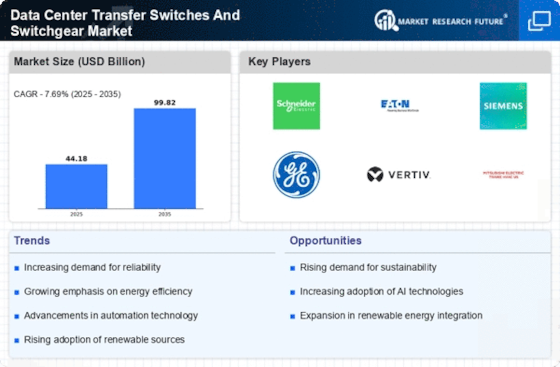

Growth of Renewable Energy Sources

The shift towards renewable energy sources is having a profound impact on the Data Center Transfer Switches And Switchgear Market. As data centers increasingly incorporate renewable energy solutions, such as solar and wind power, the need for specialized transfer switches and switchgear that can manage these energy sources becomes critical. This transition not only supports sustainability goals but also enhances energy resilience. The market is witnessing a growing demand for switchgear that can seamlessly integrate renewable energy into existing power systems. This trend indicates a potential for significant growth in the Data Center Transfer Switches And Switchgear Market as operators seek to optimize energy usage and reduce carbon footprints.

Regulatory Compliance and Standards

The Data Center Transfer Switches And Switchgear Market is significantly influenced by stringent regulatory compliance and standards. Governments and regulatory bodies are implementing various guidelines to ensure the safety and reliability of electrical systems in data centers. Compliance with these regulations often necessitates the installation of advanced transfer switches and switchgear, which can handle the complexities of modern electrical loads. As a result, data center operators are compelled to invest in these technologies to meet compliance requirements, thereby driving market growth. The increasing emphasis on safety standards, particularly in regions with high energy consumption, suggests that adherence to regulations will continue to be a key driver for the Data Center Transfer Switches And Switchgear Market.

Expansion of Cloud Computing Services

The rapid expansion of cloud computing services is driving the Data Center Transfer Switches And Switchgear Market. As businesses increasingly migrate to cloud-based solutions, the demand for data centers is surging. This growth necessitates robust power management systems to ensure reliability and efficiency. The proliferation of cloud services is expected to result in a substantial increase in data center construction, with estimates suggesting a rise in data center investments to exceed 200 billion by 2025. Consequently, the need for advanced transfer switches and switchgear to support these facilities is likely to escalate, positioning the Data Center Transfer Switches And Switchgear Market for continued growth.

Rising Demand for Uninterrupted Power Supply

The Data Center Transfer Switches And Switchgear Market is experiencing a notable surge in demand for uninterrupted power supply solutions. As organizations increasingly rely on data centers for critical operations, the need for reliable power management systems becomes paramount. This demand is driven by the growing number of data centers, which are projected to reach over 8 million by 2025. Consequently, the market for transfer switches and switchgear is expected to expand, as these systems play a crucial role in ensuring continuous power availability. Furthermore, the increasing frequency of power outages and the need for backup solutions further amplify this trend, indicating a robust growth trajectory for the Data Center Transfer Switches And Switchgear Market.

Technological Advancements in Power Management

Technological advancements are reshaping the Data Center Transfer Switches And Switchgear Market. Innovations in power management technologies, such as automated transfer switches and smart switchgear, are enhancing operational efficiency and reliability. These advancements allow for real-time monitoring and control of power distribution, which is essential for modern data centers that require high levels of uptime. The integration of IoT and AI technologies into power management systems is also gaining traction, enabling predictive maintenance and reducing downtime. As these technologies become more prevalent, they are likely to drive the adoption of advanced transfer switches and switchgear, further propelling the Data Center Transfer Switches And Switchgear Market.