 175 zettabytes by 2025. This surge in data necessitates the deployment of advanced data center racks that can accommodate high-density servers and storage solutions. Consequently, manufacturers are innovating to provide racks that optimize space and enhance cooling efficiency, thereby supporting the growing demand for data storage solutions. The Data Center Rack Market is thus positioned to experience substantial growth as enterprises invest in scalable and robust data center architectures.

Growing Focus on Energy Efficiency

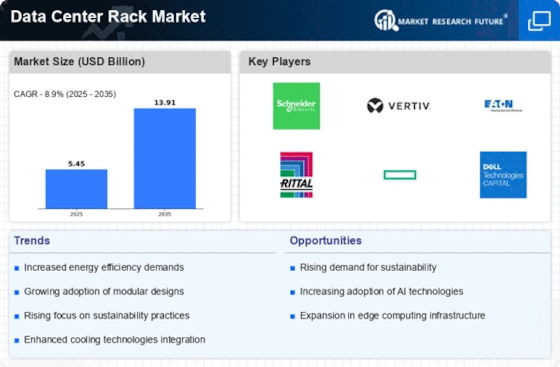

Energy efficiency has become a critical consideration in the Data Center Rack Market. With rising energy costs and increasing environmental regulations, data center operators are compelled to adopt energy-efficient solutions. The U.S. Department of Energy has reported that data centers consume about 2% of the total electricity in the country, highlighting the need for sustainable practices. As a result, manufacturers are developing racks that incorporate energy-saving technologies, such as advanced cooling systems and power management features. This focus on energy efficiency not only reduces operational costs but also aligns with corporate sustainability goals. Consequently, the Data Center Rack Market is likely to see a surge in demand for energy-efficient rack solutions as organizations strive to minimize their carbon footprint.

Increased Adoption of Cloud Computing

The proliferation of cloud computing services is significantly influencing the Data Center Rack Market. As businesses transition to cloud-based solutions, the demand for data centers that can support these services escalates. It is estimated that the cloud computing market will reach a valuation of over 800 billion USD by 2025, prompting data center operators to expand their facilities. This expansion often involves the installation of advanced data center racks designed to maximize efficiency and performance. Furthermore, the shift towards hybrid cloud environments necessitates flexible and modular rack solutions that can adapt to varying workloads. Thus, the Data Center Rack Market is likely to benefit from this trend as organizations seek to enhance their cloud infrastructure.

Technological Advancements in Rack Design

Technological innovations are reshaping the Data Center Rack Market, leading to the development of smarter and more efficient rack designs. The integration of IoT and AI technologies into data center operations is enhancing monitoring and management capabilities. For instance, smart racks equipped with sensors can provide real-time data on temperature, humidity, and power usage, allowing for proactive maintenance and optimization. This trend is expected to drive the market as organizations seek to leverage technology for improved operational efficiency. Furthermore, advancements in materials and construction techniques are enabling the production of lighter and more durable racks, which can support higher densities of equipment. As a result, the Data Center Rack Market is poised for growth as these technological advancements gain traction.